- Wall Street indices open lower

- US100 tries to bounce off the 19,000 pts area

- KKR, CrowdStrike and GoDaddy to join S&P 500 index

- Perion Networks slumps 30% after revising forecasts lower

Wall Street indices launched today's trading slightly lower, following a downbeat trading in Europe earlier today. However, scale of the move on Wall Street is much smaller than in Europe as declines on the Old Continent are driven by region-specific factors - political uncertainty caused by results of European Parliament elections and, especially, snap parliamentary elections called in France. S&P 500 launched today's trading 0.2% lower, Nasdaq dropped 0.3% at session launch, Dow Jones declined 0.1% and small-cap Russell 2000 plunged over 1%.

Source: xStation5

Source: xStation5

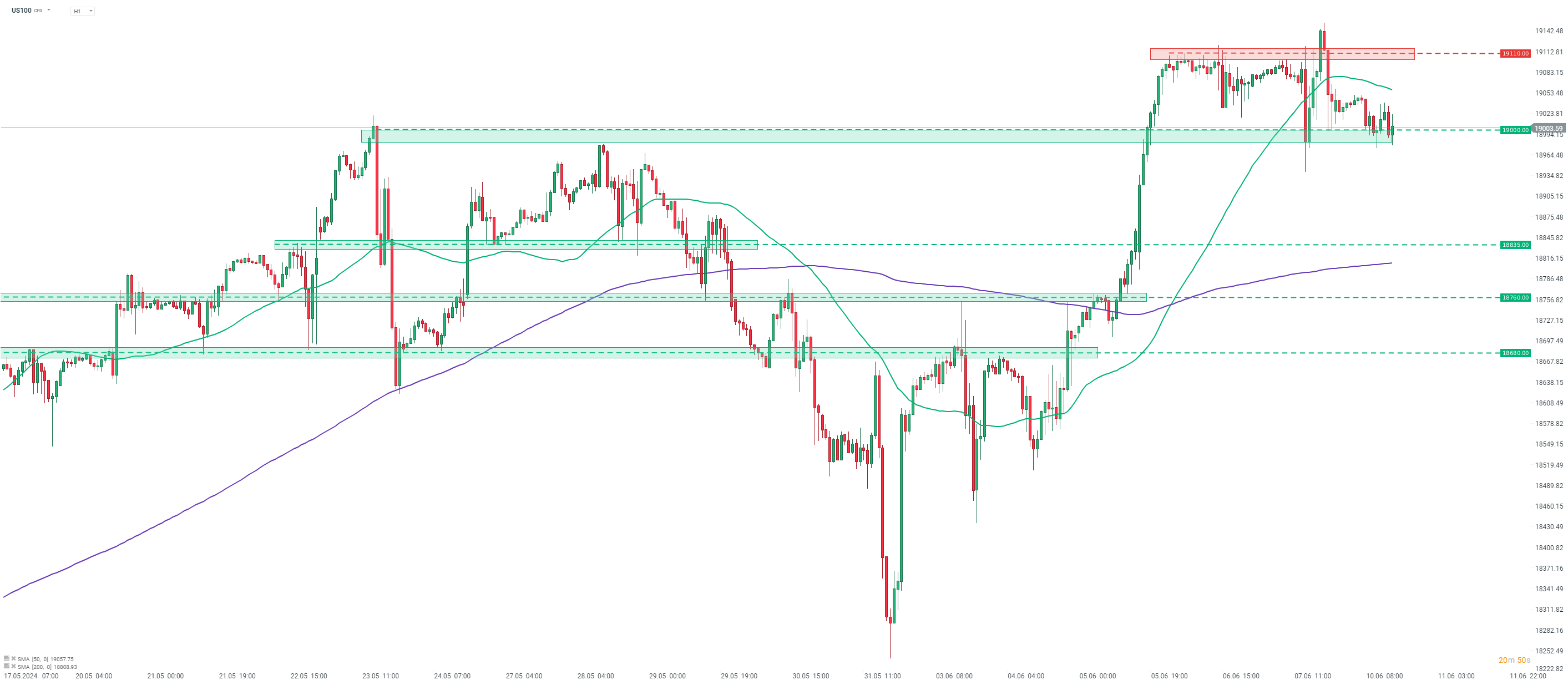

Nasdaq-100 futures (US100) are trading lower today. The index is testing support zone ranging below 19,000 pts area today, which served as a floor recently. A break below this area could pave the way for a deeper correction, with 18,835 pts zone being the first potential short-term support to watch. However, the index began to erase losses after launch of the Wall Street cash session and is now trying to bounce off the 19,000 pts mark. Should bulls regain control over the market and continue to push the index higher, the first near-term resistance zone be found in the 19,110 pts zone, just slightly below record highs.

Company News

S&P Dow Jones Indices announced the quarterly rebalancing changes to S&P 500 index. KKR & CO (KKR.US), CrowdStrike (CRWD.US) and GoDaddy (GDDY.US) will join S&P 500 index, replacing Robert Half International (RHI.US), Comerica (CMA.US) and Illumina (ILMN.US). Changes to the index will go into effect before the launch of Wall Street cash session on Monday, June 24, 2024.

Perion Network (PERI.US) launched today's trading with a big bearish price gap. Company revised its Q2 and full-year forecasts lower after it was notified by Microsoft Bing that a number of publishers will be excluded from search distribution marketplace. Perion now expects Q2 revenue to reach $106-108 million, down from previous guidance of $118-122 million, and Q2 adjusted EBITDA to reach $6.5-7.5 million, down from $10-12 million previously. Full-year revenue is now seen at $490-510 million, down from $590-610 million expected previously, and full-year adjusted EBITDA is seen at $48-52 million, down from previous goreacst of $78-82 million.

A 10-to-1 stock split on Nvidia (NVDA.US) went into effect on Friday after close of Wall Street session, meaning that today will be the first day when company trades at a post-split basis.

Southwest Airlines (LUV.US) is trading higher today, following a report from Wall Street Journal. WSJ reported that Elliott Investment Management, a well-known acitvist investor, built an almost $2 billion stake in the company, making Elliott one of the largest stakeholders in Southwest Airlines.

Analysts' actions

- Advanced Micro Devices (AMD.US) downgraded to 'equal-weight' at Morgan Stanley. Price target set at $176.00

- PG&E Corp (PCG.US) upgraded to 'overweight' at JPMorgan. Price target at $22.00

- Adobe (ADBE.US) downgraded to 'hold' at Melius Research. Price target set at $510.00

Perion Network (PERI.US) launched new week's trading with an around-30% bearish price gap, after revising its sales and adjusted EBITDA guidance lower. Stock plunge to the lowest level since early-December 2020 and is trading around 70% year-to-date lower. Source: xStation5

Perion Network (PERI.US) launched new week's trading with an around-30% bearish price gap, after revising its sales and adjusted EBITDA guidance lower. Stock plunge to the lowest level since early-December 2020 and is trading around 70% year-to-date lower. Source: xStation5

US Raises Tariffs to 15%

Market wrap: European and US stocks try to rebound rebound 📈

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Daily summary: Markets capitulate under the influence of the Persian Gulf

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.