-

US100 dives -2.34% to 21,395.48 leading broad market decline, with US500 falling -1.44% to 6,043.9 as DeepSeek sparks AI infrastructure concerns; VIX surges +7.68% to 17.53

-

Nvidia tumbles 13% in record $465B market value wipeout after Chinese AI startup DeepSeek demonstrates efficient model, triggering widespread tech selloff

-

Energy infrastructure stocks collapse with Vertiv (-25.9%), Vistra (-24.2%), and Constellation Energy (-19.3%) as DeepSeek raises questions about future data center power demands

-

AT&T bucks market trend, rising 5.4% on strong Q4 subscriber growth and fiber additions, while Apple gains 2.5% as investors favor measured AI spending approach

-

European markets show mixed performance with SUI20 (+1.23%) and ITA40 (+0.34%) in green, while NED25 (-0.50%) and EU50 (-0.30%) decline; VSTOXX rises +3.64% to 17.08

US Markets Under Pressure: US indices show significant declines, led by the US100 dropping -2.34% to 21395.48, while the US500 falls -1.44% to 6043.9. The US2000 shows a modest decline of -0.11% to 2316.5, and the US30 is slightly down -0.07% to 44570. Market volatility has spiked, with the VIX surging +7.68% to 17.53.

European Markets Mixed: European markets display mixed performance with a negative bias. The NED25 leads declines at -0.50% to 894.98, followed by AUT20 (-0.34% to 3823) and EU50 (-0.30% to 5208.6). However, some markets show resilience, with SUI20 gaining +1.23% to 12406, ITA40 up +0.34% to 36451, and UK100 adding +0.27% to 8496.0. The VSTOXX, Europe's volatility gauge, has jumped +3.64% to 17.08, reflecting increased market uncertainty.

