- US indices launched today's cash trading higher

-

Initial jobless claims rose more than expected

-

Uber (UBER.US) reportedly considering spinning off its freight business

Three major Wall Street indices launched today's session higher, with Dow Jones adding 0.50%, while S&P500 and Nasdaq rose by 0.60% and 0.65% respectively as bigger-than-expected rise of weekly jobless claims eased some rate hikes worries ahead of key NFP report which will be published tomorrow and is opposed to hotter-than-expected ADP and JOLTs Job figures.

S&P 500 index stocks categorized by sectors and industries. Size represents market cap. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

Non-seasonally-adjusted initial claims jumped to 237k. Source: Bloomberg via ZeroHedge

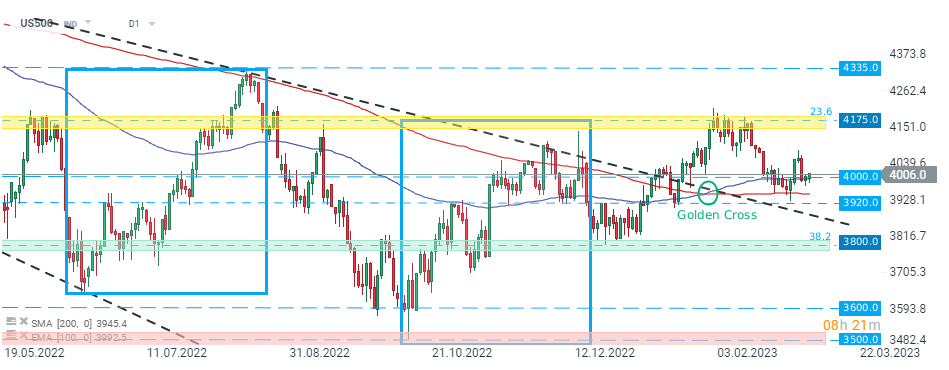

US500 returned above 4000 pts level, which now acts as major short term support. As long as price sits above the aforementioned level, upward move may accelerate towards resistance at 4175 pts. On the other hand, another downward wave may be launched towards support at 3920 pts. Source: xStation5

Company news:

Uber (UBER.US) stock jumped 2.0% in premarket after Bloomberg reported that the ride-hailing company is considering spinning off its freight logistics division, which generated $1.5 billion of revenue in Q4. Piper Sandler believes this move could eventually increase the stock’s chances of being included in the S&P 500 Index.

Uber (UBER.US) stock launched impressive upward move at the end of December 2022, however buyers failed to break above resistance at $37.26 and price tested $32.50 major support at $32.50, which coincides with 61.8% Fibonacci retracement of the upward wave started in March 2020. As long as price sits above this level, another upward impulse may be launched. Source: xStation5

Tesla (TSLA.US) shares dropped over 3.0% before the opening bell after U.S. officials will launch new investigation into a fatal crash in February involving a Model S where an advanced driver assistance system was suspected of having been used.

Etsy (ETSY.US) stock plunged over 6% in premarket after Jefferies double-downgraded the online marketplace to underperform from buy citing slowing consumer spending and need to increase marketing costs as buyer churn increases.

Silvergate Capital (SI.US) stock cratered 50% after the crypto bank announced it will wind down operations and liquidate Silvergate Bank.

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.