- Wall Street Opens with Slight Gains

- Dollar Index Gains in the First Part of the Day

- Bond Yields Decline Following Fed Decision

Markets today are recovering slightly from a nervous start to the week. The Fed's decision yesterday stirred a lot of emotions in the market. Now, volatility is somewhat lower, and investors are reassessing the Fed's monetary policy. We are seeing a gentle recovery in risky assets, including the stock market. The S&P 500 and Nasdaq 100 opened about 0.20-0.40% higher. The Dollar Index is gaining 0.20%, and 10-year US bond yields are retreating below 4.65%.

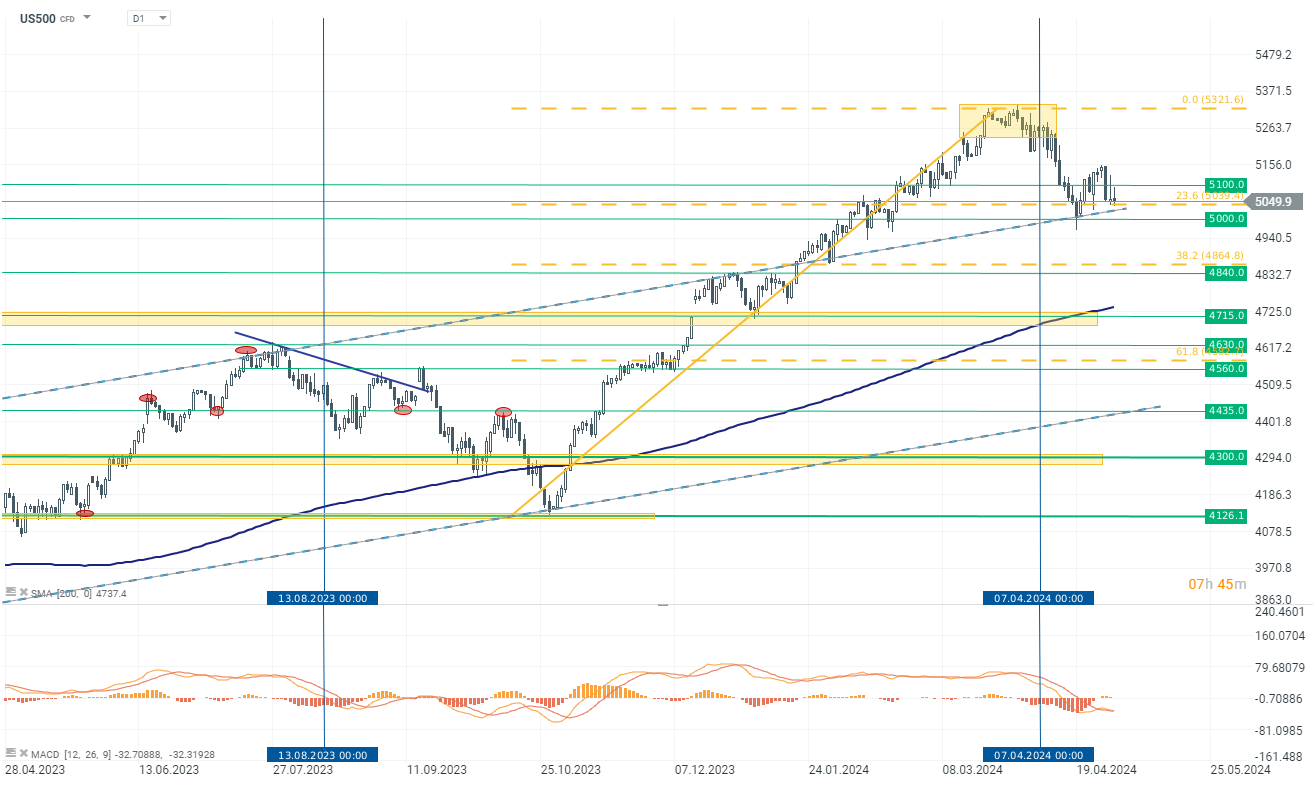

US500

US500 futures on the S&P 500 index are trading around zero today. However, at the time of publication, bulls are dominating the market. The index is up 0.15% to 5060 points. The current key support level is in the 5000-5040 points range. This is where the 23.6% Fibonacci retracement of the recent upward movement converges, and it's also a significant support level and an upward trend line marked on the chart with a dashed blue line.

Source: xStation 5

Company News

Peloton Interactive (PTON.US) dips over 6.00% after the company reported mixed financial results for Q3 FY2024, revealing a revenue of $717.7 million, slightly below the estimated $723.21 million, and a net loss of $167.3 million, worse than the expected $132.59 million. EPS was -$0.45, underperforming the projected -$0.37. Despite these setbacks, the company achieved its first positive free cash flow in over three years at $8.6 million, along with a significant gross margin increase to 43.1% from 36.1% year-over-year. Additionally, Peloton launched a new restructuring program aiming to cut annual expenses by over $200 million to streamline costs and improve cash flow sustainability.

