CPI inflation will be key for Fed

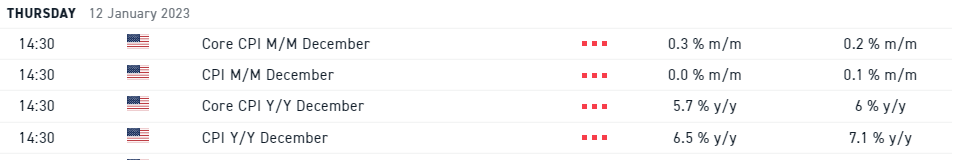

While the Fed is looking primarily at PCE inflation, CPI is usually released earlier and shows the general trend that PCE is likely to follow. Also, PCE inflation usually reacts later and with a lag compared to CPI but larger shifts in CPI gauge recently have given markets hope that Fed may be less hawkish going forward. What to expect from today's reading? Median forecasts point to a significant slowdown in both headline and core annual gauges. On the other hand, expectations for month-over-month readings do not look so rosy. While headline CPI is expected to be left unchanged, core inflation is expected to increase 0.3% MoM. This is still to a huge extent driven by 'shelter inflation'. However, should headline CPI gauge drop by 0.1-0.2% MoM and core gauge increase just 0.1-0.2% MoM, Fed would have reasons to slow rate hikes further. Without such a steep drop in inflation measures, it is unlikely that Fed will change its approach.

Headline CPI inflation is expected to slow to 6.5% YoY but, given lack of drop in monthly reading, markets would welcome a drop to 6.2-6.3% YoY. Should core gauge come in above expected 5.7% YoY, USD will have a chance to recover from recent losses. Source: xStation5

Headline CPI inflation is expected to slow to 6.5% YoY but, given lack of drop in monthly reading, markets would welcome a drop to 6.2-6.3% YoY. Should core gauge come in above expected 5.7% YoY, USD will have a chance to recover from recent losses. Source: xStation5

