- Wall Street traded lower ahead of the FOMC minutes

- Weak Chinese data deteriorate market sentiment

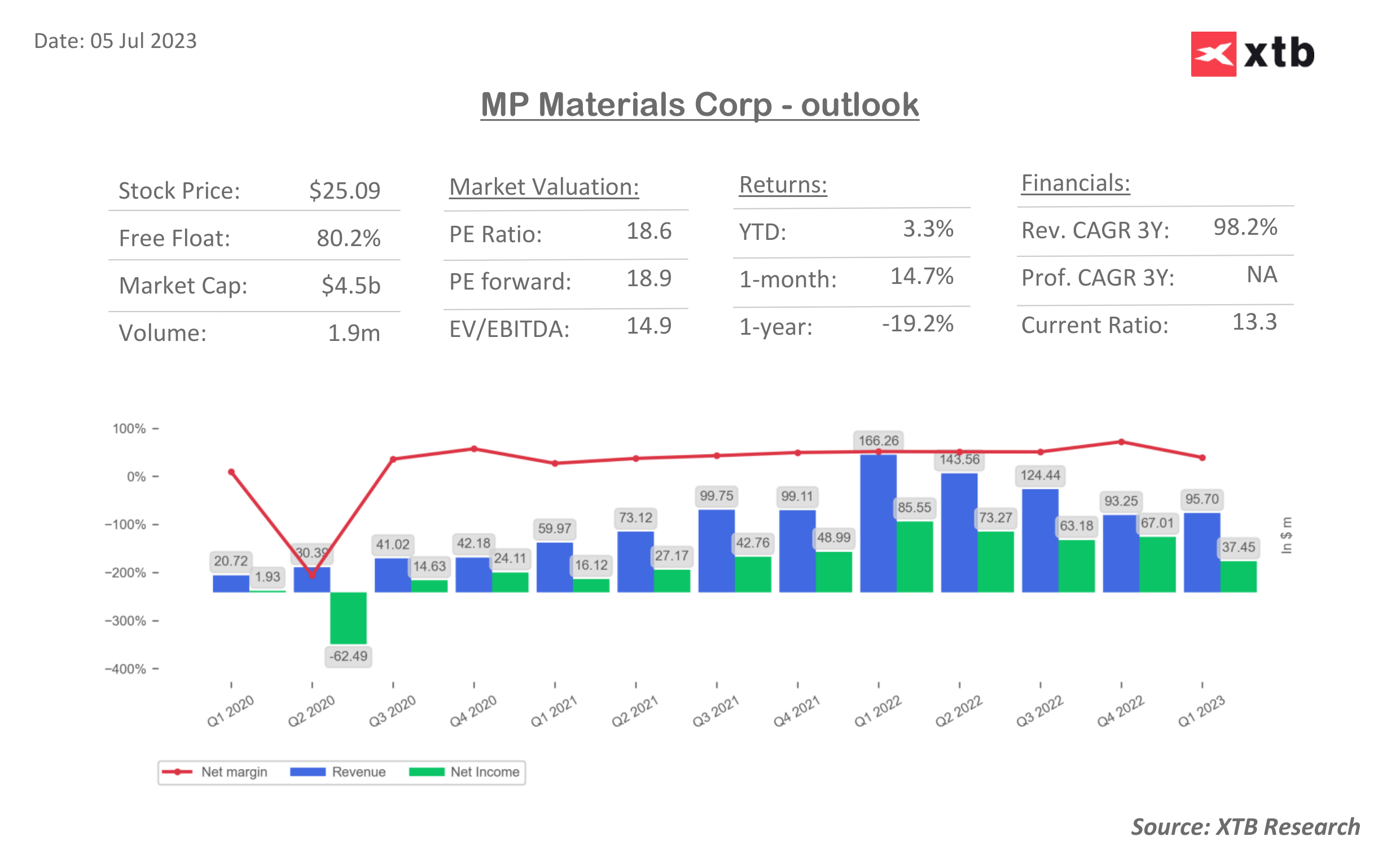

- MP Materials (MP.US) gains after China’s move to restrict export of critical minerals

Wall Street indices launched today's trading slightly lower. Nasdaq and SPX were almost 0.2% lower at the opening while Dow Jones dropped 0.4%.

Market sentiment deteriorated after disappointing data from China undermined risk appetite, leading to a decrease in market confidence. China witnessed a slower growth rate in its services sector last month, surpassing expectations and reaching its lowest level since January. This decline in growth was attributed to reduced consumer spending.

Investors have tempered their expectations for gains in Asian equities this year due to diminishing optimism surrounding the possibility of looser monetary policy and concerns about China's economic outlook. A survey conducted by Bloomberg suggests that the MSCI Asia Pacific Index is projected to reach 174 points by the end of the year, reflecting a 5% increase from its closing level on Tuesday. This forecast is lower than the prediction of 178.5 from a similar survey conducted three months prior.

A struggling Chinese economy could potentially worsen conditions in the US. However, on the other hand, it also exerts downward pressure on global prices of various commodities and weighs down inflation figures.

US equities categorised by sector and industry. Size represents market capitalisation, the leaders among large-cap companies are Google (GOOGL.US), Tesla (TSLA.US), and Meta (META.US). Source: xStation5

US equities categorised by sector and industry. Size represents market capitalisation, the leaders among large-cap companies are Google (GOOGL.US), Tesla (TSLA.US), and Meta (META.US). Source: xStation5

US500 is currently consolidating near a resistance level at 4485 points. If it breaks above this level, the next resistance zone is anticipated around 4550 points. Alternatively, if the resistance holds, the price may decline towards the 4300 level. With the upcoming release of the FOMC minutes, higher volatility on indices should be expected.

Company News:

- Netflix (NFLX.US) gains 1.2% as Goldman upgrades the streaming service to neutral, saying management has executed its password sharing crackdown more effectively than expected.

- Rivian (RIVN.US) rises as much as 2.2% after the company started delivering the electric vans it makes for Amazon.com Inc. to Europe — its first commercial shipments outside the US.

- Wolfspeed (WOLF.US) jumps 13% after Renesas Electronics makes a $2 billion deposit to secure a 10-year supply commitment of silicon carbide bare and epitaxial wafers from the chipmaker.

- MP Materials (MP.US) gains 8% after China’s move to restrict exports of rare earth specialty materials germanium and gallium.

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.