- Wall Street indices open higher

- US2000 struggles near 2,100 pts resistance zone

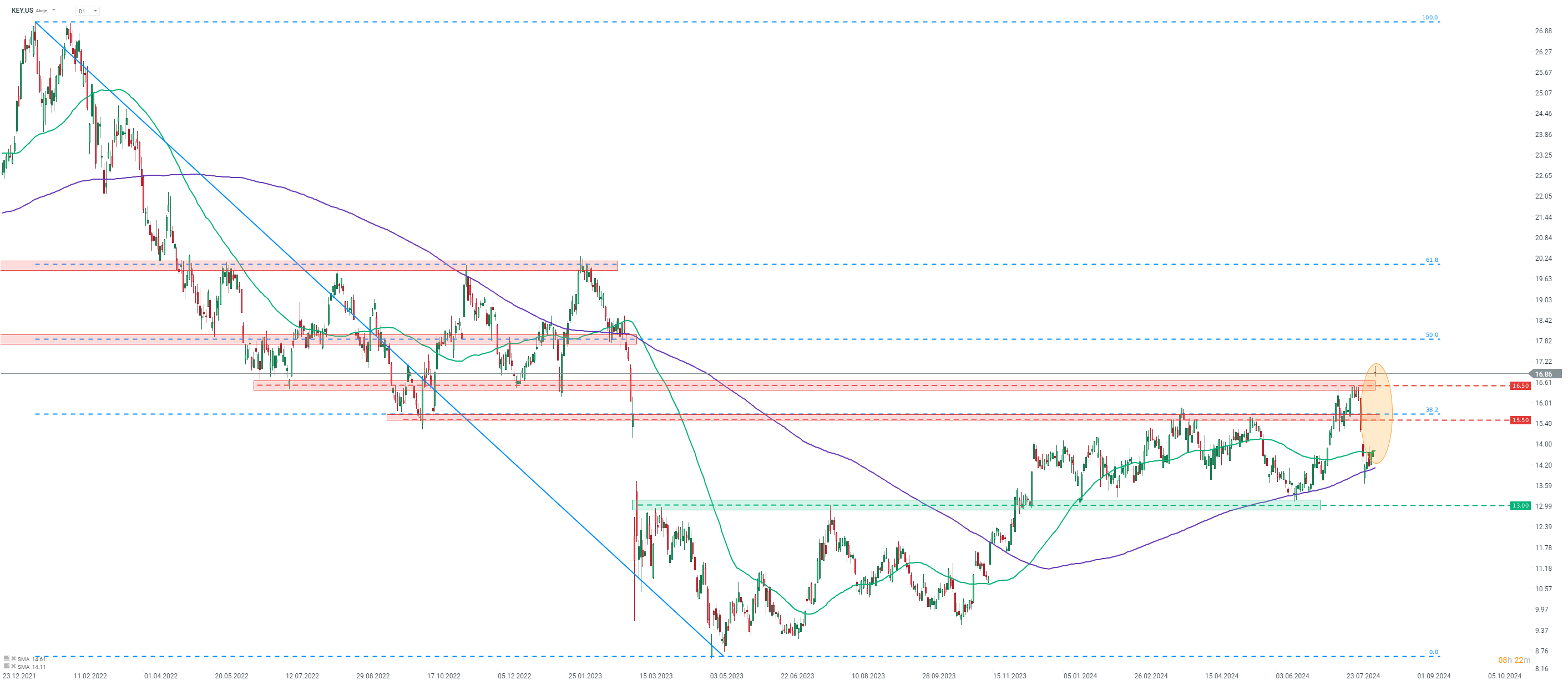

- KeyCorp jumps on Scotiabank investment

- Hawaiian Electric slumps after issuing going-concern warning

Wall Street indices launched new week's trading little changed, with small gains being seen at session launch for the major US indices. S&P 500 opened around 0.2% higher, Nasdaq jumped over 0.3% at session launch and Dow Jones was up 0.1%. Small-cap Russell 2000 was a top laggard with an around 0.2% bearish price gap at session launch.

Economic calendar for today's US session is empty, with investors preparing for top-tier macro releases scheduled for the later part of the week. Those include US CPI report for July on Wednesday as well as retail sales data for July on Thursday. A point to note is that this time PPI inflation data (Tuesday) will be released before CPI data, therefore it will also be watched closely for hints ahead of the key CPI release.

Source: xStation5

Source: xStation5

Russell 2000 launched today's trading little changed, just like other Wall Street indices. Taking a look at Russell 2000 futures chart (US2000) at D1 interval, we can see that the attempt to push the index below 2,000 pts mark last week was a failed one and US2000 began to recover. However, the recovery move was halted after the index reached 2,100 pts resistance zone. US2000 remains in the area, with sellers attempting to launch a pullback from there today. However, given no near-term catalysts for the bigger move, the index may continue to trade near 2,100 pts mark until Wednesday, when US CPI inflation report for July is released at 1:30 pm BST. However, should we see a break above the aforementioned 2,100 pts area, buyers attention may shift towards 2,165 pts swing area. On the other hand, should sellers remain in control, the aforementioned 2,000 pts psychological area will be the first support zone to watch.

Company News

Hawaiian Electric (HE.US) launched today's trading with a big bearish price gap. Company said it has pegged losses from estimated accrual of liabilities, linked to wildfires in Maui last year, at $1.7 billion and expressed concerns over continuing as a going-concern.

Starbucks (SBUX.US) launched today's trading higher following Wall Street Journal report released on Friday after close of US stock market session. WSJ reported that Starboard Value, a well-known activist investor, took a stake in the company and wants company's executives to take steps to boost its stock price.

KeyCorp (KEY.US) rallies after announcing that Scotiabank has agreed to acquire 14.9% stake in the company for about $2.8 billion. Stake will be acquired via issuance of new shares at price of $17.17 per share. This represents a premium of around 17.5% over KeyCorp's closing price on August 9, 2024.

JetBlue Airways (JBLU.US) plunged at the start of today's Wall Street cash session. Company announced that it plans to sell over $3 billion in debt. JetBlue Airways said that it intends to use proceeds to repurchase a portion of its 2025 senior convertible notes as well as for general corporate purposes.

Analysts' actions

- Eli Lilly (LLY.US) upgraded to 'buy' at Deutsche Bank. Price target set at $1,025.00

KeyCorp (KEY.US) launched today's trading with an around 15% bullish price gap, after announcing that Scotiabank will take a stake in the company. Stock moved to the highest level since March 2023. Source: xStation5

KeyCorp (KEY.US) launched today's trading with an around 15% bullish price gap, after announcing that Scotiabank will take a stake in the company. Stock moved to the highest level since March 2023. Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.