- Wall Street with higher open on Monday

- Honeywell shares rose after announcing it is exploring a potential separation of its aerospace business

- Ford Motor shares declined after Jefferies downgraded the stock to Underperform and cut its price target to $9, citing inventory challenges and strategic uncertainties

- Capri Holdings is reportedly exploring the sale of its Versace and Jimmy Choo brands through Barclays bank

- Nasdaq 100 announced major index changes effective December 23, with MicroStrategy, Palantir Technologies , and Axon Enterprise joining the index

US equity markets are showing positive momentum, with larger indices leading gains. The US100 advances 0.56% to 21916.93, while the US500 rises 0.27% to 6071.4. The US30 shows modest gains of 0.05% to 43886. The VIX remains unchanged at 16.18. However, some weakness is seen in smaller indices with the US2000 declining 0.04% to 2348.1. Latin American markets are underperforming with the BRAComp down 0.20% to 124376 and the MEXComp falling 0.22% to 51314.

European markets are broadly lower, with France's FRA40 showing the steepest decline of 0.81% to 7350.7, followed by Austria's AUT20 dropping 0.69% to 3603. Among other major markets, Italy's ITA40 falls 0.57% to 34710, while the EU50 declines 0.47% to 4947.2. The UK100 is down 0.43% to 8268.5, and Germany's DE40 loses 0.40% to 20348.1. Only Spain's SPA35 manages to stay positive with a modest gain of 0.04% to 11733.

