-

Wall Street opens higher after relatively worse macro data

-

Jobless Claims lower than expected and GDP declines

-

Meta Platforms is on a roll after beating financial results

Today's calendar is quite intense. Investors have already received several key economic data on the US economy, as well as financial reports from important companies. At 1:30 (BST time) there was a publication of GDP, PCE and Jobless Claims data.

Even though the Gross Domestic Product (GDP) only grew by 1.1%, which is lower than the expected 1.9% and the previous quarter's 2.6%. In the first quarter, final sales made to domestic buyers increased by a much stronger 3.2%. This may suggest that there is no immediate risk of a recession. The current data will probably strengthen the Federal Reserve's commitment to raise rates by 25pb in the upcoming meeting in early May, to combat the core inflation.

At the same time PCE data was released. The core inflation increased more than anticipated to 4.9% Q/Q compared to 4.7% expected.

The last important publication was Jobless Claims, which came as the only one better-than-expected. Jobless Claims fell to 230k, although this result is still higher than the data in recent months. This was contrary to expectations of a small increase.

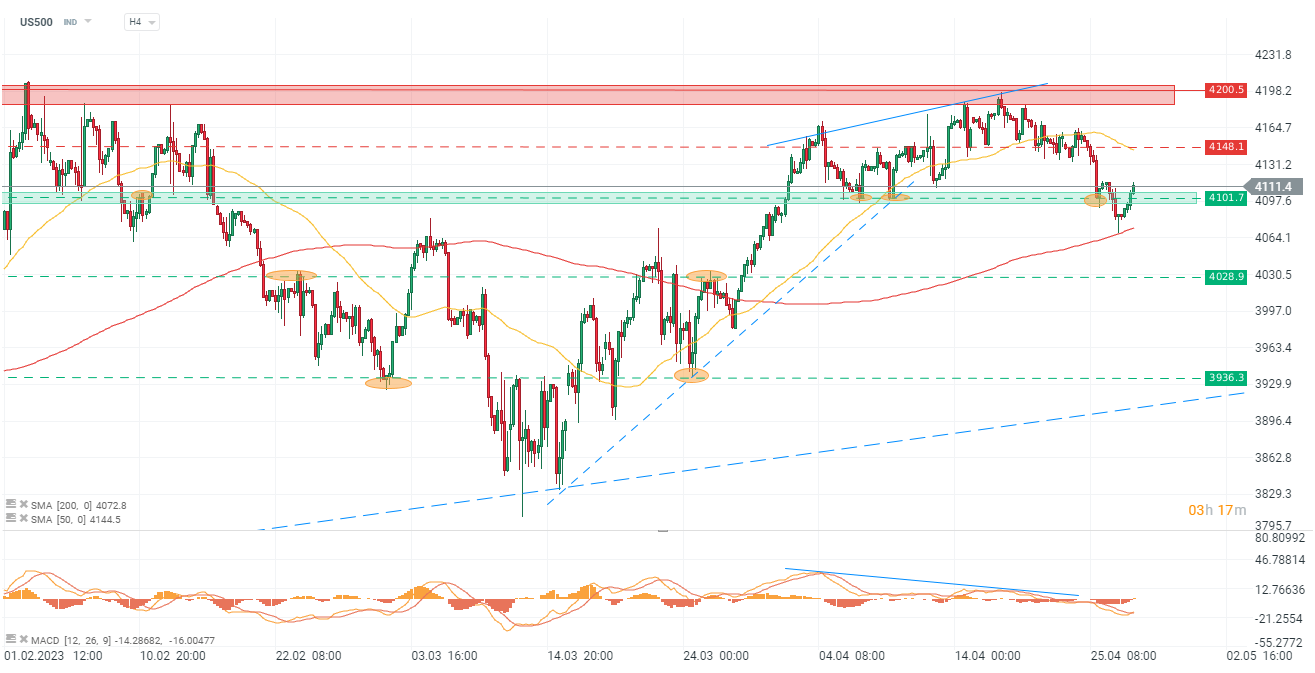

US500, the current index price is 4112 points. The price has broken through the resistance level at 4100 after rebounding from the 50 day SMA.The price has returned to the consolidation range, which suggests that there may be a lack of momentum for the index to continue to rise. Traders and investors may want to closely monitor the index to see if the price can break out of this consolidation range and establish a new upward trend, or if the price will continue to consolidate and potentially decline.

Company News

- Meta Platforms (META.US) rose as much as 14% on Thursday, after the company Q2 revenue beat expectations.

- EBay (EBAY.US) rose as much as 3.1% after the e-commerce company forecast better-than-expected net revenue for the second quarter. Analysts noted that the company’s focus categories, which include refurbished products and collectibles, outperformed the rest of the marketplace.

- Seres Therapeutics (MCRB.US) shares surge 9% after the developer of biological drugs received FDA approval for its therapeutics Vowst to prevent the recurrence of C. difficile infection (CDI) in adults.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.