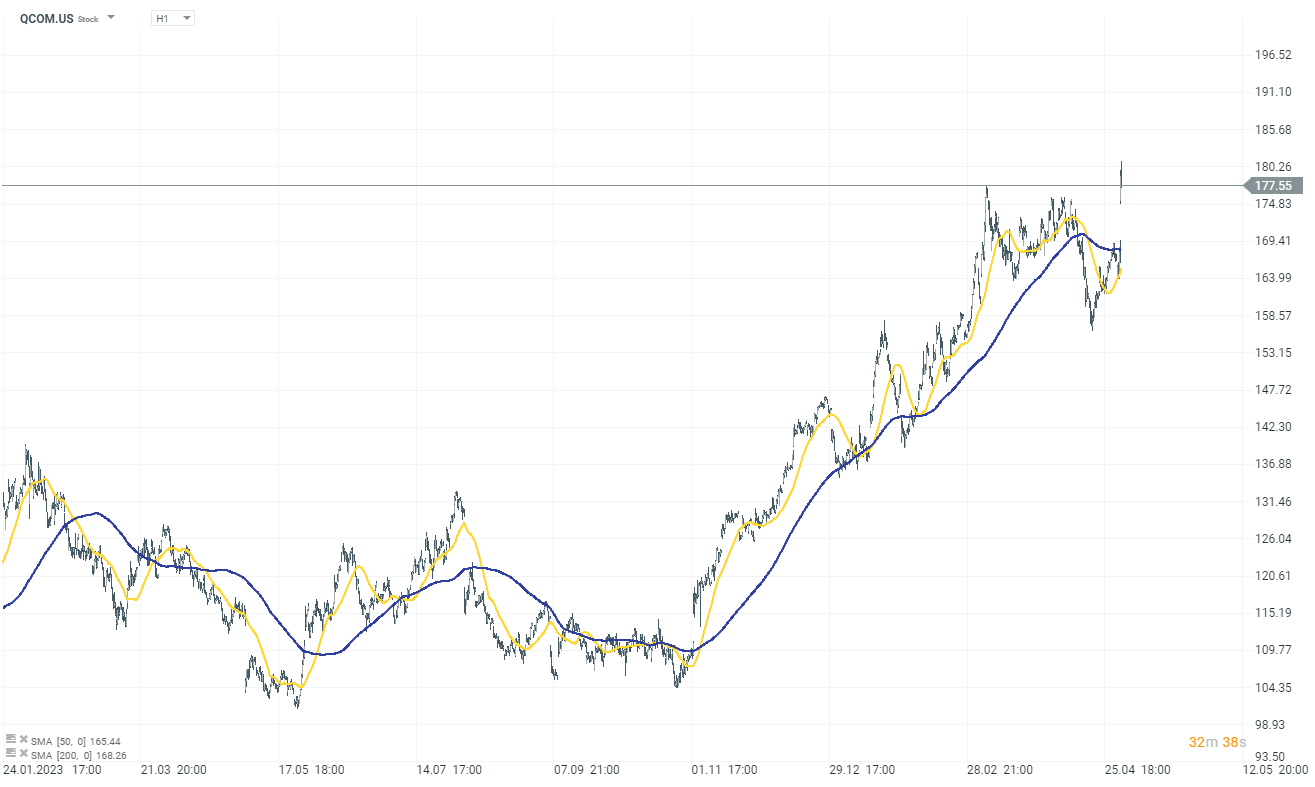

Qualcomm (QCOM.US) gains 7.70% following an upbeat Q2 performance and positive Q3 outlook. Qualcomm forecasts Q3 revenue between $8.8B and $9.6B (consensus of $9.05B) and adjusted EPS between $2.15 and $2.35 (consensus of $2.16). CEO Cristiano Amon highlighted the company's growth, diversification, and advancements in automotive sales, Snapdragon X launches, and on-device AI capabilities.

