- Wall Street indices gain

- Nasdaq100 breaks through 18,000 points

- US Dollar weakens

- US Treasury bonds also decline

On the fourth trading day of this week, Wall Street extends its gains following the release of the PCE inflation report. The US500 index is up over 0.64%, approaching its historical high above 5,100 points. The technology-heavy Nasdaq100 index shows similar trends, gaining over 1.05% and thereby breaking the 18,000-point level. These rises are driven by a weakening dollar and falling yields on 10-year US Treasury bonds, now at 4.23%.

PCE Report

Inflation in the United States, measured by the change in the Personal Consumption Expenditures (PCE) Price Index, dropped to 2.4% annually in January. This reading followed a 2.6% increase in December and matched market expectations. On a monthly basis, the PCE Price Index rose by 0.3%, as forecasted. The core PCE Price Index, which excludes volatile food and energy prices, increased by 2.8% annually, aligning with analyst estimates.

Despite the data meeting expectations, the market reacted positively with a surge in indices and a weakening dollar. Investors had feared data higher than expected, as was the case with CPI data. Therefore, the report in line with consensus had a positive impact.

US100

The index is gaining over 1.00% today, surpassing the 18,000-point level. The gains clearly accelerated immediately after the PCE report was published. However, the market still feels the impact of Nvidia's better report and investor euphoria related to artificial intelligence.

Source: xStation 5

Company News

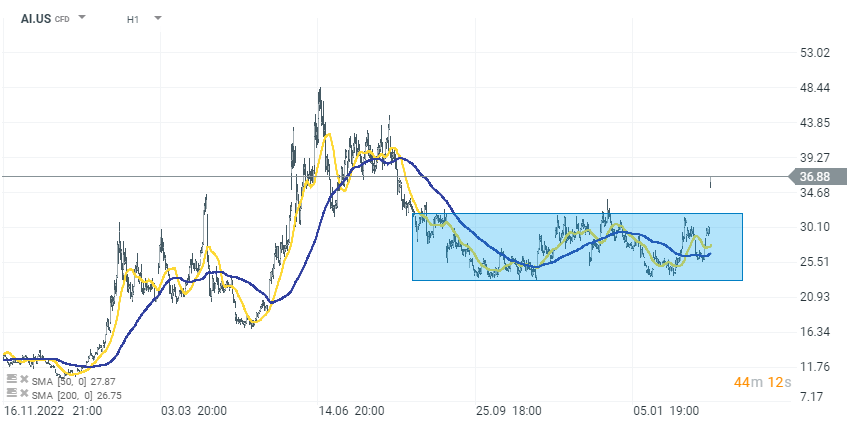

C3.ai's (AI.US) stock surged over 20% in early trading on Thursday following the announcement of better-than-expected third-quarter results and an optimistic outlook, earning commendation from Wall Street. Led by Thomas Siebel, C3.ai is making strides in the generative artificial intelligence sector and is actively investing to increase its global market presence. Following these positive results, Wedbush Securities analyst Dan Ives raised his price target for C3.ai to $40 from $35. The company has revised its fiscal 2024 revenue forecast to a range of $306M to $310M, up from the earlier projection of $295M to $320M, aligning closely with the consensus estimate of $305.53M. Additionally, C3.ai anticipates fiscal fourth-quarter sales to be between $82M and $86M, compared to the consensus estimate of $83.91M.

Source: xStation 5

Source: xStation 5

Verizon (VZ.US) has announced a quarterly dividend of $0.665 per share, consistent with its previous dividend distribution. As of February 29, 2024, the forward yield stands at 6.64%. This dividend is scheduled to be paid on May 1, and it applies to shareholders who are on record as of April 10.

Best Buy (BBY.US) shares rose almost 6% after the consumer electronics retailer reported a smaller-than-expected decline in comparable sales for FQ4 2024. Despite the holiday season, the company faced challenges as domestic revenue fell by 0.9% year-over-year to $13.41 billion. This decline was attributed to reduced consumer spending on major items like home theatres, appliances, mobile phones, and tablets.

Chemours (CC.US) plunged over 43% amid ongoing repercussions from a recent disclosure about potential material weaknesses in its internal financial reporting controls. The chemical company announced the administrative leave of its top executive, Mark Newman, and CFO Jonathan Lock, pending an internal review by the board's audit committee with outside counsel. Additionally, Chemours has further delayed filing its annual report.

Upcoming Results

Zscaler (ZS.US): Shares of cybersecurity firm Zscaler are drawing attention as it prepares to release its FQ2 2024 report in extended trading. Analysts anticipate earnings of 58 cents per share on revenue of $506.83 million, reflecting year-over-year growth of nearly 57% and 31% respectively. The sector has seen a resurgence due to increased global ransomware attacks over the past year, boosting demand for cybersecurity services. Analysts will be looking for Zscaler's near-term guidance and management's forward-looking statements.

Dell Technologies (DELL.US) is set to report its FQ4 2024 earnings after the market closes, with Wall Street expecting earnings of $1.72 per share on a revenue of $22.17 billion. Investors are keenly awaiting Dell's PC sales results and insights on the PC market, especially following its competitor HP's (HPQ) recent quarterly revenue miss due to sluggish PC demand, attributed to a significant post-holiday slowdown and cautiousness among commercial customers.

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.