- Wall Street returns to gains following the bill that sparks hope for the end of government shutdown.

- Tech stocks lead rally, recovering almost all of recent losses.

- Potential changes to Obamacare weigh on health insurers.

- Wall Street returns to gains following the bill that sparks hope for the end of government shutdown.

- Tech stocks lead rally, recovering almost all of recent losses.

- Potential changes to Obamacare weigh on health insurers.

Wall Street rebounded sharply on Monday after the U.S. Senate passed a bipartisan deal to end the record 40-day government shutdown — the first major step toward reopening federal agencies. Futures on U.S. indices have regained nearly all of the past two sessions’ losses, with improving sentiment also reflected across crypto and bond markets (US100: +1.5%, US2000: +1.4%, US500: +0.9%, US30: +0.4%).

The U.S. government shutdown, now 41 days long, has left 1.4 million federal workers unpaid and disrupted key services, including air travel and food aid for 41 million Americans. A bipartisan Senate deal provides temporary funding through January 30, full-year appropriations for some agencies and back pay for federal employees.

However, several Democrats, including Senators Schumer and Warren, have already opposed it, citing lack of action on expiring healthcare subsidies, which are now scheduled for a December vote. The package also reimburses states for SNAP and WIC costs during the shutdown, but still faces hurdles in the House before reaching President Trump’s desk.

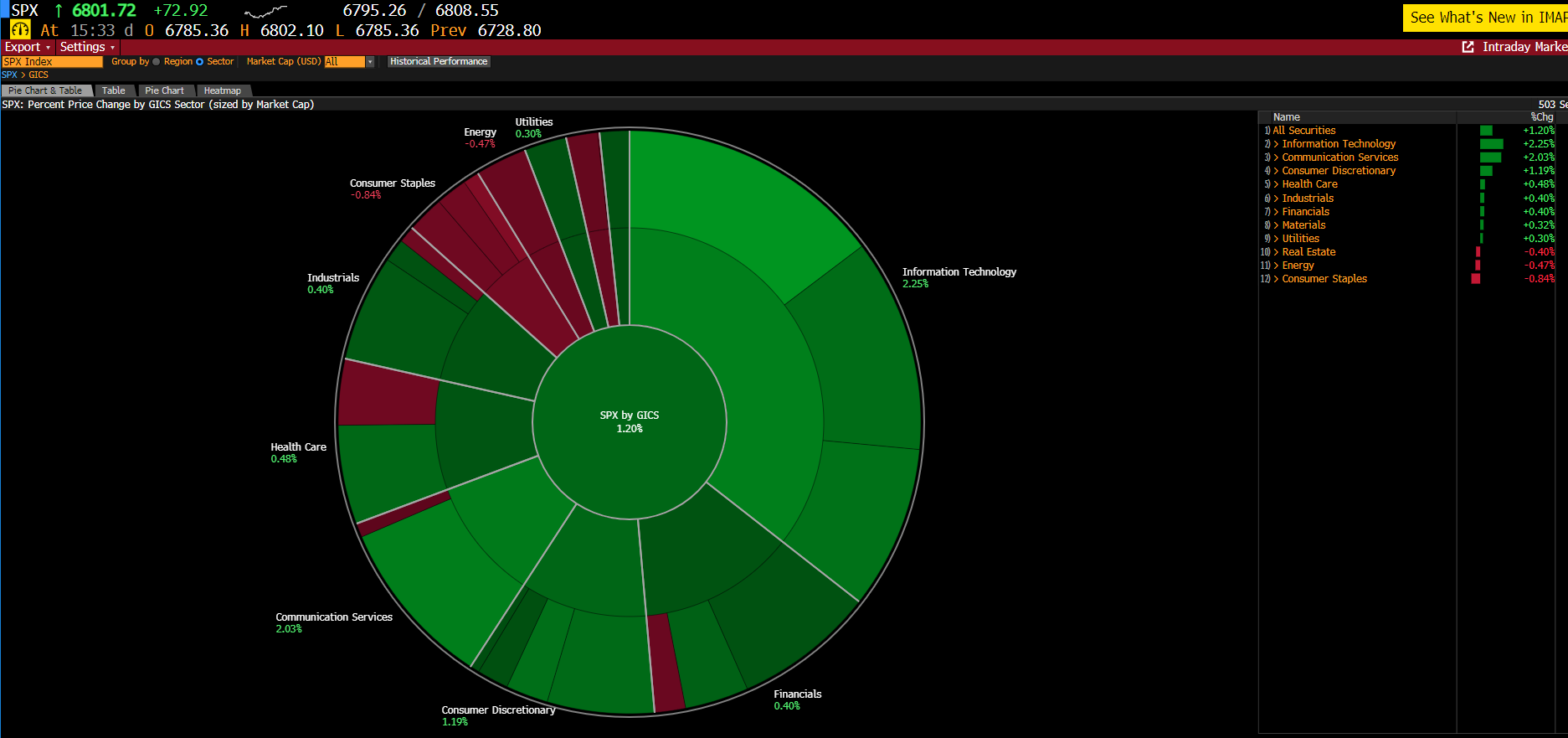

Tech stocks are championing today’s rally, with Mag7 driving significant gains in main U.S. indices. Nvidia is the biggest gainer in the group (NVDA.US: +3.6%), followed by Alphabet (GOOGL.US: +3.3%), Tesla (TSLA.US: +2.7%) and Amazon (AMZN.US: +2%). Significant gains are also seen in the other semiconductor stocks (AMD.US: +5.4%, MU.US: +7.1%, INTC.US: +2.5%).

The optimism is market-broad today, with defensive sectors (Consumer staples, Energy, Health services) giving up some in favour of more risk/growth-oriented stocks. Source: Bloomberg Finance LP.

