Investor sentiment across U.S. equities is mixed today, despite a record-breaking rally in Nvidia (NVDA.US), which became the first company in history to surpass $4.5 trillion in market capitalization, surging more than 2%. The U.S. technology sector is performing solidly; CoreWeave (CRWV.US) shares are up over 12% following reports that the company will provide computing power for Meta Platforms (META.US). On the other hand, Intel shares are down nearly 3%, likely due to profit-taking after recent gains.

Meanwhile, Senate Minority Leader Chuck Schumer warned that the United States is currently on track for a government shutdown. On the Kalshi prediction platform, participants are now pricing in an 80% probability of a shutdown after midnight on October 1. Initial gains triggered by the JOLTS data, Conference Board consumer confidence, and the Chicago Fed’s regional index have largely faded.

Short-term concerns about a government shutdown, uncertainty around the timing of macroeconomic data releases (among other, still uncertain NFP reading this Friday), potential labor market issues, and the duration of any possible closure are all weighing on Wall Street. The US100 index is struggling to maintain gains, currently trading around 24,780 points, down 0.13%. At the same time, USDIDX futures are also down nearly 0.1%. Gold is benefiting from this uncertainty, poised to close out September with a gain of nearly 10%.

Source: xStation5

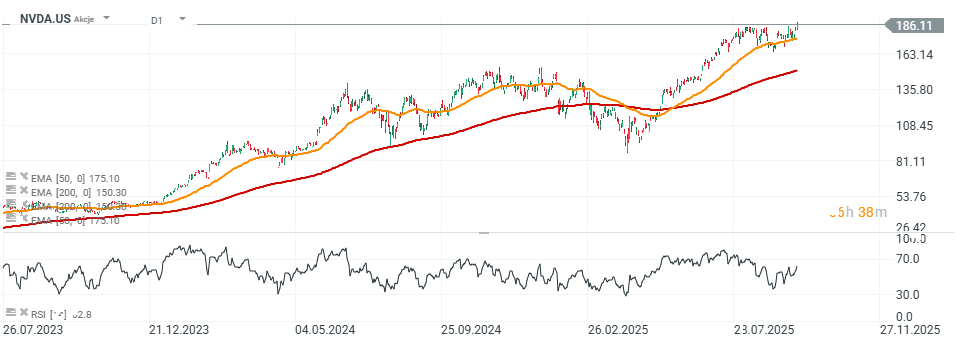

In recent days, Nvidia shares tested the 50-session exponential moving average (EMA50) near $175, rebounded, and are now trading at all-time highs above $186 per share. Source: xStation5

Source: xStation5

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.