- Wall Street retreats slightly

- Bond yields gain again

- Chevron announces a takeover for 53 billion dollars

The first day of the new week does not bring the sentiment change on Wall Street that investors were hoping for. The start of the day looked promising, given the lack of escalation in the Middle East conflict and the arrival of humanitarian aid in the conflict zones. However, the sentiment quickly reverted to its previous direction.

At the start of the Wall Street session, we again observe rising yields of US Treasury bonds and a rather strong dollar. The yields of 10-year US Treasury bonds remain just below the 5.0% level. Today, the dollar is one of the stronger currencies of developed countries, alongside the euro. The EURUSD currency pair is trading flat.

The US500 is down 0.50% today, and the price is approaching resistance at the 4200 point level. This is the lowest level since May 2023. The 4200 point level is significant resistance, as historically it has been a strong barrier and has marked many peaks and troughs in recent months. However, if the selling pressure is strong enough to break this level, the next range for the movement will be 4100 points.

Company news:

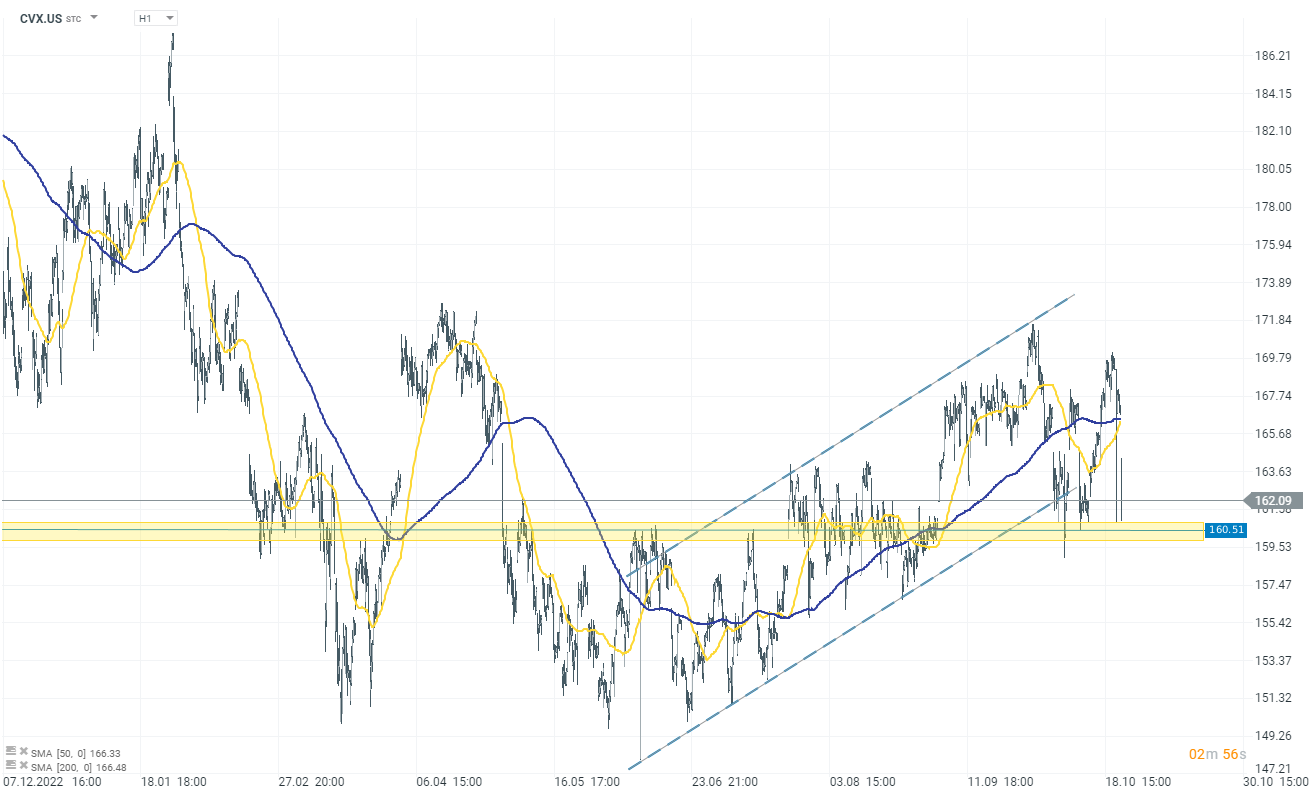

Chevron Corp. (CVX.US) has agreed to acquire Hess Corp. for $53 billion in an all-stock transaction, aiming to bolster its production growth amidst the U.S. oil industry's confidence in the long-term viability of fossil fuels. This acquisition, which values Hess at a 10% premium based on a 20-day average price, will provide Chevron with a significant presence in Guyana, a newly emerging oil producer. Analysts highlight the immense potential of Guyana's oil reserves. This move follows another major U.S. oil deal where Exxon Mobil Corp. agreed to purchase Pioneer Natural Resources Co. for $58 billion. The Chevron-Hess deal, expected to close in the first half of 2024, underscores the belief in the continued centrality of oil and gas in the global energy landscape.

