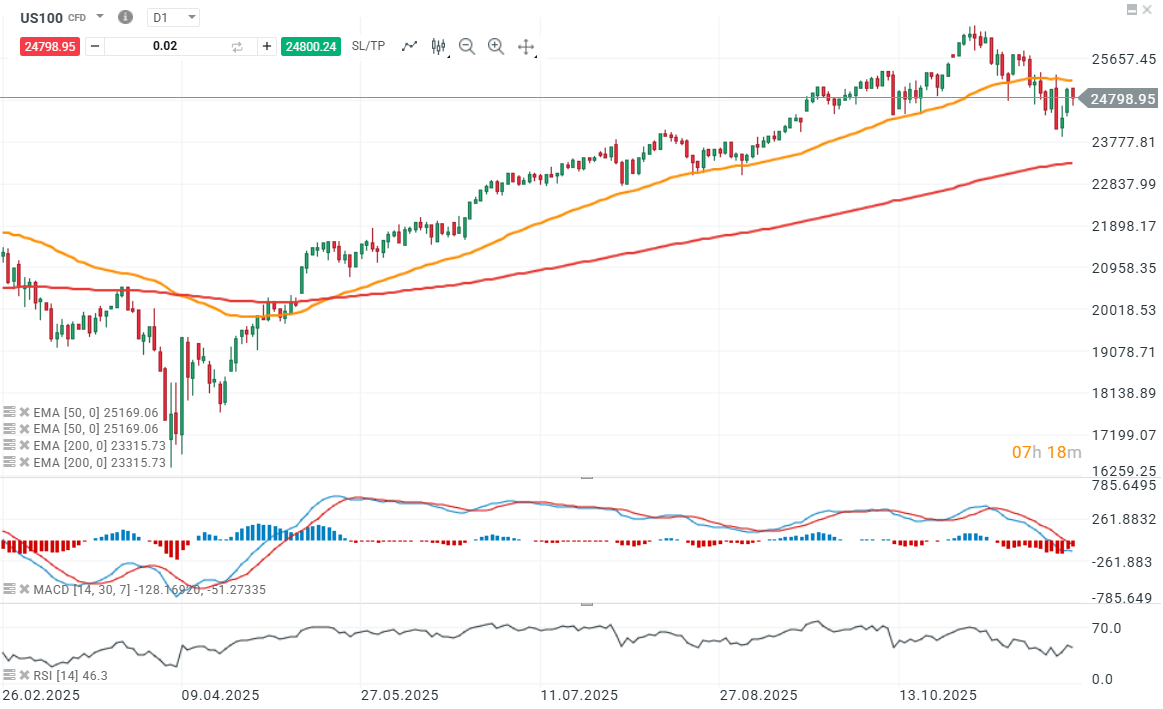

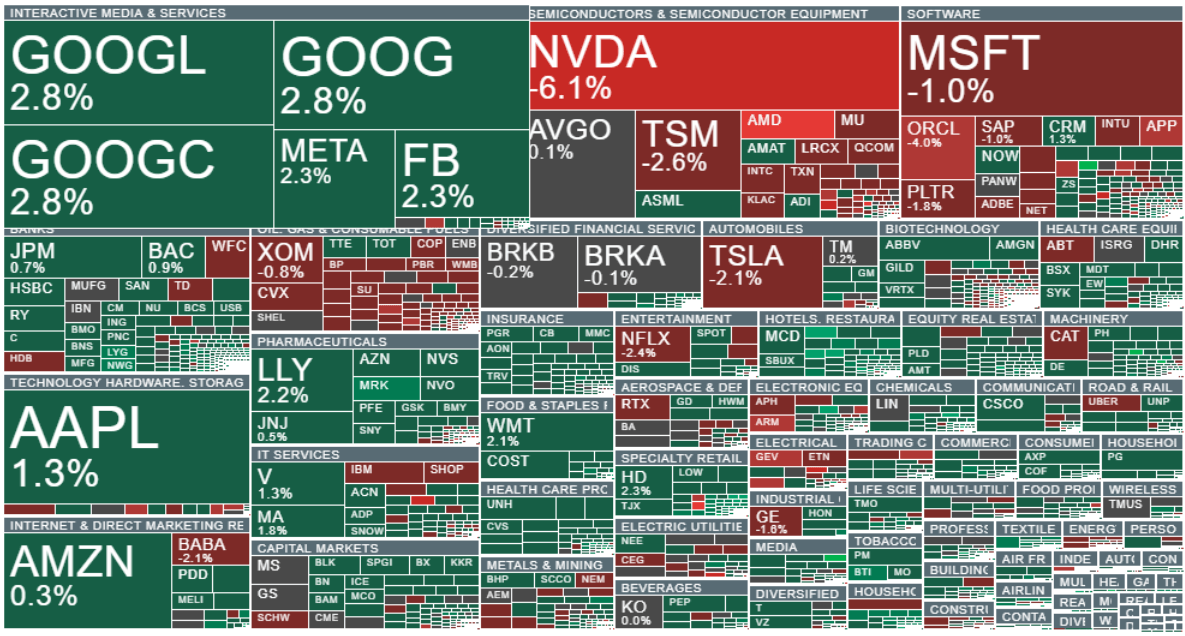

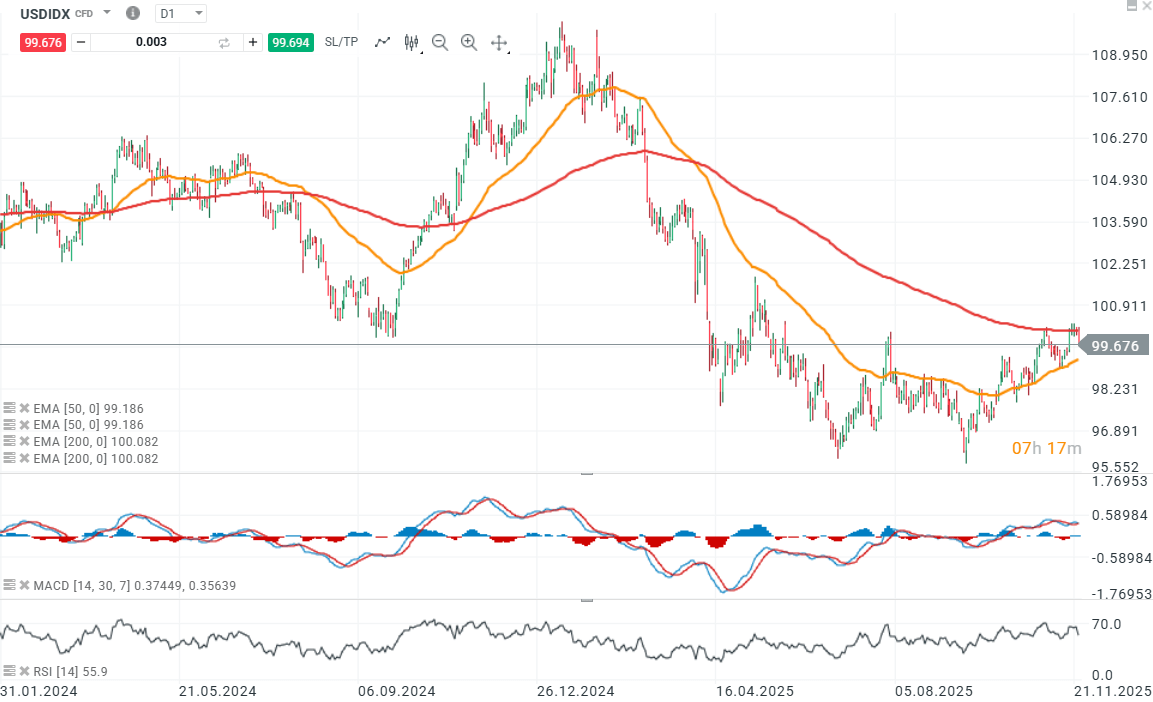

US index futures are weaker on Tuesday, pressured by deteriorating sentiment in the semiconductor sector, where AMD, Nvidia and TSMC are falling following reports that Meta Platforms has chosen Google’s TPU AI chips for future implementation instead of Nvidia’s units. The market is beginning to price in a real risk of declining dominance among semiconductor giants. Investors are also waiting for a batch of macroeconomic data to assess whether optimism around a potential Federal Reserve rate cut can hold. The US dollar is sharply lower today, weighed down by soft macro data. PPI came in below forecasts on core readings, and consumer confidence from the Conference Board unexpectedly weakened, following disappointing retail sales.