Source: xStation 5

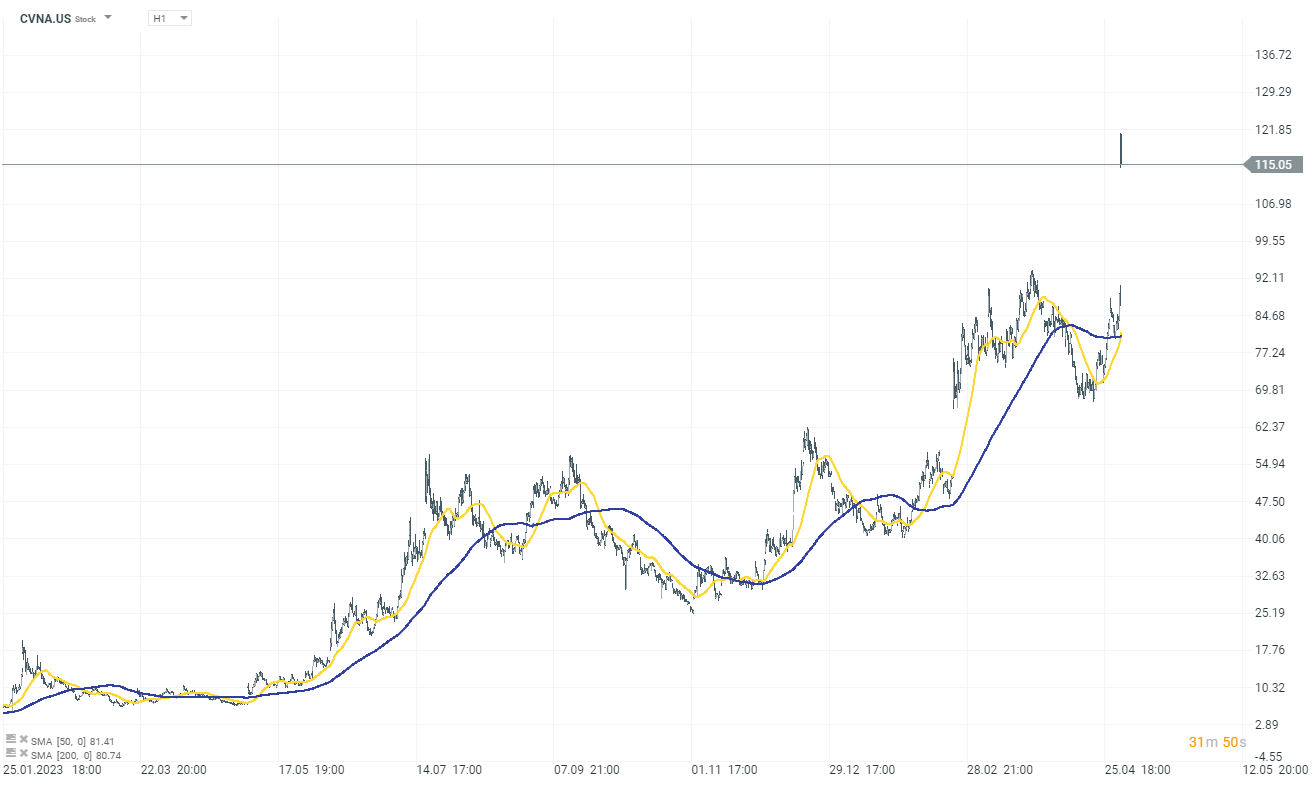

Carvana (CVNA.US) soared over 35% after a successful Q1, with 91,878 cars sold, marking a 16% Y/Y increase despite less inventory and reduced marketing spending. This is the company's third consecutive quarter with positive net income, with adjusted EBITDA surpassing expenses. Carvana anticipates continued growth in Q2, with increased sales and profitability.

Source: xStation 5

XPeng (XPEV.US) gains 6.00% after delivering 9,393 Smart EVs in April, a 33% Y/Y increase and a 4% M/M increase. The XNGP system has achieved an 82% penetration rate in urban driving scenarios, and the company is set to launch its new brand, MONA, in June 2024.

DoorDash (DASH.US) fell 15% despite strong revenue growth, beating consensus on orders, and achieving record adjusted EBITDA. The company processed 620 million orders in the quarter (+21% Y/Y), surpassing consensus of 607.7M orders. However, the company reported a disappointing profit forecast for the current quarter, projecting adjusted EBITDA between $325 million and $425 million, with the midpoint below average estimates.

Fastly (FSLY.US) fell by 34% following mixed Q1 earnings and a disappointing outlook. Q2 revenue is forecasted between $130M and $134M (below the consensus of $140.4M), with adjusted EPS between -$0.10 and -$0.06 (below the consensus of -$0.02). FY2024 revenue is expected to be between $555M and $565M, with adjusted EPS of -$0.12 to -$0.06 (vs. the consensus of -$0.04).

Daily summary: Dollar dominates FX trading as odds of US intervention in Iran rise (13.01.2026)

Will the U.S. Supreme Court decision shake Wall Street? 🗽 These stocks could benefit

The L3Harris Technologies rollercoaster ⚔️Nearly 13% gains wiped out despite a billion-dollar government investment❓

DE40: European equities overbought❓All eyes on US CPI💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.