-

US stocks opened lower

-

Weak housing market data

-

GameStop (GME.US) stock surges after CEO Cohen acquired additional shares

US indices launched today's session 0.5% lower amid rising oil prices and lack of progress in the Russia-Ukraine peace talks. President Zelenskyy called western countries to put additional pressure on Russia as the conflict appears to be entering a stalemate. Investors also digest the higher possibility of a 50-bps hike in May following recent hawkish comments from several FED members. On the data front, mortgage applications dropped 8.1% , following a 1.2% decline in the previous week, as mortgage rates surged to the highest in three years. Applications to refinance a home loan declined 14.4%, while those to purchase a home edged down 1.5%. Meanwhile, the average fixed 30-year mortgage rate increased by 23 bps, the most since March 2020, bringing the rate to 4.50%, the highest since early 2019.

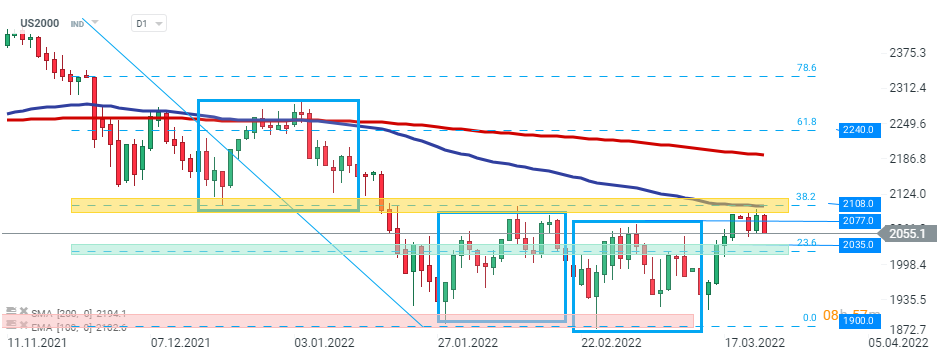

US2000 index pulled back after buyers again failed to break above local resistance at 2108 pts which coincides with 38.2% Fibonacci retracement of the last downward wave and upper limit of the 1:1 structure. Currently the index is approaching major support around 2035 pts, which is marked with 23.6% Fibonacci retracement. Source: xStation5

US2000 index pulled back after buyers again failed to break above local resistance at 2108 pts which coincides with 38.2% Fibonacci retracement of the last downward wave and upper limit of the 1:1 structure. Currently the index is approaching major support around 2035 pts, which is marked with 23.6% Fibonacci retracement. Source: xStation5

Company news:

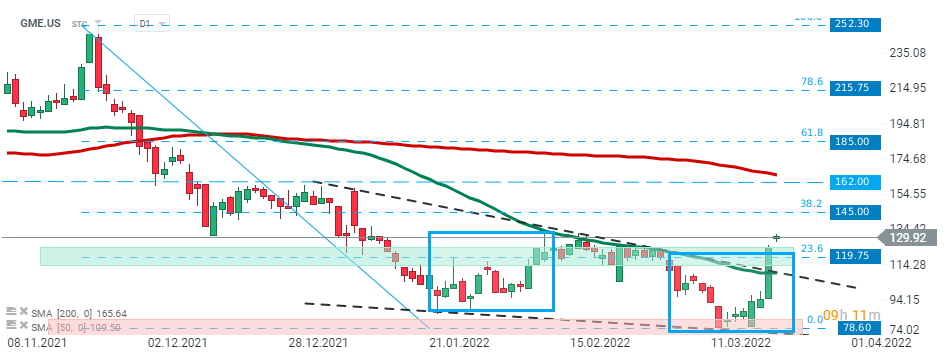

GameStop (GME.US) stock jumped over 12.0% before the opening bell, after company’s CEO Ryan Cohen acquired 100,000 additional shares, raising his stake in the video game retailer to nearly 12.0% according to SEC filing.

GameStop (GME.US) stock launched today's session above major resistance at $119.75, which is marked with upper limit of the 1:1 structure, 23.6% Fibonacci retracement of the last downward wave. If current sentiment prevails, upward move may accelerate towards next resistance at $145.00 which is marked with 38.2% Fibonacci retracement. Source: xStation5

GameStop (GME.US) stock launched today's session above major resistance at $119.75, which is marked with upper limit of the 1:1 structure, 23.6% Fibonacci retracement of the last downward wave. If current sentiment prevails, upward move may accelerate towards next resistance at $145.00 which is marked with 38.2% Fibonacci retracement. Source: xStation5

General Mills (GIS.US) stock rose over 1.5% in the premarket after the food producer posted upbeat quarterly results and raised its full-year guidance as demand for food at home continues to be elevated. Company reported earnings of 84 cents per share, beating analysts’ estimates of 78 cents per share, while revenue matched market estimates.

Tencent Holdings (TME.US) ADR price is expected to open lower after Chinese social media giant's revenue increased only by 8% in Q4, its slowest growth since going public in 2004.

Adobe (ADBE.US) stock dropped over 3.0% after the software maker beat its first-quarter targets, however issued a weak outlook, warning of a hit to its digital media business in Ukraine.

Morning wrap (22.01.2026)

Daily Summary: Trump signals restraint over Greenland, easing market jitters

⏫US500 climbs over 1%

US OPEN: Trump pivot lifts Wall Street sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.