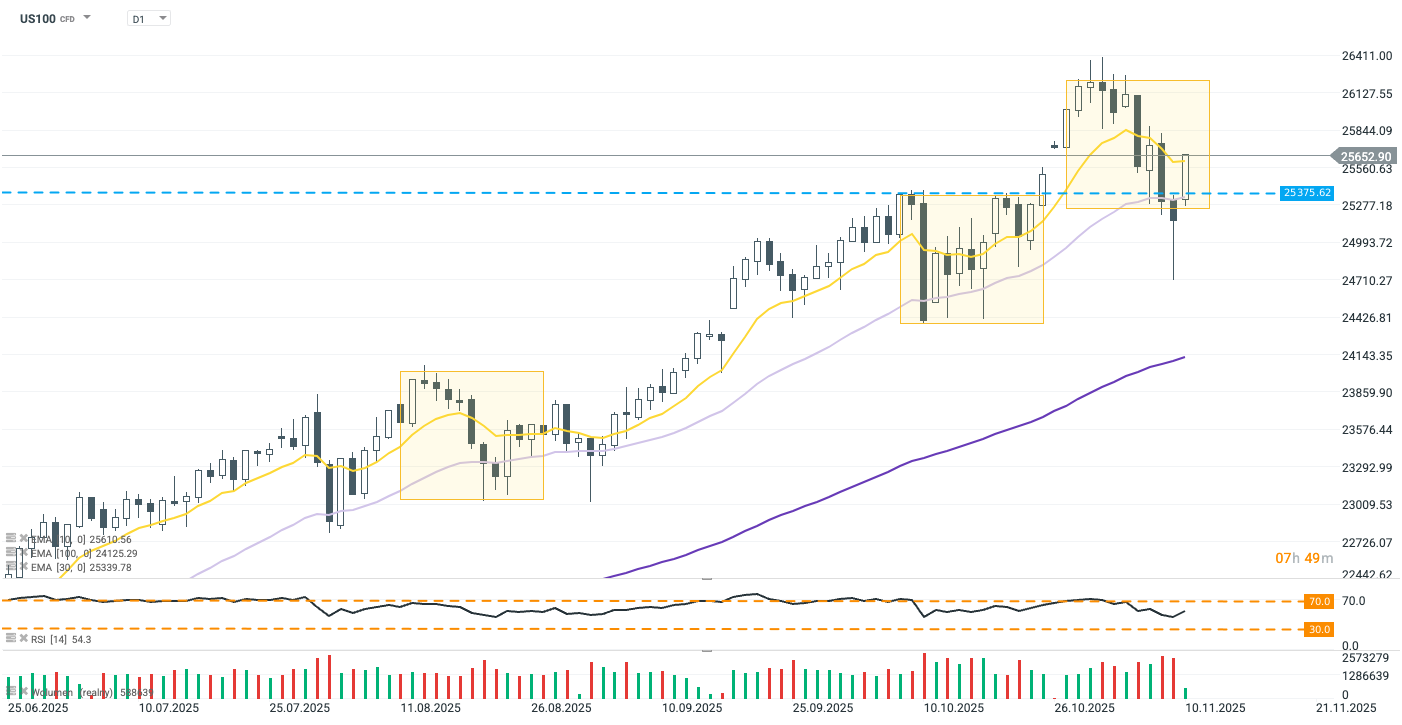

US100 (D1)

Nasdaq 100 futures rebounded strongly today, hovering just 0.3% below recouping losses from the past two sessions. The index has returned above recent resistance near 25,375 points and is attempting to leverage bullish momentum to break above its 10-day exponential moving average. With the price approaching the center of its typical trading range and a neutral RSI around 55, investors have room to adjust amid the latest government shutdown news and ongoing earnings season, with Nvidia in focus this week. Source: xStation5

Source: xStation5

Company news:

-

Health insurer stocks fell Monday after former President Donald Trump called for redirecting Obamacare subsidies directly to consumers. Shares of Centene slid 8.4%, Elevance Health 1.6%, and UnitedHealth 0.3%. The subsidies, set to expire year-end, were introduced during the pandemic to help low-income Americans but are now central to a 40-day federal shutdown over healthcare funding.

-

Monday.com shares plunged 16% despite record third-quarter results and a sharp narrowing of losses. Revenue rose 26% to $317 million, beating guidance, while adjusted operating profit hit a record $47.5 million. The company maintained its full-year forecast, but investor concerns over AI’s impact on workplace software continue to weigh on sentiment. The pessimism is driven by a narrowed full-year revenue forecast.

-

Nvidia (NVDA.US) CEO Jensen Huang requested more chip supplies from TSMC during a visit to Taiwan, raising robust AI demand. He credited TSMC’s support as vital to Nvidia’s success, noting all major AI memory suppliers have expanded capacity. Despite recent pressure on megacap tech stocks amid AI skepticism, Nvidia remains the world’s most valuable company. TSMC’s CEO C.C. Wei expects record sales to continue as demand outpaces supply.

-

Pfizer (PFE.US: +1%) clinched a $10 billion deal to acquire obesity drug developer Metsera, defeating Novo Nordisk in a heated bidding war. Metsera accepted Pfizer’s offer citing antitrust risks in Novo’s bid (NOVOB.DK: +2.2%). The deal gives Pfizer a long-sought foothold in the booming weight-loss drug market, though Metsera’s treatments are still years from launch. Novo said it will focus on advancing its own obesity pipeline.

-

Rumble (RMBL.US) shares jumped 9% after the video platform narrowed its third-quarter net loss to $16.3 million from $31.5 million a year earlier and boosted average revenue per user by 7% to $0.45. Revenue slipped slightly to $24.8 million, while monthly active users fell to 47 million. Investors welcomed signs of improved monetization and cost control despite user decline.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.