Yesterday's speech by Fed Chairman Jerome Powell cooled investor sentiment. His remarks that asset prices are "relatively high" and that the central bank will be cautious with further rate cuts pushed indices down. As a result, the S&P 500, Nasdaq, and Dow ended the session slightly weaker. However, today the market is trying to recover some losses, with futures contracts slightly up at the opening, but unable to maintain the growth.

Markets are still analyzing yesterday's comments from Jerome Powell and other Fed members, which reminded investors of the central bank's cautious approach to further policy easing. As a result, sentiment remains volatile, and market participants are looking for further impulses, both from new macroeconomic readings this week and from data that will arrive next week. These are the ones that may set the direction for further index movements and expectations for the Fed's next decisions.

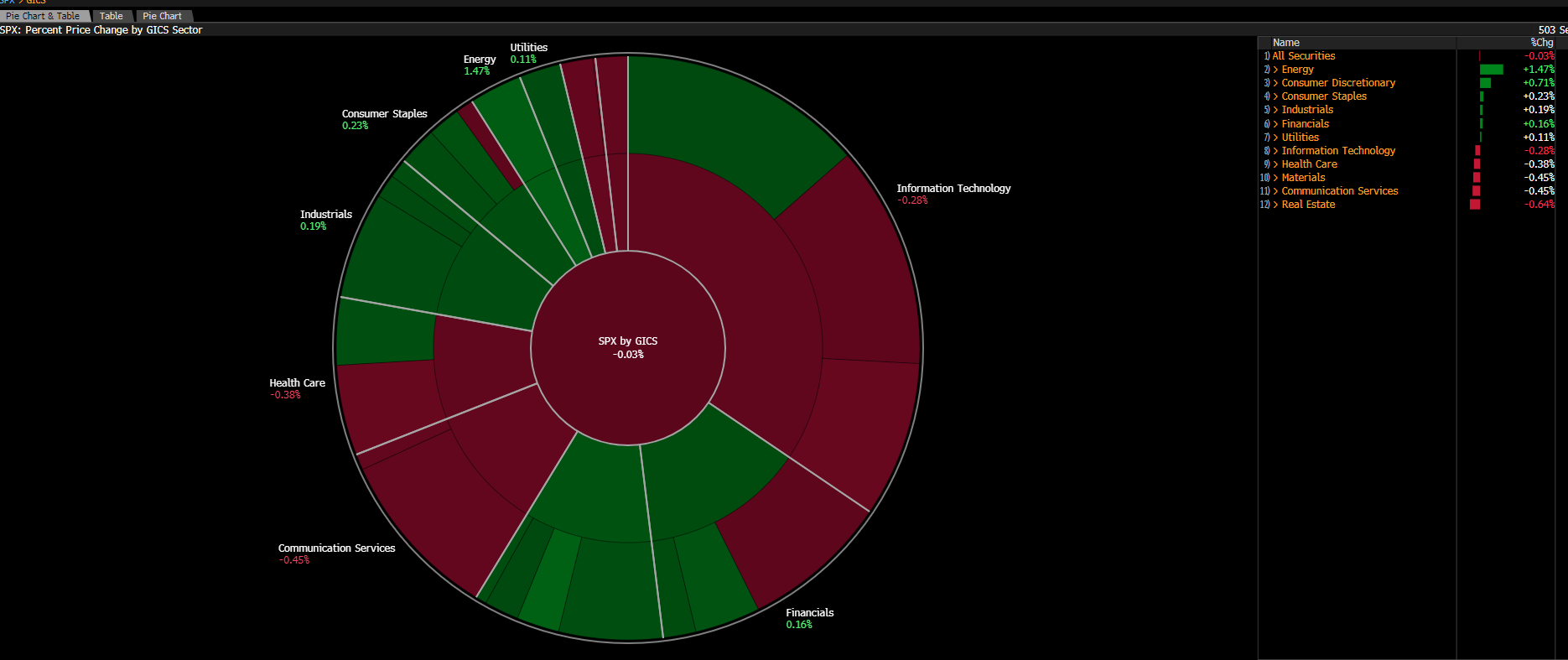

Source: Bloomberg Finance LP

Today, the real estate, health, and technology sectors are clearly losing ground. Indices are being pushed up by mining and consumer goods companies.

Macroeconomic Data:

Today at 4:00 PM, we learned about new home sales data in the USA:

-

Home sales in September: 800k (Expected: 650k, Previous: 652k)

Today's new home sales data in the USA surprised the market. Housing demand remains high despite still costly mortgage loans. This is a signal that consumers have a relatively strong financial position, and the economy continues to show resilience.

Such a strong reading may reinforce concerns about persistent inflationary pressure and put further Fed cuts into question, which may exert pressure on markets but support the dollar.

