Futures on Nasdaq100 (US100) soars more than 1.4% today and stronger than expected macro readings from US didn't stop Wall Street bulls, as Taiwan Semiconductors improved sentiments among chip producers.

- US jobless claims as well as housing starts and buildings permits came in stronger than expected but Wall Street looks closely into Taiwan Semiconductor (TSM.US) strong earnings and optimistic remarks over chips and AI

- Strong macro data from US supported dollar and 10-year yields but from the 2 PM GMT we can see the US dollar index futures (USDIDX) declines from 103.4 to 103.2

- According to Mark Liu, the Chairman of TSM, the largest chip producer in the world, AI is still in a nascent stage and 'we are only seeing the tip of the iceberg'

- The company expects 20% revenue growth in 2024, AI and high performance computing will be it the biggest growth drivers in current year

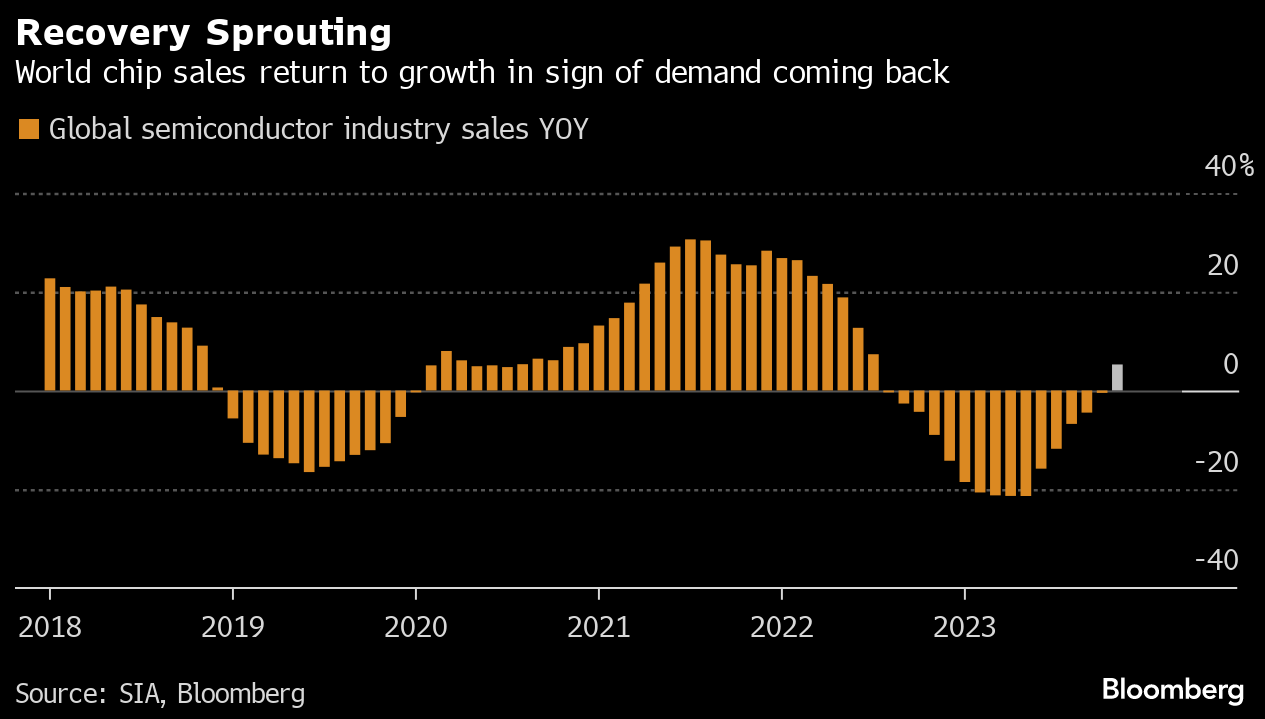

- Markets expect that not only AI but also cyclicality may support semiconductor producers in a new year. We can see huge gains among AMD (AMD.US), Nvidia (NVDA.US) or Marvell Technology (MRVL.US) but the strongest gainer today is TSM with stocks rising more than 8%

- Today, gains are also supported by Apple (AAPL.US) as company shares soars by 3.2%. Bank of America analysts raised the company to 'buy' from a previously 'neutral' rating. Analysts highlighted a new revenue stream for Apple, from VR and AR. On the other hand, iPhone prices are being slashed in China ahead of the Lunar New Year holiday, with major online retailers offering competing discounts as the device faces flagging sales amid competition from Huawei and other Chinese brands.

Source: Bloomberg Finance LP, SIA

Source: Bloomberg Finance LP, SIA

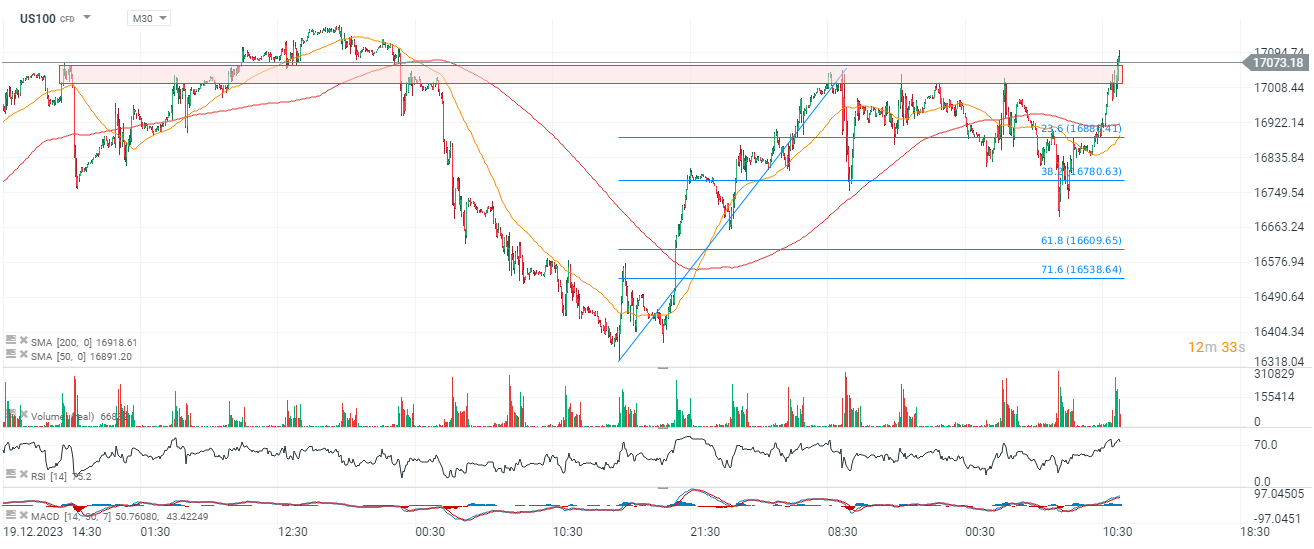

US100 and TSM.US charts (M30, D1)

US100 gains today on strong, buyers volume and is only 130 points below all-time-highs.

Source: xStation5

Source: xStation5

Shares of Taiwan Semiconductors (TSM.US) opened today session with huge, bullish gap, breaking out above levels of local highs from June 2023. Price has approached record level from February 2022 as company expects stronger demand on phones and AI chips solutions, in 2024.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.