- Wall Street indices open with weaker sentiment, US100 is declining.

- PPI inflation surprised on the downside, while jobless claims came in higher than expected.

- Disney's (DIS.US) shares are declining after the release of their Q1 2023 results.

- Alphabet's (GOOGL.US) stocks are gaining nearly 5% due to product updates in AI following the developers' conference.

Indices open today with mixed sentiment, which, if it turns into a larger sell-off, could help Nasdaq (US100) retreat from local highs. Key macroeconomic publications supported hopes for a pause in the Fed's rate hike cycle - PPI inflation growth was milder than expected at 2.3%, and the core PPI also positively surprised. The initial higher-than-expected increase in jobless claims signals that the US labor market may be losing steam, as anticipated by the Fed. Continuing claims turned out to be lower than expected. Today, investors are primarily focused on Disney's disappointing results and the rising stock price of Alphabet (Google), which, along with Meta and Amazon, is one of the few gaining US large-cap companies today.

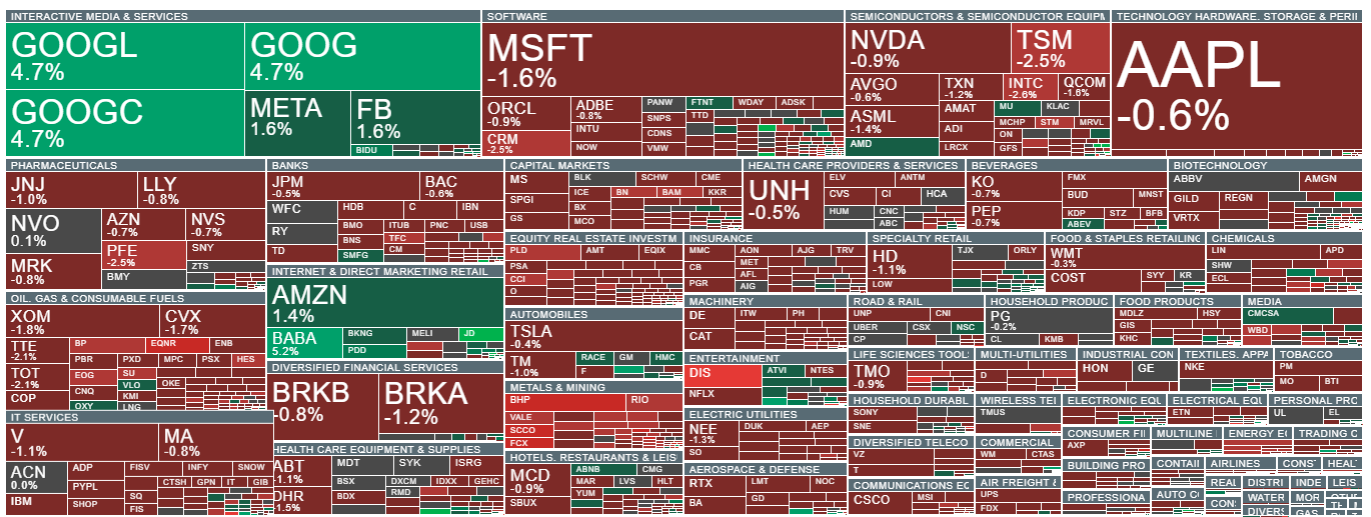

Most active stocks among the US500. Source: xStation5.

Most active stocks among the US500. Source: xStation5.

US, PPI inflation for April.

- Headline. Actual: 2.3% YoY. Expected: 2.5% YoY. Previous: 2.7% YoY

- Core. Actual: 3.2% YoY. Expected: 3.3% YoY. Previous: 3.4% YoY

- PPI monthly inflation Headline: 0.2% m/m (expected: 0.3% m/m; previous: -0.5% m/m)

- Monthly core PPI inflation: 0.2% m/m (expected: 0.2% m/m; previous:-0.1% m/m)

US, jobless claims. Actual: 264k. Expected: 245k. Previous: 242k

US100 started the session with declines, but looking at the bigger picture, we can see that it is still trading above the SMA200 and the key 38.2% Fibonacci retracement level of the upward wave from March 2020, which is around 12,900 points. However, if sentiment deteriorates in the coming days, the price may want to test the key support level. Source: xStation5.

Company News

-

Disney's (DIS.US) shares are down nearly 8% today after a report that disappointed investors. The decline is attributed to weak performance in the streaming platform and slower sales. Disney's earnings have declined for the third consecutive quarter, down 13% YoY to $0.93 per share. Revenues increased by 13.3% to $21.82 billion amidst a slowdown in sales growth over the past three quarters. The results were roughly in line with analysts' expectations from FactSet, but investors focused on the projected growth prospects for the company in the coming quarters and the weak performance of the streaming platform. The total number of Disney subscribers in Disney+, Hulu, and ESPN+ fell short of expectations by nearly 7 million subscribers, reaching 231.3 million compared to 205.5 million in Q1 2022, a decrease of 1.4% QoQ. Wall Street had predicted that the company's subscriber count would increase to 238.88 million.

Disney's (DIS.US) stock, D1 timeframe. Source: xStation5.

-

Google (GOOGL.US) is up 4.7% as the company unveiled its latest AI tools and new hardware at its annual developers' conference. Analysts remain optimistic about the pace at which the company is implementing AI into its products and services

-

JD.com (JD.US) shares are up 5% as the Chinese e-commerce giant reported higher-than-expected profits and sales in Q1. Furthermore, the forecasts were lowered in the period leading up to the results, increasing the surprise effect after the report.

-

Magnite Inc (MGNI.US) shares are up 15% as the online advertising company released positive Q1 results and issued revenue forecasts above market consensus, indicating an improvement in sentiment in the digital advertising market.

-

PacWest Bancorp (PACW.US) is down 17% as the bank reported a 9.5% decline in deposits for the week ending May 5, with the majority of the drop occurring on May 4 and 5.

-

AppLovin (APP.US) is up 24% as the game software producer reported its first-quarter results and outlook, which satisfied Wall Street, primarily due to stabilization in the mobile gaming market.

-

CareDx Inc (CDNA.US) is down 17% as the medical company expressed caution in evaluating its diagnostic business serving organ transplant patients. It also withdrew its latest revenue forecast for 2023, citing uncertainty regarding further changes in its operations.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.