- Indices open slightly higher

- Dollar slightly recovers losses

- US bond yields continue to decline

- Low PPI data supports speculation about the first interest rate cuts

Investors in the stock market can definitely count this week as successful. Although there are still two trading days left, the most important events of the week are behind us. Yesterday, the Fed was moderately hawkish, acknowledging progress in bringing inflation to target. Jerome Powell noted that the lower CPI data was factored into the dot-plot chart. Nonetheless, a single report will certainly not change the Fed's expectations, but it is a good first step towards interest rate cuts. Today's PPI release was another such step. Much lower readings, driven by falling oil prices, provided another growth catalyst for bulls in the stock market. At the time of publication, investors are practically expecting 2 full 25 basis point rate cuts in 2024. The first is expected to occur in September or November, with another in December.

Positive data supports the main indices at the opening of the cash session in the USA. The US500 opens without significant changes at 5440 points. However, considering yesterday's dynamic gains, this is a satisfactory result. Meanwhile, the US100 gains about 0.25% to 19650 points, after the technology index broke above the 19000 point level yesterday. However, at the time of publication, initial gains are reduced and US100 declines 0.15% and US500 0.20%.

US100 (D1 Interval)

The technology stock index gains for another consecutive day. Although the gains are not significant, after yesterday's rally above 19000 points, the bulls are trying to maintain control. The rises in the US100 are particularly supported by recent above-average returns from Nvidia and Apple - two of the three companies in the world with a market capitalization above USD 3 trillion. The US100 index is also currently trading over 100% higher than the pre-pandemic highs of around 9700 points.

Source: xStation 5

Company News

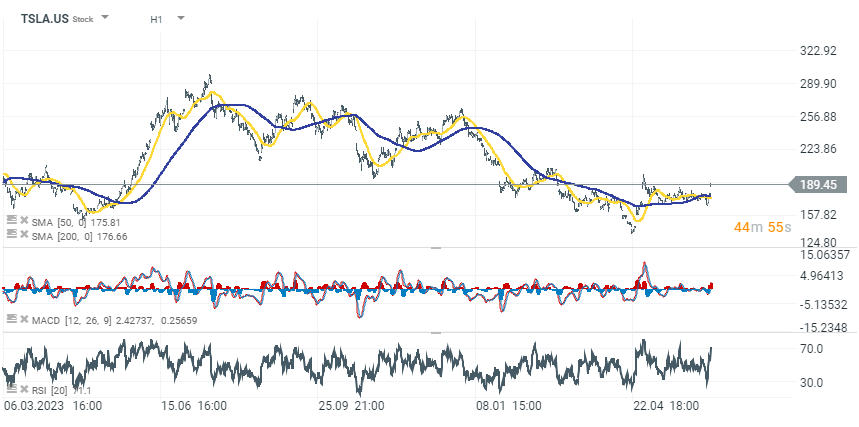

Tesla (TSLA.US) shares surged 6.70% following a social media post by Elon Musk announcing that both shareholder resolutions—his $56 billion pay package and the company's relocation to Texas—are on track for approval by a wide margin. The approval of these resolutions addresses two significant points of contention among investors and is seen as a positive move for the company’s strategic direction.

Adobe (ADBE.US) will announce its FQ2 2024 results after the market closes. Analysts expect the company to report earnings of $4.39 per share on revenue of $5.29 billion. Based in San Jose, California, Adobe is renowned for its Photoshop and Premier Pro software.

Broadcom (AVGO.US) gains as much as 14.60% after the chipmaker reported better-than-expected FQ2 results and provided a strong outlook. Additionally, the company's board of directors declared a 10-1 stock split, effective July 15. Broadcom also raised its FY2024 revenue outlook from $50 billion to $51 billion, surpassing the consensus estimate of $50.58 billion.

Pfizer (PFE.US) shares dropped by 0.80% after the company reported that its late-stage trial for an investigational gene therapy aimed at treating ambulatory boys with a muscle-wasting disease was unsuccessful. The therapy, fordadistrogene movaparvovec, failed to meet its primary goal of improving motor function in boys aged four to seven. Additionally, the secondary goals showed no significant differences between the treated group and those given a placebo.

Warren Buffett's Berkshire Hathaway (BRKB.US) continues to increase its stake in the Occidental Petroleum (OXY.US). Berkshire Hathaway purchased another 1.75 million shares on June 10, 11, and 12, at an average price slightly above $60 per share. The conglomerate now holds over 252.3 million shares, equating to nearly a 28.5% stake in Occidental Petroleum, valued at over $15 billion, which constitutes approximately 4.6% of Berkshire's total portfolio.

Virgin Galactic Holdings (SPCE.US) shares plunged 11.10% after the company's Board of Directors approved a 1-for-20 reverse stock split, effective after market close on June 14. This move is intended to boost the per-share market price to meet the NYSE's minimum bid price requirement for continued listing.

Dave & Buster's Entertainment (PLAY.US) shares fell over 12.30% following disappointing Q1 results. The company reported a 5.6% decline in comparable sales, a 12.6% decrease in adjusted EBITDA, and a 37.2% drop in adjusted net income year-over-year.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.