- US500 gains 0.10%

- US2000 gains 1.30% to 2,300 points

- The dollar remains strong

- Morgan Stanley gains 7% at the open after quarterly results

At the start of the U.S. cash session, indices are opening without a clear direction, except for the US2000 index (Russell 2000). The positive sentiment among small-cap companies can be attributed to investors' growing confidence in a "soft landing" scenario—returning interest rates to lower levels without triggering an economic recession. Additionally, the sentiment is bolstered by very strong quarterly results from Morgan Stanley, which is up over 7% at the opening of the cash session.

US2000

At the time of publication, the index is already up 1.40% to 2,300 points. This is a major resistance level and the upper boundary of the consolidation channel. These levels have been tested three times since July 2024, and each time we observed a return to declines and a deeper correction. If the bulls manage to permanently break through the 2,300-point zone this time, we can expect a continuation of the upward trend.

Source: xStation 5

Company News

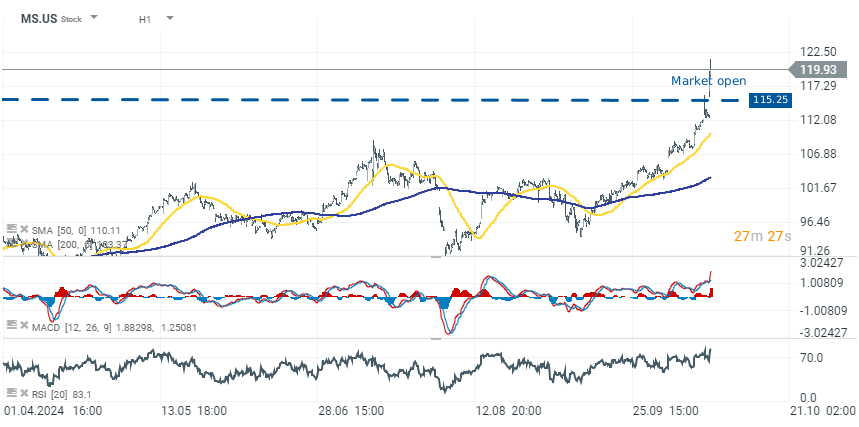

Morgan Stanley (MS.US) gains almost 7% after better-than-expected Q3 2024 earnings, reporting a 32% rise in profit to $3.2 billion, or $1.88 per share, compared to a $1.58 estimate. Revenue increased by 16% to $15.38 billion, surpassing the $14.41 billion forecast. All key divisions performed well, with Wealth Management revenue up 14% and Investment Banking revenue soaring 56%.

J.B. Hunt Transport Services (JBHT.US) gains 4.80% after Q3 earnings beat estimates, despite a 2.8% year-over-year revenue decline. Key drivers included growth in the JBI segment and higher revenue per load in ICS. Excluding fuel surcharges, the revenue decrease was less than 1%.

U.S. Bancorp (USB.US) stock opens 4.75% higher after better-than-expected Q3 earnings, driven by growth in net interest income. The bank maintained stable Q4 guidance and reaffirmed its full-year outlook for net interest income and adjusted non-interest income.

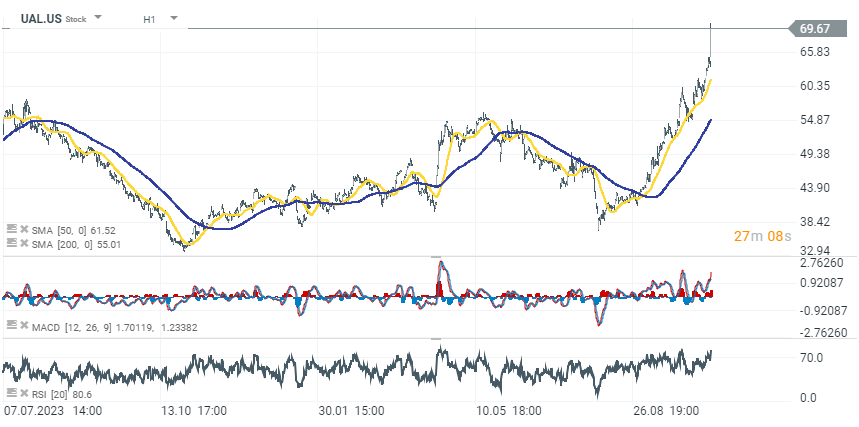

United Airlines (UAL.US) surged 9.80% after exceeding Q3 expectations and announcing a $1.5 billion share repurchase program. The company forecasted Q4 earnings of $2.50 to $3.00 per share, significantly higher than the prior year.

ASML (ASML.US) dropped over 4.70% after reporting weaker-than-expected Q3 bookings, with a 53% sequential decline. Despite strong Q3 net sales and income, concerns over 2025 revenue due to export controls contributed to the decline.

Interactive Brokers (IBKR.US) fell 3.24% after mixed Q3 results. Although revenue grew by 20% year-over-year, net interest margin decreased, contributing to the stock's decline.

Novavax (NVAX.US) plummeted nearly 16.40% following an FDA clinical hold on its COVID-19 and flu vaccine trials, citing safety concerns after a trial participant developed motor neuropathy.

Daily summary: Alphabet shares support sentiments on Wall Street 🗽Oil, precious metals and crypto slide

Critical Metals at the center of speculation around Greenland 🔎

US Open: Nasdaq continue to climb📈Intel and Eli Lilly stocks surge

Chart of the day: CHN.cash (07.01.2026) China's rally hits the wall 📉 🇨🇳

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.