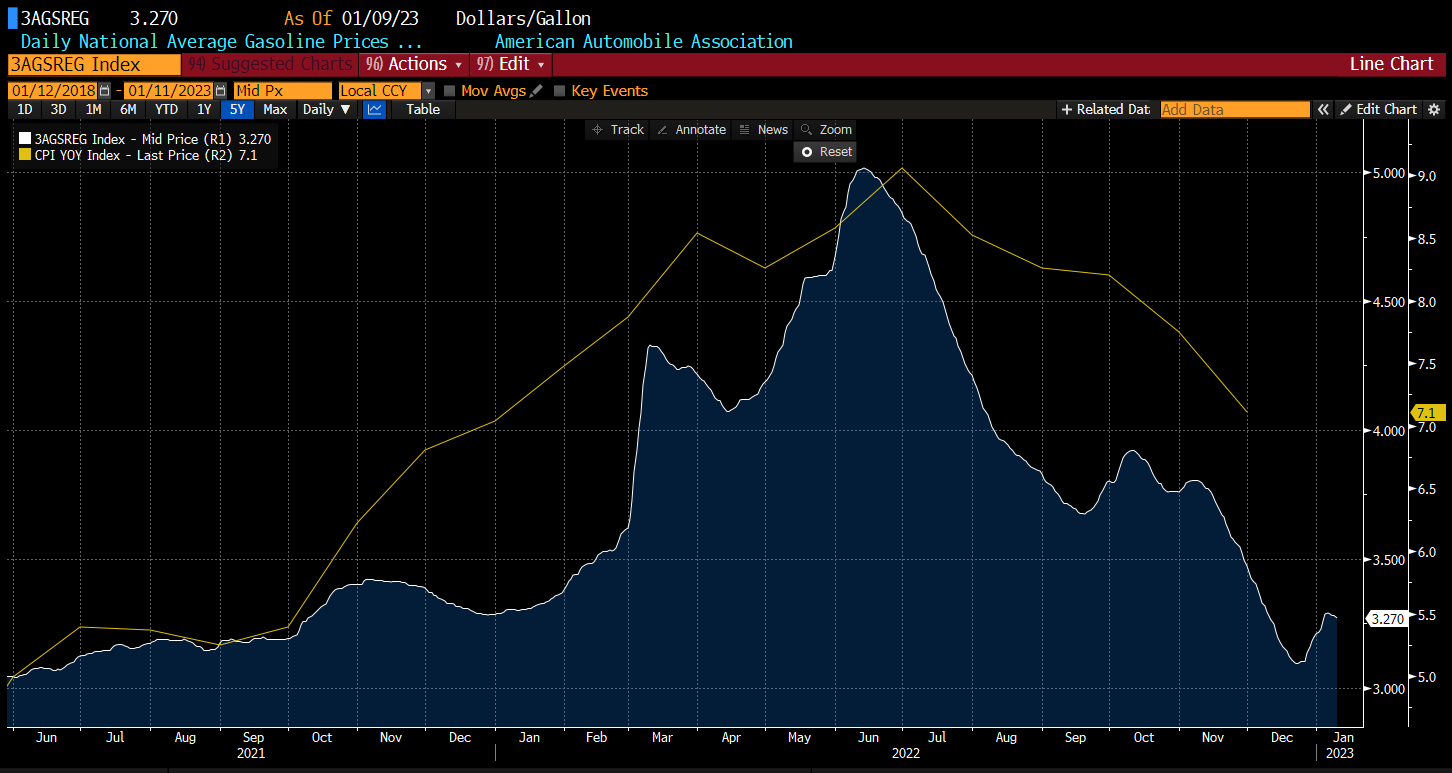

Energy prices are dropping

Of course, taking a look at energy prices we can see that those dropped significantly in December. This means that the contribution of energy prices is likely to drop further from the current 1 percentage point. It stood at above 2 percentage points in mid-2022.

Fuel prices dropped and were lower than a year ago. Gas prices were significantly higher but this relates only to market prices, not consumer prices. Simultaneously, one should remember that gas prices have dropped significantly off the peak. Source: Bloomberg

Fuel prices dropped and were lower than a year ago. Gas prices were significantly higher but this relates only to market prices, not consumer prices. Simultaneously, one should remember that gas prices have dropped significantly off the peak. Source: Bloomberg

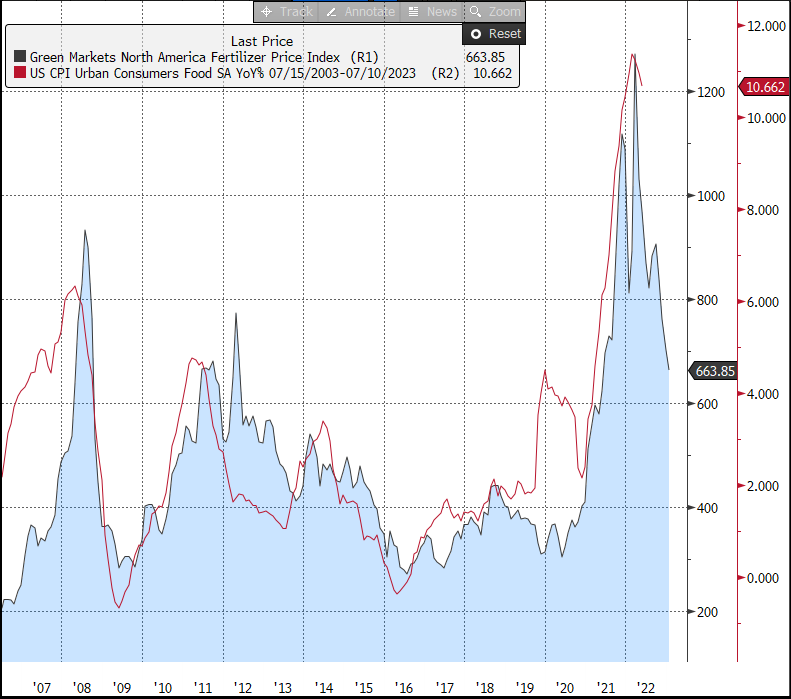

Food prices are expected to start dropping

A bearish trend on the food market can also be spotted. A drop in fertilizer prices signals that food prices may drop even quicker in the coming months. Source: Bloomberg

A bearish trend on the food market can also be spotted. A drop in fertilizer prices signals that food prices may drop even quicker in the coming months. Source: Bloomberg