source: xStation 5

source: xStation 5

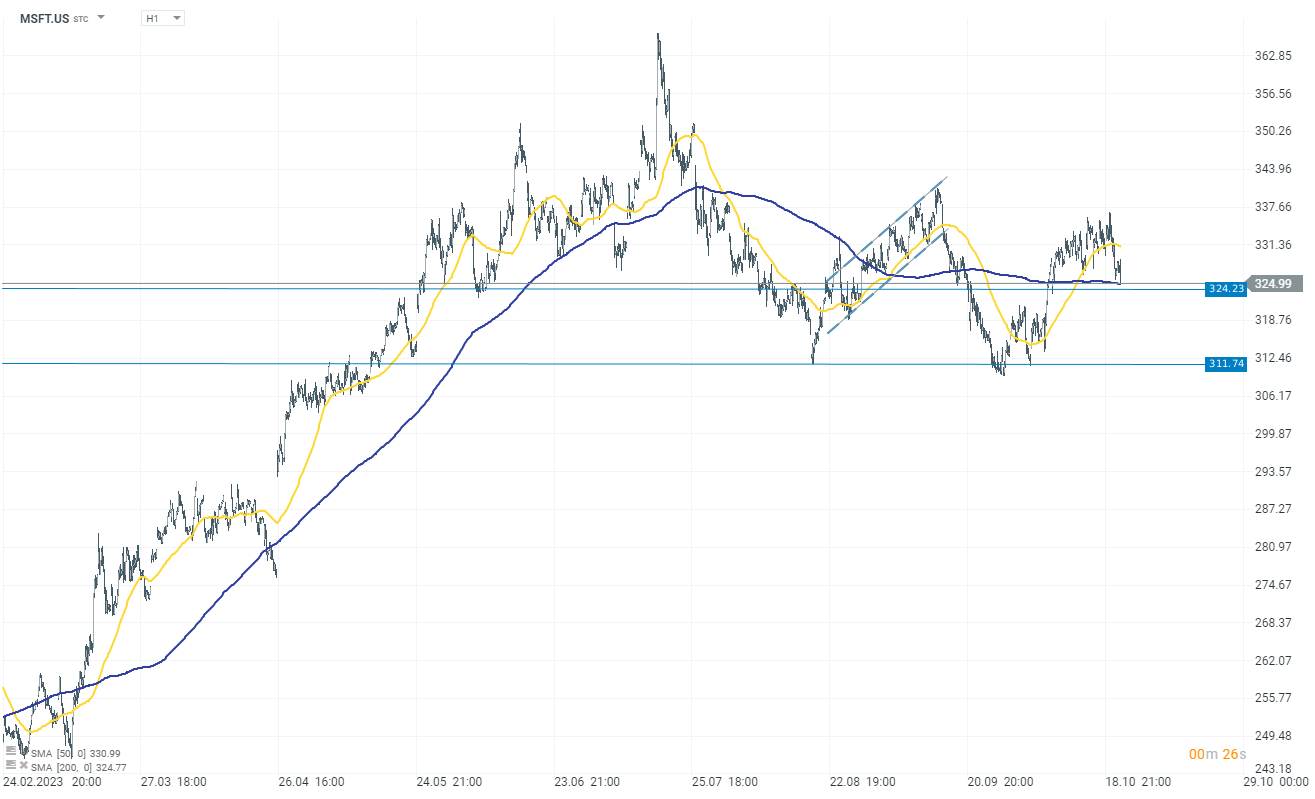

Microsoft Corp. (MSFT.US) has announced an investment of $5 billion AUD ($3.2 billion) in Australia over the next two years to enhance its cloud computing and AI infrastructure. This marks the company's most significant investment in Australia in 40 years. As part of this initiative, Microsoft plans to expand its data centers in Canberra, Sydney, and Melbourne by 45%, increasing the number from 20 to 29 sites. Furthermore, in collaboration with the state of New South Wales, Microsoft will establish a Datacenter Academy and will also partner with the Australian Signals Directorate on a cybersecurity project. Microsoft President Brad Smith emphasized the company's commitment to Australia's growth in the AI era. This announcement coincides with Prime Minister Anthony Albanese's visit to the US, where discussions on critical minerals and tech innovation are anticipated. The investment aligns with the Aukus agreement signed in 2021, fostering closer collaboration between the US, UK, and Australia in areas like quantum computing and AI.

Source: xStation 5

Source: xStation 5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.