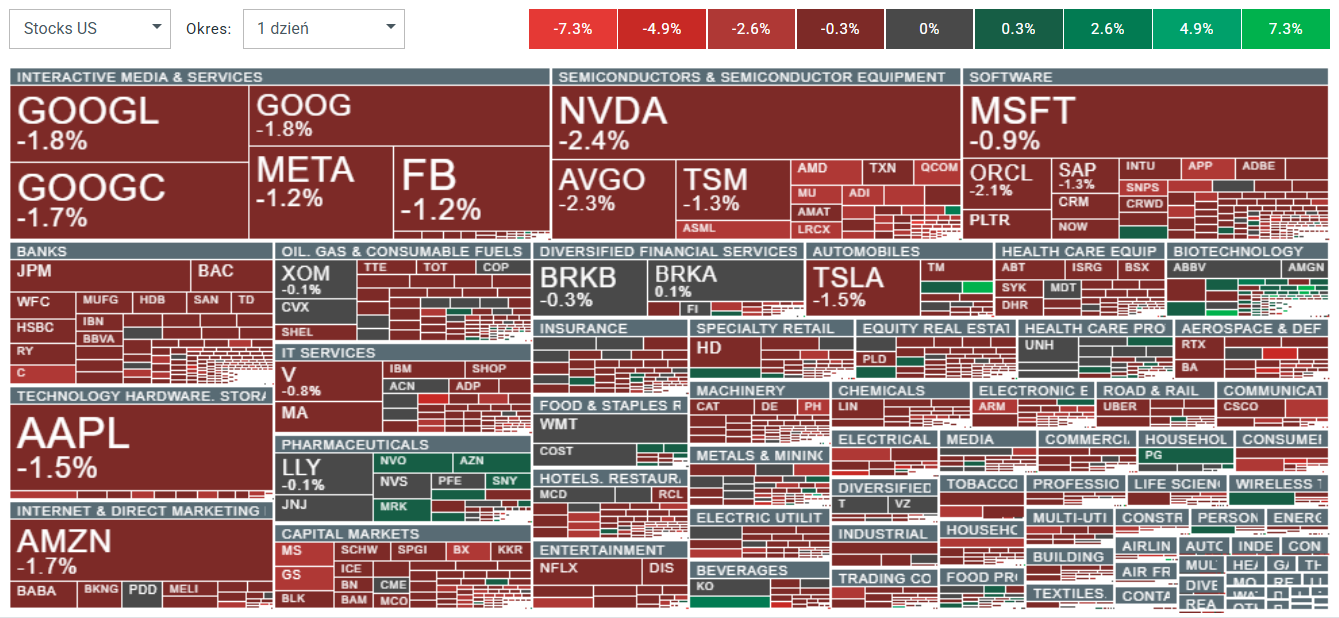

U.S. stock market sentiment is softening on Tuesday, just ahead of the release of the August ISM Manufacturing report. Investors remain concerned about historically elevated equity valuations amid rising bond yields and uncertainty surrounding Friday’s Nonfarm Payrolls (NFP) data.

The worst possible macro “mix” for Wall Street would likely be surging price subindexes alongside weaker labor market and economic activity readings.

-

US100 falls -1.7% within 15 minutes of the U.S. open, with technology names under pressure, including Nvidia (-2.7%).

-

10-year Treasury yields climb more than 4 basis points above 4.27%.

-

Markets still price a September Fed rate cut as almost certain (~90% probability).

-

Euphoria surrounds United Therapeutics and Mineralys Therapeutics, with both stocks gaining more than 36%.

Source: xStation5

Source: xStation5

Company News

-

Cytokinetics (CYTK) surges over 20% after the heart-drug developer reported late-stage trial data that impressed Wall Street.

-

Frontier Group (ULCC) jumps 12% after Deutsche Bank upgraded the low-cost carrier to Buy, citing strong positioning to benefit from Spirit Airlines’ bankruptcy.

-

Ionis Pharmaceuticals (IONS) gains more than 20% after announcing that olezarsen reduced triglycerides and acute pancreatitis events in Phase 3 trials for patients with severe hypertriglyceridemia.

-

PepsiCo (PEP) rises 4% after the Wall Street Journal reported activist fund Elliott Investment Management has built a ~$4 billion stake and plans to push for changes at the beverage giant.

-

Signet Jewelers (SIG) advances 4% after raising its full-year adjusted earnings per share guidance.

-

Telus Digital (TIXT) climbs 14% after Telus Corp. agreed to acquire all remaining shares it does not already own.

-

United Therapeutics (UTHR) soars 49% after announcing its Teton-2 study of Tyvaso inhalation solution for idiopathic pulmonary fibrosis met its primary efficacy endpoint.

-

Mineralys Therapeutics (MLYS) jumps 37% after AstraZeneca’s hypertension drug results came in “numerically worse” than Mineralys’ data, according to Jefferies.

-

Constellation Brands (STZ) drops nearly 7% after cutting its fiscal 2026 profit outlook, raising concerns over the strength of the U.S. consumer.

Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.