- Tech companies leading the gains

- Dollar index shows little change

- US bond yields decline

The end of the week on Wall Street brings an improvement in sentiment. Gains are especially noticeable in tech companies, with the US100 index gaining nearly 1.50% at the time of publication.

Key catalysts contributing to the improved market sentiment on Friday include positive quarterly earnings reports, notably from Tesla, and a tapering of recent hawkish speculation around a more restrictive Fed approach. Currently, the market appears to be cooling hawkish tendencies and gradually returning to normalization. Strong US economic data also supports sentiment. Orders for durable goods came in better than expected, and the final UoM report for October showed improved consumer sentiment and a drop in inflation expectations.

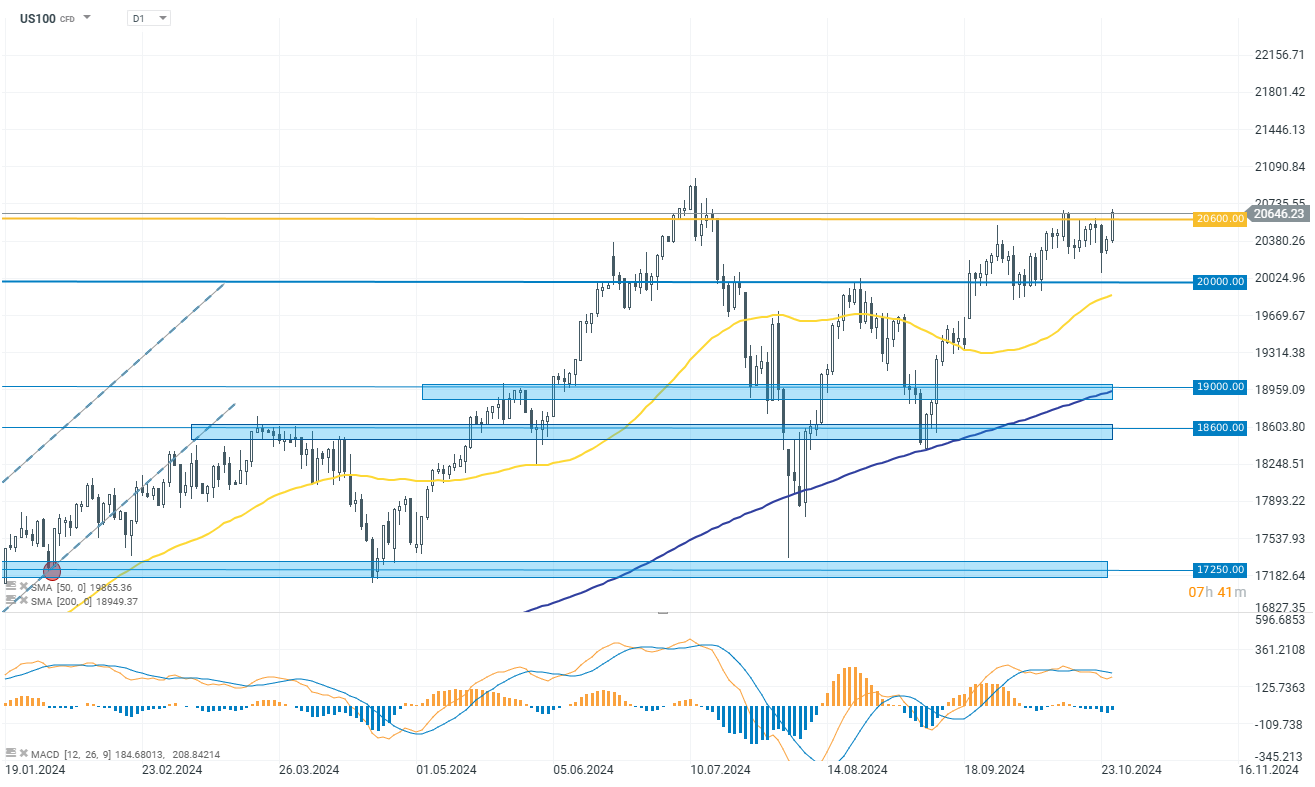

US100

The technology companies' index is decisively breaking through the barrier at 20,600 points. At the time of publication, the US100 is already up by 1.50%. Leading gainers include companies in the semiconductor and advanced technology sectors, such as AMD, Tesla, Intel, Lululemon, and ON Semiconductor. If gains are sustained, the next stop for bulls will be the historic ATH above 20,900 points and below 21,000 points.

Source: xStation 5

Company News

-

L3Harris Technologies (LHX.US) stock gains 4.50% following strong Q3 results and an upward revision to the lower end of its FY2024 guidance. Revenue is now expected between $21.1B and $21.3B, and adjusted EPS was raised to $12.95–$13.15.

-

Skechers (SKX.US) reduces all gains from the initial higher opening and now is losing 0.25%. The company reported Q3 results, with sales up 15.9% year-over-year (Y/Y). The wholesale segment led with a 20% increase to $241.4M, and direct-to-consumer (DTC) sales grew 9.6% to $81.3M. Q4 guidance forecasts $0.70–$0.75 EPS on $2.165B–$2.215B in sales, slightly below consensus. FY2024 outlook was raised to $4.20–$4.25 EPS and $8.925B–$8.975B in sales, surpassing expectations.

