- Wall Street opens lower ahead of FOMC minutes

- US500 tests drops to 2-week low

- Avalanche of new recommendations for US stocks

Wall Street indices launched today's trading lower, following a downbeat trading in Asia-Pacific and Europe earlier today. Markets are in risk-off mode at the beginning of 2024 with USD gaining and equities pulling back. Escalating tensions in the Middle East, disruptions to shipping in the Red Sea as well as concerns over how much monetary easing will be delivered this year are driving the sell-off.

Traders will be offered 3 top-tier releases from the United States today. Manufacturing ISM for December and JOLTS report for November will both be released at 3:00 pm GMT, while FOMC minutes from December 12-13, 2023 meeting will be published at 7:00 pm GMT. Those may shed some more light on whether cuts are imminent or the Fed has comfort to continue with its wait-and-see data approach.

Source: xStation5

Source: xStation5

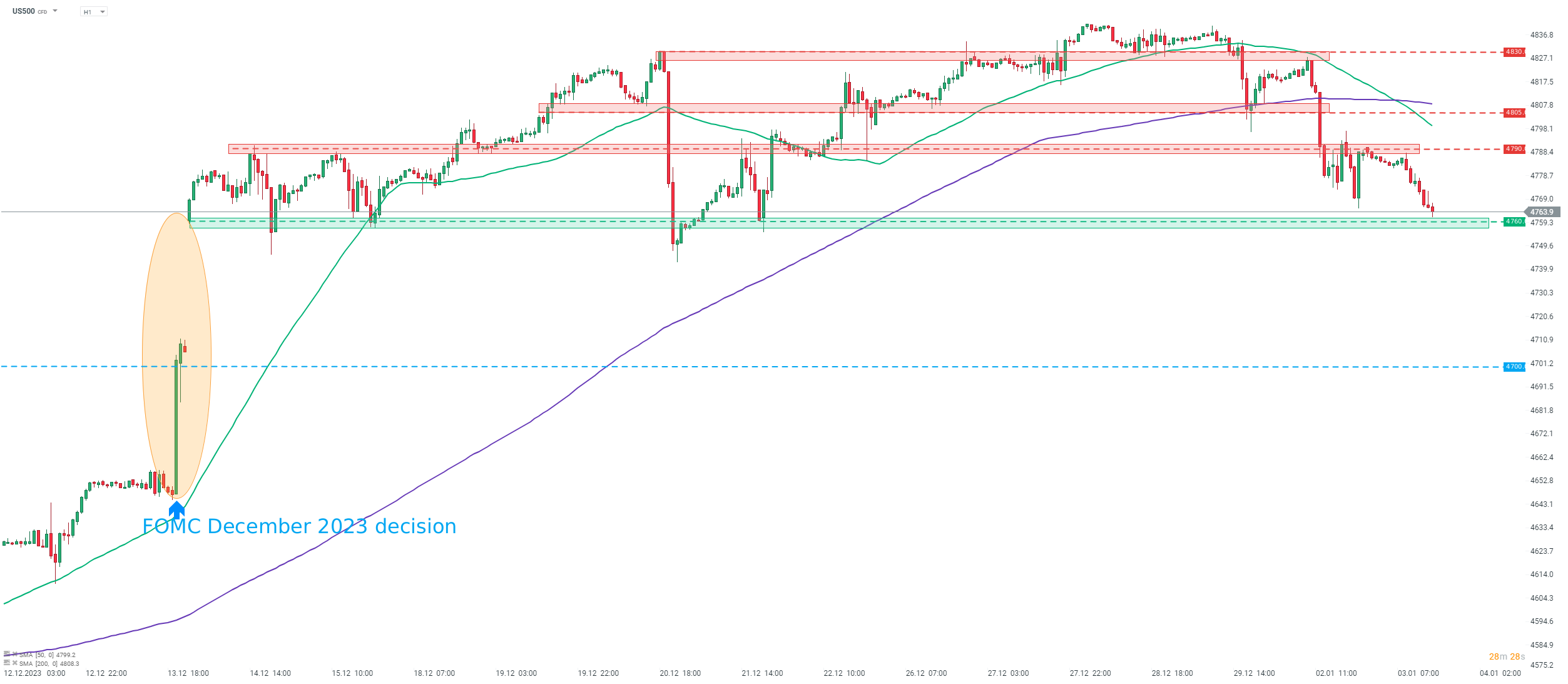

S&P 500 futures (US500), as well as other US indices, are trading lower today. US500 broke below yesterday's lows this afternoon and trades at the lowest level since December 21, 2023. Index is testing the 4,760 pts support zone at press time. A break below will set US500 on the way to fill the bullish price gap that came after FOMC December 2023 rate decision. The first major support zone to watch can be found in the 4,700 pts area, which saw some price reactions in the November 2021 - January 2022 period.

Company News

S&P Dow Jones Indices announced yesterday after the close of the Wall Street session that Pure Storage (PSTG.US) will replace Patterson Cos. (PDCO.US) in the S&P MidCap 400 index, effective prior to session opening on January 5, 2024. In turn, Patterson will move to S&P SmallCap 600 index and replace Chico's FAS (CHS.US) in the index.

Analysts' actions

- Verizon Communications (VZ.US) upgraded to 'overweight' at KeyBanc. Price target set at $45.00

- Discover Financial (DFS.US) upgraded to 'overweight' at Piper Sandler. Price target set at $129.00

- Exxon Mobil (XOM.US) downgraded to "neutral" at Mizuho Securities. Price target set at $117.00

- Occidental Petroleum (OXY.US) downgraded to 'neutral' at Mizuho Securities. Price target set at $64.00

- PBF Energy (PBF.US) upgraded to 'buy' at Mizuho Securities. Price target set at $52.00

- SoFi Technologies (SOFI.US) downgraded to 'underperform' at KBW. Price target set at $6.50

- Ambarella (AMBA.US) downgraded to 'equal-weight' at Wells Fargo. Price target set at $65.00

- MaxLinear (MXL.US) downgraded to 'equal-weight' at Wells Fargo. Price target set at $25.00

- Wendy's (WEN.US) downgraded to 'equal-weight' at Barclays. Price target set at $21.00

- Yum! Brands (YUM.US) upgraded to 'overweight' at Barclays. Price target set at $146.00

Pure Storage (PSTG.US) launched today's trading over 5% higher, following an announcement from S&P Dow Jones Indices. Stock opened at the highest level since December 19, 2023, and is trading around 3% below $38 resistance zone. Source: xStation5

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.