The US government shutdown, the first in seven years, has caused some concern, but the market reaction remains moderate. Although some federal agencies have halted operations and payments to certain employees have been suspended, investors have not succumbed to panic. The markets have already priced in the risks associated with this deadlock, which is why observed declines are relatively small and do not resemble a sharp sell-off.

However, a significant factor remains the lack of publication of key macroeconomic data, such as the weekly employment report (NFP), which introduces additional uncertainty and limits the market’s ability to accurately assess the state of the economy. Nevertheless, most market participants assume that the budget impasse will have a limited, short-term impact on the economy and expect a swift agreement between the parties.

Political tensions resulting from the rivalry between Democrats and Republicans, as well as the upcoming 2026 elections, remain a risk factor, but at this moment Wall Street is primarily focused on economic data and Fed decisions. The Federal Reserve, taking into account increased uncertainty, will likely be more cautious regarding further interest rate hikes.

Although the political situation in Washington remains unstable, financial markets seem prepared for such scenarios and do not currently foresee sharp turmoil. The moderate calm among investors suggests that the current government shutdown has largely been priced in, and the potential negative effects on the economy will be limited and short-lived.

US500 (H1 Interval)

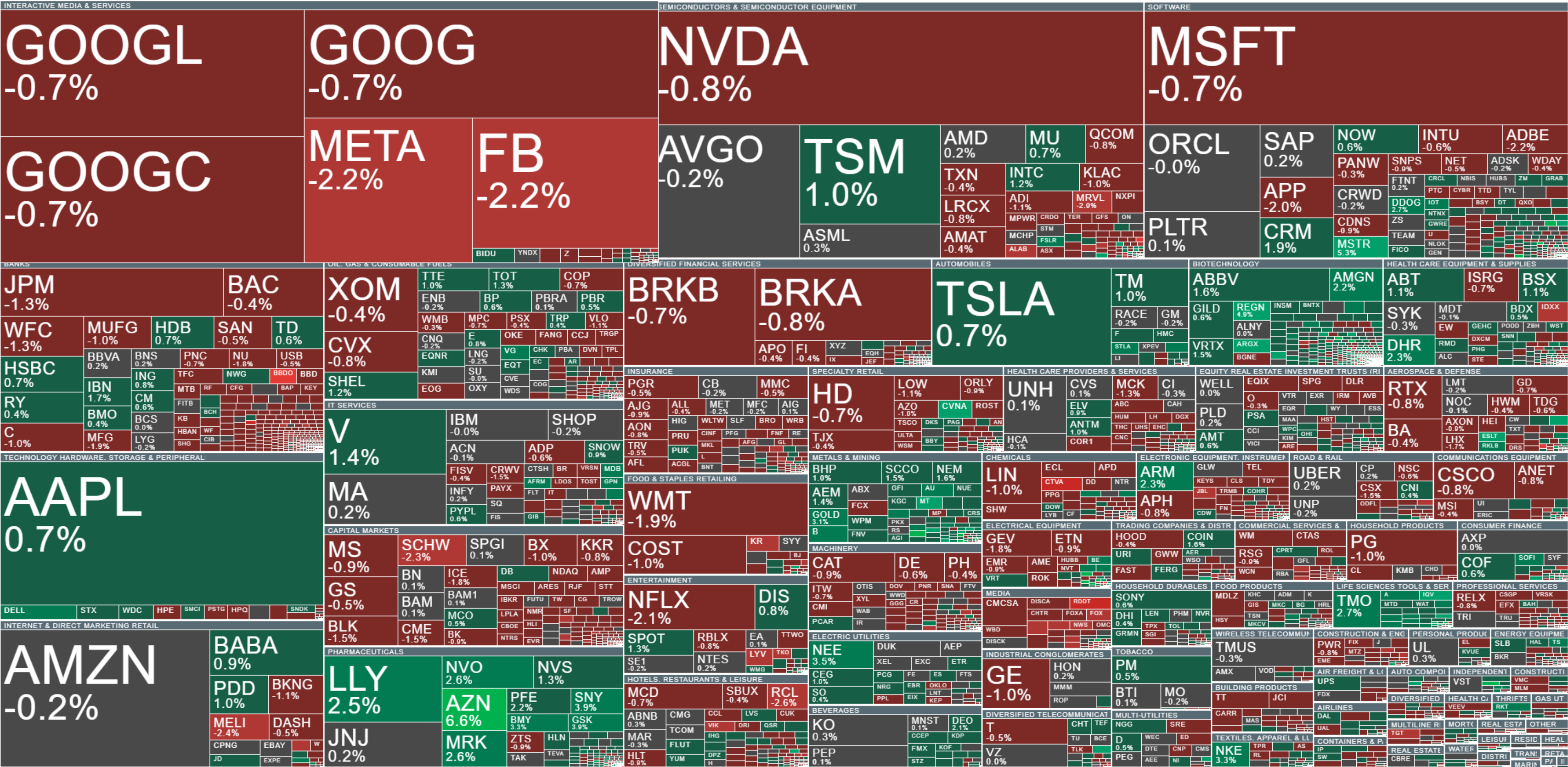

S&P 500 index futures (US500) are rising during morning trading despite ongoing disruptions related to the US government shutdown. The political deadlock in Washington and the suspension of some federal institutions’ operations have not triggered a strong market reaction, suggesting that investors perceive the situation as temporary and with limited economic impact.

Source: xStation5

Company News:

IBM (IBM.US) and AMD (AMD.US) have entered into a strategic partnership to deliver advanced AI infrastructure for Zyphra, a company specializing in open-source software and AI research. Zyphra, based in San Francisco, develops open-source AI solutions by advancing sophisticated AI models and technologies. This agreement will provide Zyphra access to IBM’s powerful cloud computing resources, enabling the development and training of large-scale, cutting-edge AI models. The collaboration marks an important step in the advancement of generative AI technologies and demonstrates how major tech firms are joining forces to support innovation in this rapidly evolving field. Zyphra, which recently closed a $1 billion funding round, plans to use these resources to further develop breakthrough AI solutions.

Fortress Biotech (FBIO.US) is losing value during Wednesday’s session, dropping about 34% after the US Food and Drug Administration (FDA) declined to approve its drug CUTX-101 for the rare Menkes disease. This negative news triggered strong selling pressure, impacting the company’s stock price.

Nike’s (NKE.US) shares are up over 3% during Wednesday’s session after reporting first-quarter results that exceeded average analyst forecasts. This confirms the company’s effective focus on key sports disciplines like running and basketball, which is starting to yield tangible results. The biggest positive driver was wholesale revenue growth, supported by partnerships with Amazon and Foot Locker. Additionally, Nike saw a clear improvement in running shoe sales. These positive results were met with enthusiastic investor response, leading to increased demand for the company’s shares.

Marvell Technology’s (MRVL.US) shares are currently down about 3% following a downgrade. Analysts highlight that Marvell’s data center business has nearly tripled over the past two years, driven by successes in deploying custom XPU processors and a strong portfolio of networking chips supporting AI. Nevertheless, limited market visibility and rising competition in the custom XPU processor segment—especially after the recent rapid rise in the stock price—cause analysts to adopt a more cautious stance toward the company.

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.