- Wall Street is rising despite the US government shutdown – investors are ignoring the political impasse in Washington, focusing on technology and macroeconomic data.

- NASDAQ leads the gains, while Russell 2000 lags behind – the dominance of the AI and Big Tech sectors remains at record levels.

- Elon Musk's xAI has raised $20 billion for purchasing and renting Nvidia chips – Nvidia itself is among the investors, highlighting the growing demand for AI computing power.

- Strong gains in precious metals and indices indicate that the market is increasingly playing the so-called Debasement Trade – a flight to real and technological assets.

- The market is awaiting the release of the FOMC Minutes, which this evening may indicate the direction of the Fed's policy and expectations regarding future interest rate cuts.

- Wall Street is rising despite the US government shutdown – investors are ignoring the political impasse in Washington, focusing on technology and macroeconomic data.

- NASDAQ leads the gains, while Russell 2000 lags behind – the dominance of the AI and Big Tech sectors remains at record levels.

- Elon Musk's xAI has raised $20 billion for purchasing and renting Nvidia chips – Nvidia itself is among the investors, highlighting the growing demand for AI computing power.

- Strong gains in precious metals and indices indicate that the market is increasingly playing the so-called Debasement Trade – a flight to real and technological assets.

- The market is awaiting the release of the FOMC Minutes, which this evening may indicate the direction of the Fed's policy and expectations regarding future interest rate cuts.

American indices started Wednesday's session with gains, despite the budget impasse and ongoing federal government shutdown being a hot topic among analysts and journalists. Investors seem to be ignoring the political chaos in Washington, focusing instead on the performance of technology companies, which continue to drive the market.

At the opening, NASDAQ is rising the most, while Russell 2000 lags behind. This maintains the months-long trend of dominance by AI and technology sector companies, which are capturing an increasingly larger share of market capital, pushing smaller and more traditional firms out of the spotlight for investors.

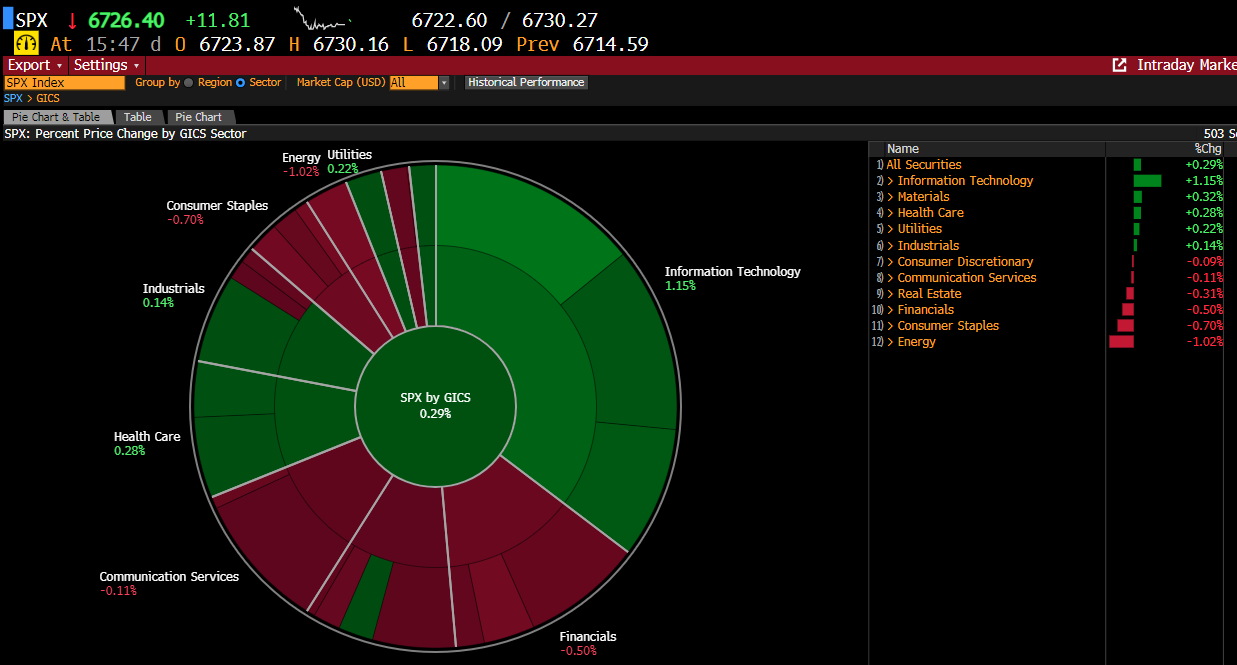

Source: Bloomberg Finance Lp

At the opening of today's session, companies in the information technology and healthcare sectors are performing best, while energy and finance are dragging the indices down.

Meteoric rises in precious metals, particularly gold and silver, and today also Palladium, combined with rising indices despite political tensions, may indicate that investors are increasingly pricing in the so-called "Debasement Trade." This refers to a flight to tangible and digital assets amid growing concerns about public debt and the real value of the dollar.

The gains continue despite yesterday's cooling of sentiment following Oracle's results. The company revealed it spent $100 million renting Nvidia chips, raising some doubts about the cost-effectiveness of these projects and the company itself. Importantly, in this context, Elon Musk's startup "xAI" has already raised $20 billion to purchase and rent Nvidia chips. Interestingly, Nvidia itself is among the investors funding the project.