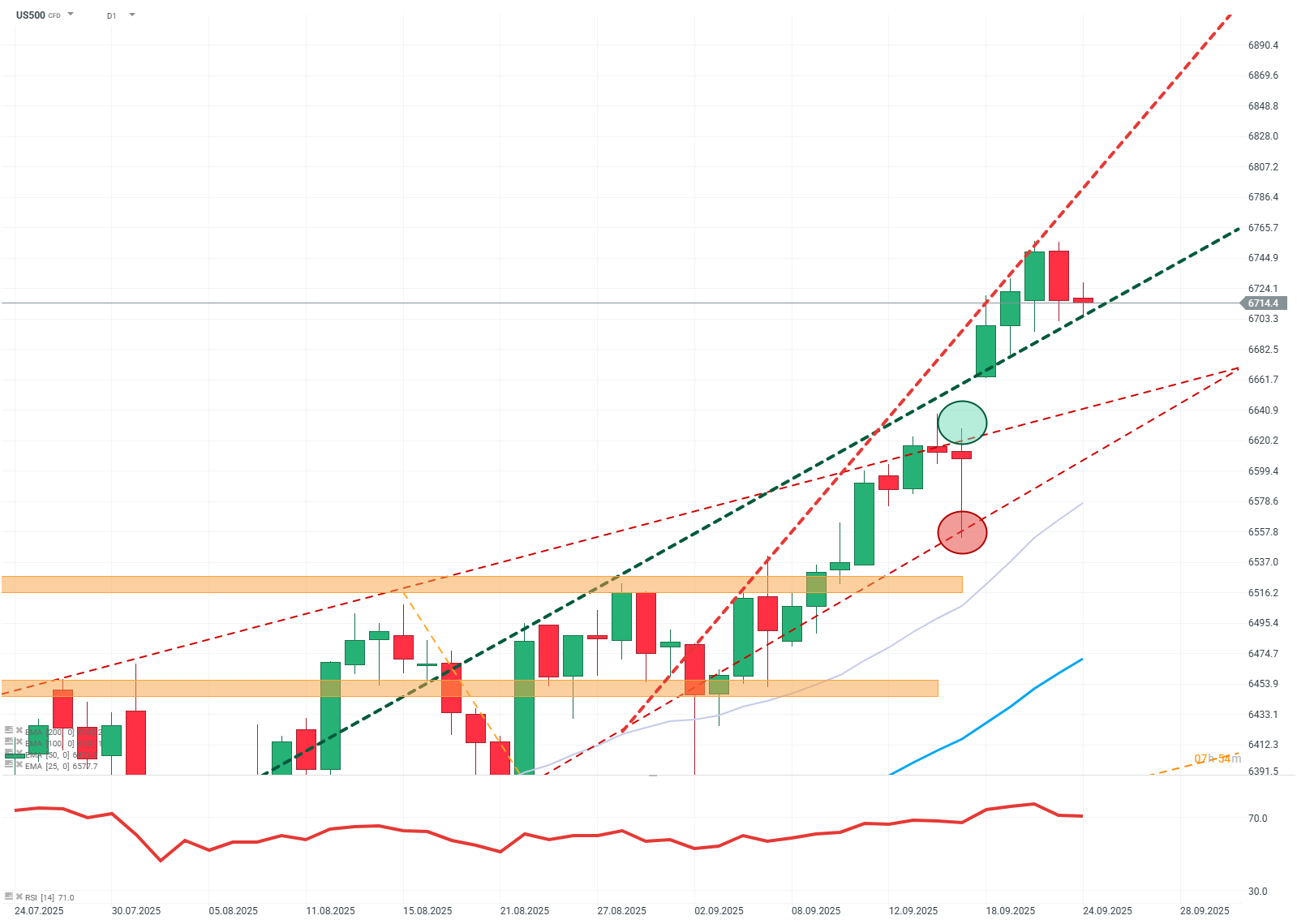

US500 (D1)

Source: xStation

The index broke out of the previous upward channel at the top and established another, steeper one. Considering the "overbought" RSI indicator, buyers may have trouble maintaining the pace. In the case of a breakout from the new channel at the bottom, a test of support around 6660 dollars is possible. If the support is breached, the most likely scenario is consolidation around 6500 dollars.

Company News:

Lithium Americas (LAC.US) - The lithium mining company soared over 50% at the opening after announcing the purchase of 10% of shares by the US government as part of strategic sector control.

Adobe (ADBE.US) - The software company is down about 1.5% after Morgan Stanley lowered its forecasts for the company.

Alibaba (BABA.US) - The Chinese e-commerce giant announced an increase in its AI development budget to 50 billion, causing the stock to rise over 8% at the opening.

Micron (MU.US) - The semiconductor manufacturer published optimistic sales forecasts on the wave of AI demand. The company is up over 2%.

Arista Networks closes 2025 with record results!

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.