-

Western Digital (WDC.US) gains 7.80% despite posting mixed FQ1 results. The company reported a profit of $1.71 per share (a reversal from last year’s loss of $1.76), with revenue up 49% Y/Y. Cloud revenue, making up 54% of total sales, grew by 153% Y/Y and 17% quarter-over-quarter (Q/Q).

-

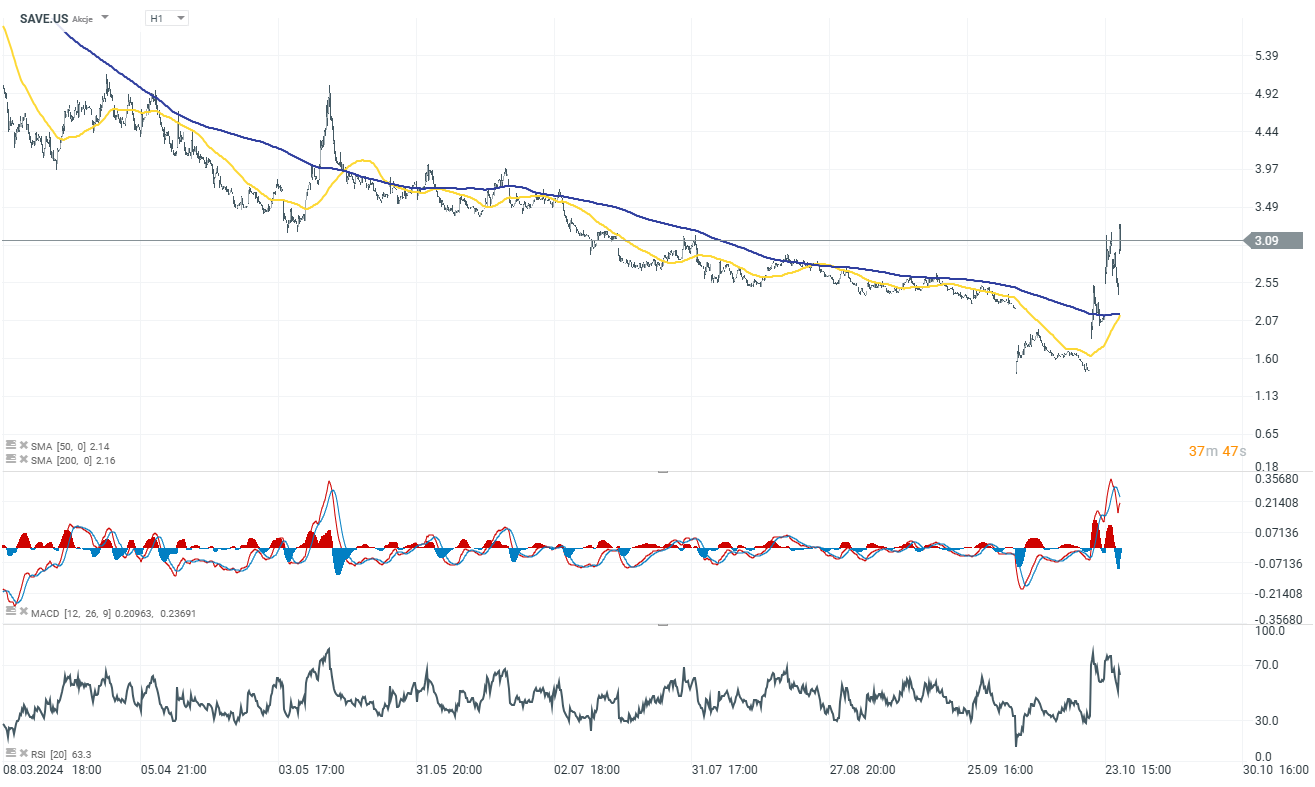

Spirit Airlines (SAVE.US) surged another 28% after announcing liquidity-boosting measures, including selling 23 Airbus planes to GA Telesis for about $519M, expected to improve liquidity by $225M by the end of 2025. Spirit also plans capacity reductions and job cuts, aiming to end the year with over $1 billion in liquidity.

-

Capri Holdings (CPRI.US) stock plunged 49% after a judge blocked its $8.5B merger with Tapestry (TPR.US) over antitrust concerns. Tapestry, whose shares rose 14.40%, plans to appeal.

-

HCA Healthcare (HCA.US) fell over 8% due to Q3 results missing expectations and lowering its full-year forecast to the lower end of prior ranges, citing hurricane impacts. HCA reaffirmed its 2024 guidance with EPS between $21.60–$22.80 and revenue of $69.75B–$71.75B, near the consensus estimate.

-

Dexcom (DXCM.US) dips 4.50% despite reporting a 2% Y/Y revenue increase; U.S. revenue dropped 2%. The company upheld its reduced full-year revenue guidance of $4.0B–$4.05B, aligning with the consensus estimate.

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.