In the background remains the tense political situation. The Senate yesterday rejected another Republican budget bill, and the federal government remains shut down. There are currently no prospects for a compromise.

In this environment, investors are primarily waiting for the release of the minutes from the last FOMC meeting, which will be published this evening. The market hopes the document will shed more light on how the central bank assesses the situation and how the government shutdown affects the FED's decision-making process.

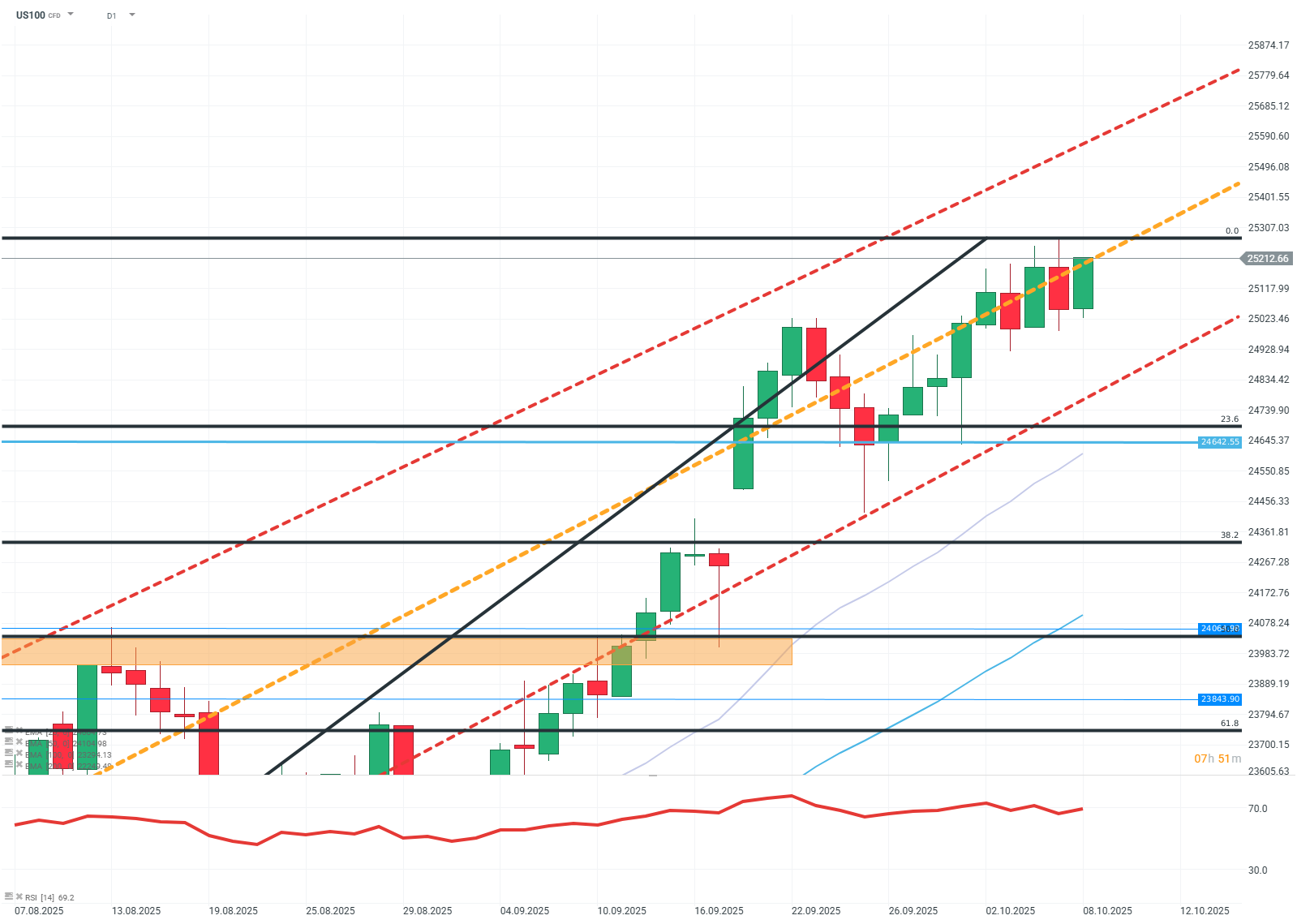

US100 (D1)

Source: Xstation5

From a technical standpoint, the price is solidly within a long-term upward channel, whose lower boundary has effectively served as support for many months. The trend structure remains intact, and the movement dynamics suggest that buyers still control the market. The only significant resistance at the moment remains the level of the last ATH. However, if a downward correction occurs, the first significant support will be the area of $24,640. This is a zone where local minima, the EMA25 moving average, and the FIBO 23.6% retracement level converge. Maintaining this zone should be crucial for preserving the current upward momentum.

Company News:

Confluent (CFLT.US) - The software and database infrastructure company announced it is seeking a new buyer. The stock price is up 10% at the opening.

Rocket Lab (RKLB.US) - The company responsible for designing and manufacturing rockets continues its upward trend, rising over 9% today after announcing a contract with a Japanese satellite operator.

Anglogold (AU.US) - The gold mining company is up over 2% amid euphoric sentiment towards precious metals.

FedEx (FDX.US) - The logistics company is down about 2% after Morgan Stanley lowered its outlook.

QuantumScape (QS.US) - The battery manufacturer is up 5% after announcing a collaboration with Murata on a new project.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.