- Wall Street Opens Flat at the Start of a New Week

- Indices Consolidate at High Levels

- Investors Await Powell's Speech on Wednesday Following the Fed's Decision

- Dollar Continues to Rise (USDIDX)

- Macy's (M.US) Surges Over 20% After Receiving a Buyout Offer from an Investor

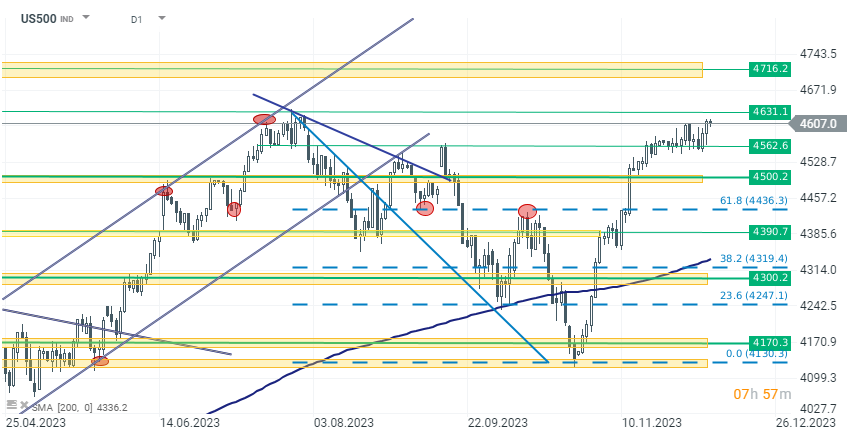

The first day of the week on Wall Street looks relatively calm. Major indices are consolidating at high levels. The S&P 500 (US500) is down 0.06% today, but remains around 4600 points, while the NASDAQ 100 (US100) is slightly up, rising above 16100 points. The calm in the markets may be due to investors waiting for the Federal Reserve's interest rate decision, which will be announced on Wednesday. While the decision itself might not bring major surprises, the focus will be more on Jerome Powell's speech, which presents an opportunity for him to cool the market euphoria. Powell may signal that while the improvement in inflation dynamics is evident, market expectations are detached from reality, and the Fed does not intend to prematurely ease policy.

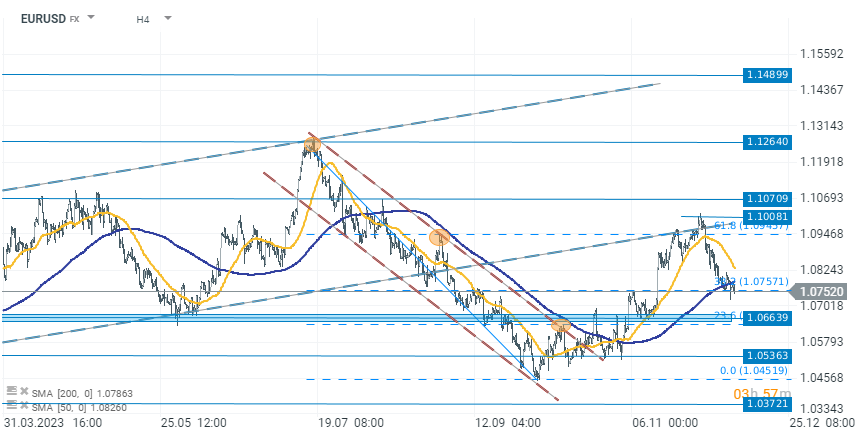

The dollar continues its upward trend, causing a decline in the EURUSD rate. The strengthening dollar is not favorable for index quotations, and since its return to growth, a sideways trend has been observed in the S&P 500. Source: xStation 5

The US500 remains in a consolidation range above 4560 points since the end of November. Despite recent dynamic increases, the index is approaching its annual high of 4630 points.

Company News

Macy's (M.US) gains over 20% at the market open after an alleged $5.8 billion buyout offer from Arkhouse Management and Brigade Capital Management, valuing the company at about $21 per share, a 32.4% premium to its closing price on Nov. 30. Macy's, known for its valuable real estate including the iconic Herald Square location in New York City, is currently in the thick of the holiday season and preparing for a CEO transition in 2024.

source: xStation 5

Occidental Petroleum (OXY.US) is set to acquire Permian Basin energy producer CrownRock in a $12 billion deal, including debt, aiming to expand its Texas operations and boost production by 170,000 barrels per day in 2024. The purchase, financed through new debt, equity issuance, and assumed debt, marks Occidental's first significant acquisition since its controversial 2019 Anadarko Petroleum buy. The deal, closing in early 2024, follows a trend of oil producers expanding inventories but raises concerns over increased leverage on Occidental's balance sheet. The company plans substantial debt reduction in the coming 12 months through asset sales.

source: xStation 5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.