Nvidia and AMD are the weakest performers on the US market today; Oracle continues to decline as well. Alibaba (BABA.US) shares are falling despite strong earnings. Source: xStation5

Company News

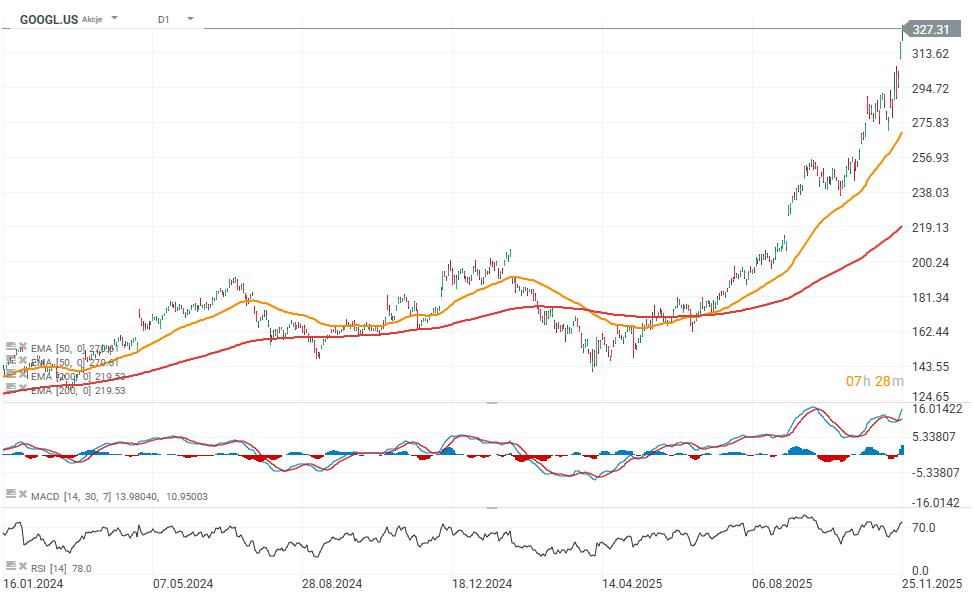

- Nvidia (NVDA) is down 6% after reports that Meta Platforms is in talks to spend billions of dollars on Google’s AI chips, suggesting the search leader is gaining ground against the most profitable AI accelerator on the market. Alphabet (GOOGL) is up 4% at the open, moving closer to a $4 trillion market valuation.

- Alibaba Group (BABA) rises 4.1% after reporting better-than-expected growth in its key cloud segment, highlighting surging demand for computing power during China’s AI boom.

- Amentum Holdings (AMTM) gains 8.4% after the IT firm posted adjusted Q4 revenue that grew 10% year over year and beat expectations.

- Brinker International (EAT) is up 2.0% after Citi analyst Jon Tower upgraded the operator of Chili’s and Maggiano’s from neutral to buy.

- Sandisk (SNDK) rises 1.1% after being selected to replace Interpublic Group in the S&P 500 index.

- Spotify (SPOT) jumps 4.1% after the Financial Times reported that the company plans to raise US subscription prices in the first quarter of next year.

- Symbotic (SYM) climbs 13% after issuing a first-quarter revenue forecast that topped the average analyst estimate.

- Zoom Communications (ZM) gains 5.1% after its third-quarter results beat expectations. The company also raised its full-year guidance.

Source: xStation5

US Macro Data

Conference Board Consumer Confidence (October): 88.7 vs. Expected 93.5; Previous 94.6

Richmond Manufacturing Index (October): -15 vs. Expected -5; Previous -4

Retail Sales (September):

- Headline: 0.2% m/m; forecast 0.4% m/m; previous 0.6% m/m

- Core: 0.3% m/m; forecast 0.3% m/m; previous 0.6% m/m

- Ex-gasoline/vehicles: 0.1% m/m; forecast 0.4% m/m; previous 0.6% m/m

Producer Price Inflation (September):

- PPI y/y: 2.7% vs. forecast 2.7%; previous 2.7%

- PPI m/m: 0.3% vs. forecast 0.3%; previous -0.1%

- PPI excl. food/energy/transport y/y: forecast 2.7%; previous 2.8%

- PPI excl. food/energy/transport m/m: forecast 0.2%; previous 0.3%

- Core PPI y/y: forecast 2.7%; previous 2.8%

- Core PPI m/m: forecast 0.2%; previous -0.1%

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.