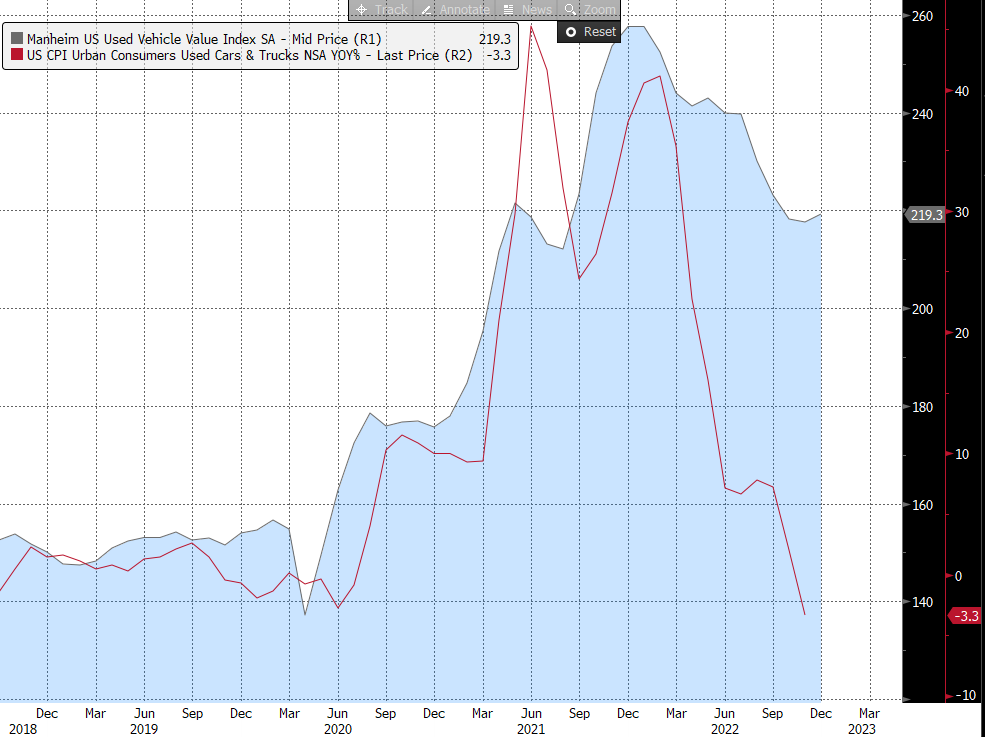

Cars and rents key for core inflation

When it comes to core inflation, cars and rents will be key components. Car prices dropped recently but December saw a rebound. Of course, earlier price cuts should also impact CPI reading, which tends to react with a lag. When it comes to rents, lagged inflation data continues to show rising prices but more timely market data starts to show signs of slower price growth emerging.

Car prices according to Manheim index and car component in CPI inflation. Source:Bloomberg

How will US100 react?

US100 has been one of the most oversold major indices in 2022. The latest drop in yields failed to support the Nasdaq index as it was the case with S&P 500. Fed will look primarily at core inflation data for hints on the size of a rate hike at February meeting. Market is currently pricing a small chance of a 50 bp rate hike and latest comments from Bostic and Daly showed that today's data will be crucial. If headline inflation slows to 6.3% Yoy or more, euphoria on the markets may ensue. On the other hand, if car prices and rents have a significant contribution to inflation in December, Fed may have reasons to go on with a 50 bp rate hike. In such a scenario, US100 may trim recent gains and USD may regain some of its shine.

If US inflation slows significantly more than expected, the range of the double bottom pattern on US100 may be realized and the index may break above 11,600 pts. On the other hand, should core inflation surprise to the upside, the chance for a 50 bp rate hike would increase and US100 may pull back towards 11,300 pts. Source: xStation5

If US inflation slows significantly more than expected, the range of the double bottom pattern on US100 may be realized and the index may break above 11,600 pts. On the other hand, should core inflation surprise to the upside, the chance for a 50 bp rate hike would increase and US100 may pull back towards 11,300 pts. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

📈Wall Street rebounds, VIX slips 5% 🗽What does US earnings season show us?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.