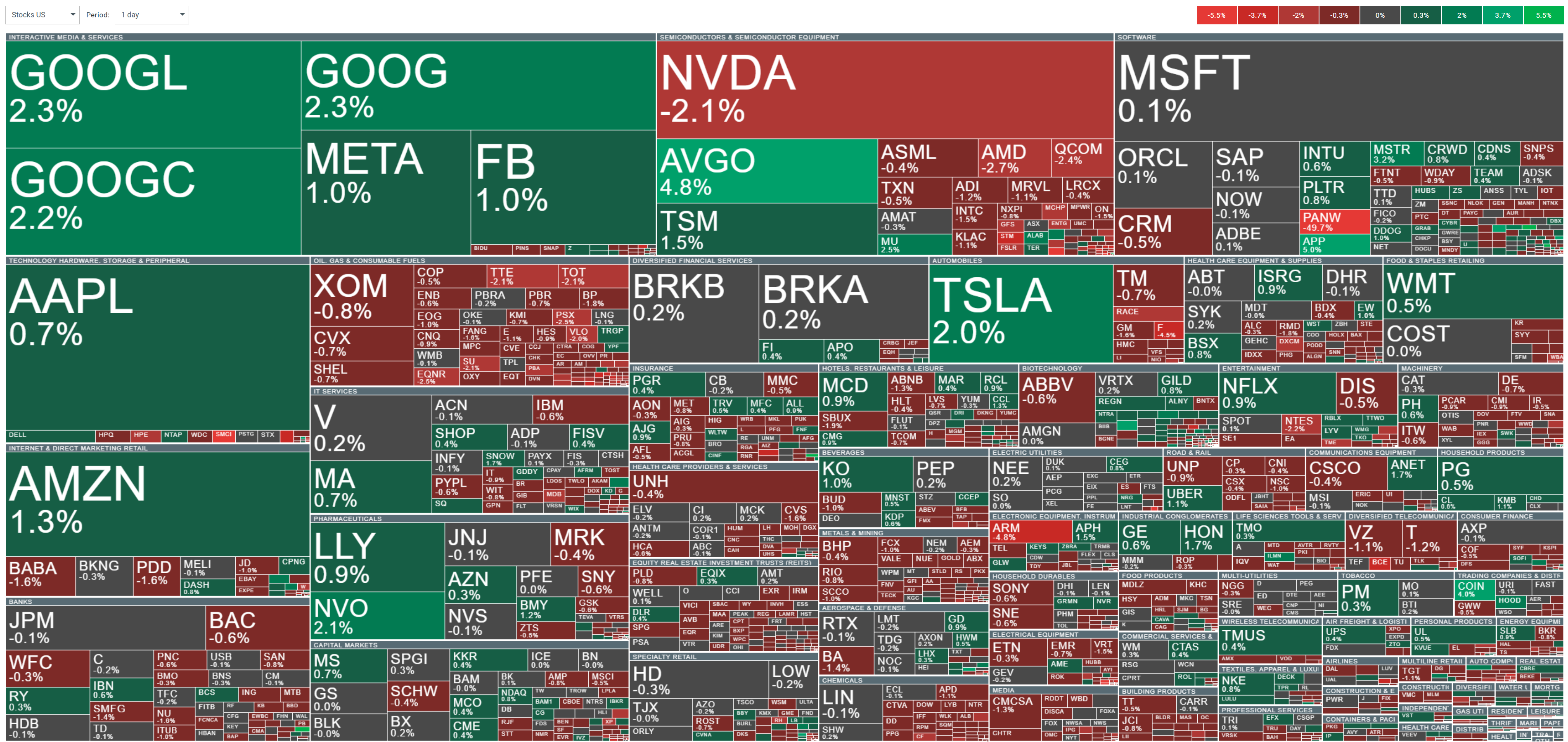

Looking at S&P 500 sectors, Communication Services leads gains with a 1.15% advance, followed by Consumer Discretionary up 0.80% and Consumer Staples adding 0.23%. Utilities, Health Care, Financials, and Information Technology show modest gains between 0.01-0.16%. However, several sectors are trading lower: Real Estate (-0.10%), Materials (-0.32%), and notably Energy showing the largest decline at -0.78%. The overall market remains slightly positive with the S&P 500 up 0.21%.

Current volatility observed on Wall Street. Source: xStation

The Nasdaq-100 index, represented by the US100 contract, is trading at all-time highs. The mid-November high at 21,255 acts as the initial support level for bulls, with the mid-July high of 20,895, closely aligned with the 50-day SMA at 20,851, providing additional support. For bears, key targets include the 100-day SMA and the August highs near 19,917, which serve as critical downside levels.

The RSI is consolidating near the overbought zone, reflecting sustained bullish momentum. Meanwhile, the MACD is narrowing but continues to display bullish divergence, underscoring the strength of the prevailing upward trend. Source: xStation

News

- Honeywell (HON.US) shares rose 3.2% after announcing it is exploring a potential separation of its aerospace business, which generates about 40% of annual revenue. The move comes a month after activist investor Elliott Investment Management, which holds a $5 billion stake, pushed for breaking up the conglomerate. CEO Vimal Kapur indicated the company will provide an update on its portfolio review with Q4 results. Honeywell has already announced plans to spin off a $10 billion advanced-materials business and recently sold its personal-protective-equipment unit for $1.33 billion.

- Ford Motor (F.US) shares declined after Jefferies downgraded the stock to Underperform and cut its price target to $9, citing inventory challenges and strategic uncertainties. Despite 15% higher U.S. sales, Ford's inventory has ballooned to 96 days, significantly above competitors. The automaker faces tough decisions regarding its European operations and electrification strategy, while dealing with an $8.5 billion warranty and quality provisions gap since 2020. Separately, Ford agreed to a $165 million settlement with NHTSA over recall issues.

- Capri Holdings (CPRI.US) is reportedly exploring the sale of its Versace and Jimmy Choo brands through Barclays bank, following the collapse of its $8.5 billion merger with Tapestry in October. The potential divestment comes as both brands struggle, with Versace reporting a 22.1% revenue drop and Jimmy Choo declining 0.6% in the first half of 2024. Previous reports suggested Exor and Kering showed interest in acquiring Versace. The move would allow Capri to focus on its Michael Kors brand despite its recent underperformance.

- Nasdaq 100 announced major index changes effective December 23, with MicroStrategy (MSTR.US), Palantir Technologies (PLTR.US) and Axon Enterprise (AXON.US) joining the index. MicroStrategy, up 500% this year as Bitcoin's largest corporate holder, and Palantir, which gained 343% on AI-driven growth, highlight the increasing influence of cryptocurrency and artificial intelligence in tech. The additions will replace Moderna (MRNA.US), Super Micro Computer (SMCI.US), and Illumina (ILMN.US), with Bloomberg Intelligence estimating at least $22 billion in ETF-related trading activity.

Other news coming from individual S&P 500 index companies. Source: Bloomberg Financial LP

Tesla falls 1.30% despite record quarterly revenue 🔎

Daily wrap – US Export Restrictions on China and Weaker Earnings Trigger Wall Street Correction

Google Quantum Echoes – A Quantum Computing Breakthrough

Those Stocks Scared Investors Ahead Of This Halloween🎃 — Market Losers of 2025

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.