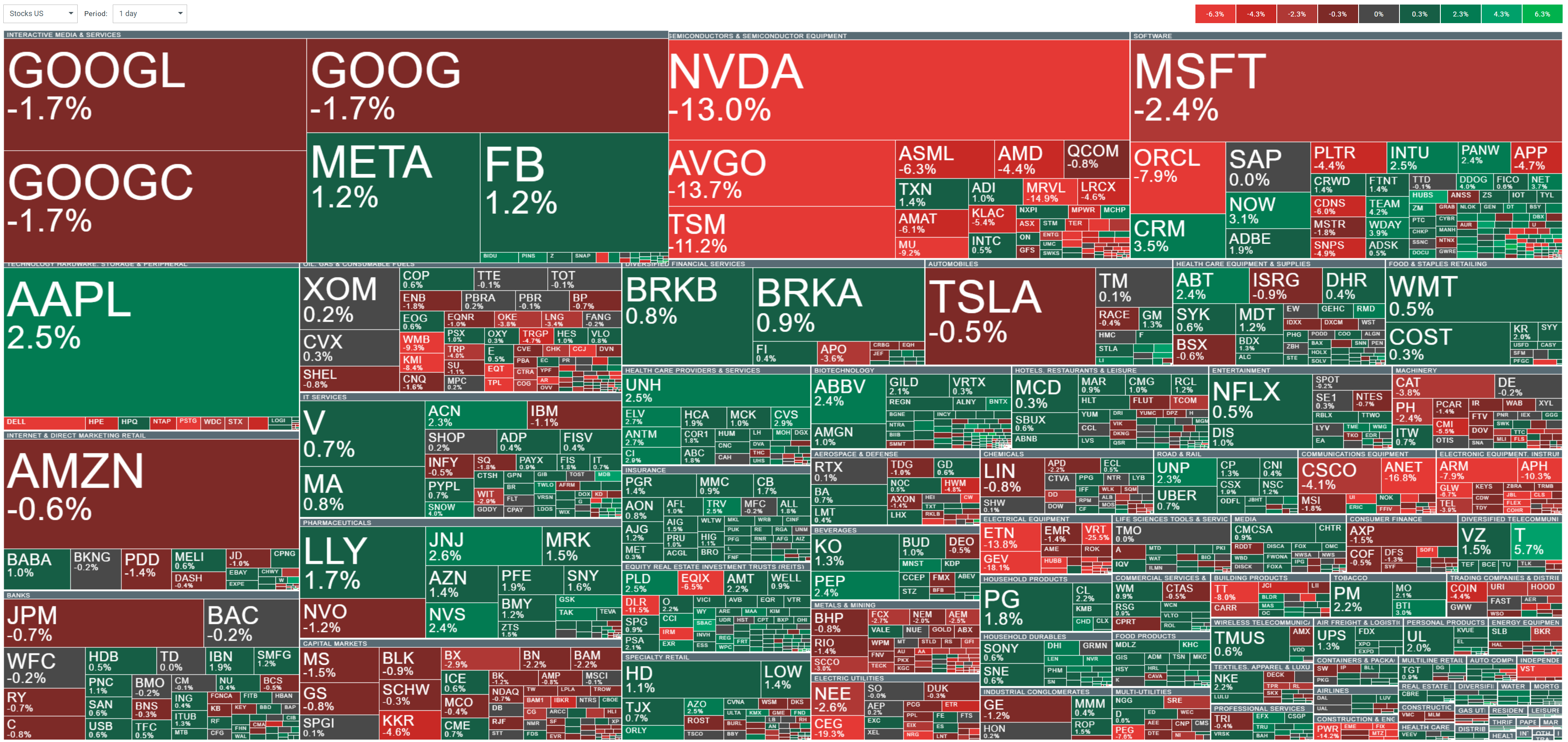

S&P 500 Sectors Show Mixed Performance. Source: Bloomberg Financial LP

Current volatility observed on Wall Street. Source: xStation

The Nasdaq-100 index, represented by the US100 contract, has broken below key support levels: the 23.6% Fibonacci retracement level, which aligns with the early December high of 21,668, the 50-day SMA at 21,370, and the 38.2% Fibonacci retracement level. These levels will now act as resistance for bulls attempting a rebound.

Bears, on the other hand, will target a retest of the 61.8% Fibonacci retracement level, which coincides with the lower Bollinger Band and the 50-day SMA, as key downside objectives. The RSI has entered a zone that has historically led to reversals in the index. Meanwhile, the MACD is tightening, signaling potential bearish divergence in the near future. Source: xStation

News:

-

Nvidia (NVDA.US) plunges 13% in its largest-ever market value drop, erasing $465B after Chinese AI startup DeepSeek's efficient approach sparks concerns over AI infrastructure spending. The semiconductor giant's decline has rippled through the market, causing the S&P 500 to fall 2.3% and the Nasdaq 100 to drop 3.6%. Analysts at Jefferies warn that DeepSeek's model could disrupt the current AI business model, which relies heavily on high-end chips and extensive computing power.

-

AT&T (T.US) rises 5.4% after beating Q4 expectations with strong subscriber growth. The telecom provider reported EPS of 54c, topping the 50c estimate, while revenue increased 0.9% to $32.3B. The company added 482,000 new monthly mobile subscribers and 307,000 fiber-optic customers, both exceeding analyst projections. Management reaffirms 2025 guidance and plans to complete the DirecTV sale by mid-2025.

-

Constellation Energy (CEG.US) leads S&P 500 declines, tumbling 20% alongside other energy infrastructure stocks as DeepSeek's efficient AI model threatens data center power consumption outlook. Nuclear power providers and cooling system manufacturers face pressure as the Chinese startup demonstrates AI capabilities with reduced computing requirements, challenging assumptions about future energy demand from data centers.

-

Apple (AAPL.US) gains 2.5%, bucking the tech sector decline as investors rotate toward companies with measured AI investments. While the Nasdaq 100 drops 3.1%, Apple's relatively conservative approach to AI spending and potential benefits from AI services through iPhone and hardware offerings appear to shield it from the broader tech selloff. The company is set to report Q1 results later this week.

-

U.S. Housing Market shows resilience as new home sales climb 3.6% to 698,000 units in December, surpassing expectations of 675,000 units. The positive data signals continued momentum in housing market activity despite rising mortgage rates, with total 2024 sales reaching 683,000 units, up 2.5% from 2023.

-

Energy Infrastructure Stocks face broad selloff as AI efficiency concerns ripple through the sector. Vertiv Holdings (VRT.US) plummets 25.9%, GE Vernova (GEV.US) drops 18.8%, and Vistra (VST.US) falls 24.2%. The dramatic decline reflects growing uncertainty about future power demands from data centers, particularly impacting companies focused on cooling solutions and sustainable power generation for AI infrastructure. The sector's selloff highlights the interconnected nature of the AI and energy markets, with efficient AI models potentially reducing the massive power requirements previously anticipated for the AI boom.

Other news coming from individual S&P 500 index companies. Source: Bloomberg Financial LP

Daily summary: Wall Street tries to rebound 📈Amazon and Microsoft under pressure of Rotschild & Co Redburn

Home Depot shares slide 4% on outlook cut citing weakening consumption 📉

📌US500 loses 1%

US Open: Wall Street indices under continued selling pressure 📌Technology stocks slide

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.