- Wall Street opens higher after yesterday's declines

- Market tries to adjust prices post-Fed conference

US markets open higher following yesterday's end-of-session drops. Jerome Powell's more hawkish stance caused declines in risky assets and a rise in the dollar's value. The Fed clearly communicated that a rate cut in March is not on the table, contrary to some speculations.

Despite the hawkish tone, the market reaction is limited. Today, we see that the declines are not continuing, and the dollar's appreciation is somewhat slowing. On one hand, the Fed indicated no initial cuts in March, but on the other, it confirmed a willingness to cut rates this year and begin QT (Quantitative Tightening). Today, on US500 and US100, we observe increases of 0.30-0.40%. The dollar has slowed its gains from the first part of the day and is no longer the strongest currency. Meanwhile, the yields on 10-year Treasury bonds have dropped to even 3.87%.

US500

US500 retreated from around 5000 points. This psychological barrier will be extremely tough to overcome. After Jerome Powell's conference, the index price dipped below 4900 points and remains in this zone up to the present moment. The first support from below is the 4830-4840 point level.

Source: xStation 5

Company News

AMD (AMD.US) has raised its artificial intelligence-related revenue forecast for this year to $3.5 billion, up from the previous $2 billion estimate. Citi analysts, however, believe AMD is deliberately underestimating and expect the company to generate around $5 billion this year and $8 billion next year from the MI300. AMD CEO Dr. Lisa Su is confident in exceeding the $3.5 billion mark, citing potential upside.

Source: xStation 5

Microsoft (MSFT.US) and Meta (META.US) are reportedly the biggest customers for the MI300, with average selling prices ranging from $10,000 to $15,000. Despite weaker-than-expected guidance causing a sell-off in AMD shares on Wednesday, Citi notes multiple opportunities for AMD to improve gross margins, including growth in its Xilinx business and the MI300 ramp-up.

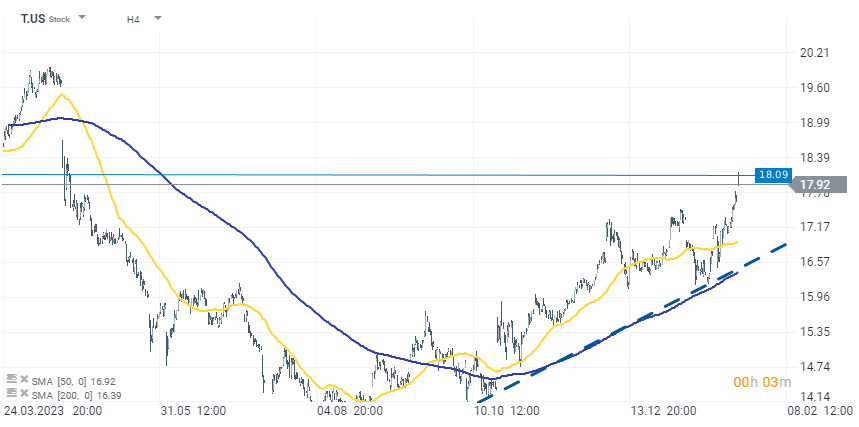

J.P. Morgan upgraded AT&T (T.US), expecting consistent, long-term growth in its wireless and broadband sectors, particularly due to potential in its broadband segment and ongoing fiber buildout. The firm raised its rating to Overweight from Neutral, with a year-end price target increased to $21 from $18. AT&T.

Source: xStation 5

Source: xStation 5

Altria (MO.US) rose over 1.8% following the announcement of a new $1 billion share buyback plan. The tobacco giant reported Q4 2023 adjusted earnings per share in line with expectations, but saw a 2.2% year-over-year revenue decline, mainly due to a decrease in its smokeable products segment, partly offset by growth in oral tobacco products.

Honeywell (HON.US) fell 4.5% due to a Q4 2023 revenue miss and 2024 sales forecast below expectations. The adjusted profit per share guidance midpoint for 2024 was also lower than estimates. Despite this, CEO Vimal Kapur expressed confidence in Honeywell's positioning for 2024, citing automation, the future of aviation, and energy transition as key growth drivers.

Plug Power (PLUG.US) stock surged over 15% after the company announced the completion of the first fill of a Plug tanker with liquid green hydrogen at its Georgia plant.

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.