NFP report for September scheduled for release at 1:30 pm BST today is a key macro report of the week and its importance only grew after US labor market data released earlier this week turned out to be inconclusive. Release will be watched closely as failure to show a jobs market cooling in-line with Fed projections could trigger another spike in Treasury yields. Let's take a quick look at what market expects from the report and how key markets look like before the release.

What does the market expect?

- Non-farm payrolls. Expected: 170k. Previous: 187k

- Private payrolls. Expected: 160k. Previous: 179k

- Unemployment rate. Expected: 3.7%. Previous: 3.8%

- Wage growth. Expected: 4.3% YoY. Previous: 4.3% YoY

ADP came in weak, other reports signaled labor market strength

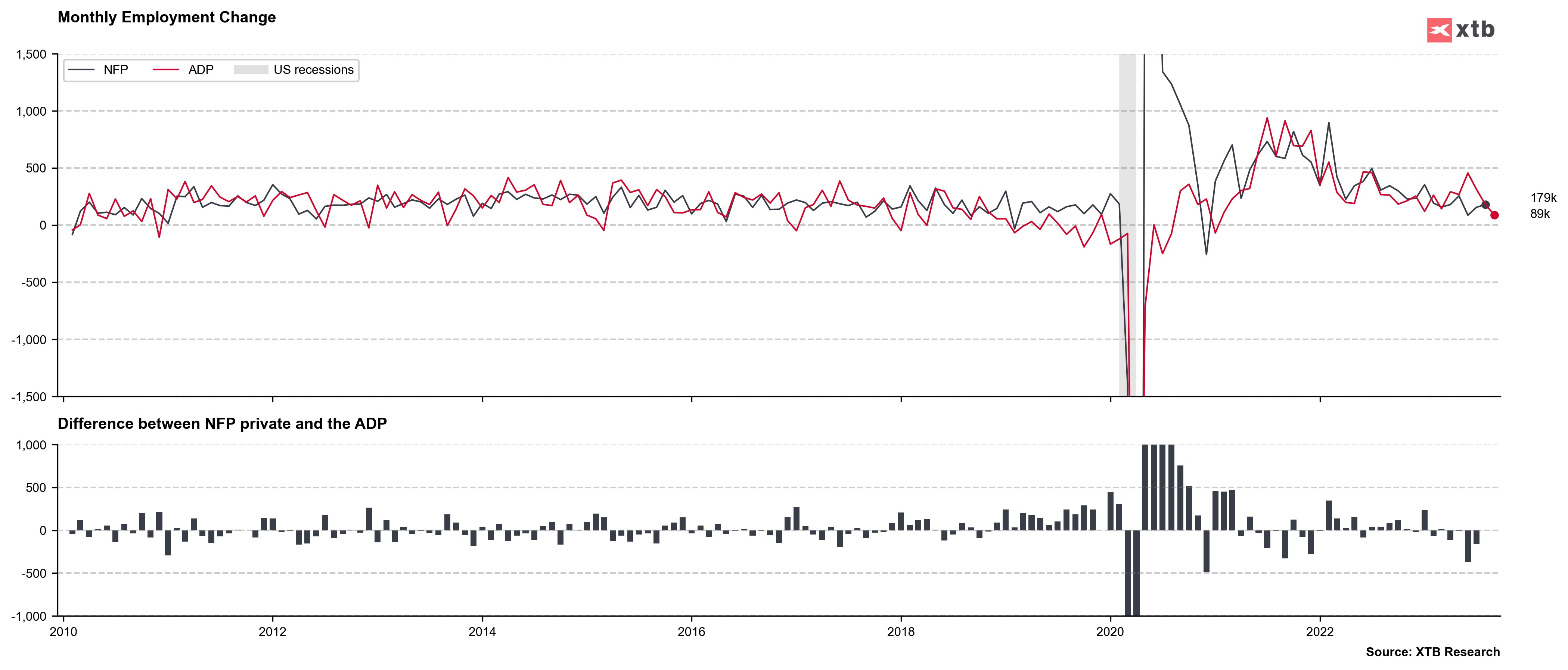

Investors were offered a number of reports from the US labor market this week. ADP report for September released on Wednesday turned out to be much worse than expected, showing a jobs gain of just 89k while the market expected a gain of 155k. However, Challenger report pointed to a much smaller lay-offs in September (47.46k) than it did for August (75.15k), and initial jobless claims data has once again come in below expectations (207k vs 210k expected). NFP report will therefore be a key and should it print a solid reading, signaling that the US labor market is not cooling as Fed expected, it could be a trigger for more hawkish pricing in the markets with potential resumption of a strong upward move on yields and USD.

ADP report for September hinted at a weakish jobs gain of just 89k. Source: Bloomberg Finance LP, XTB Research

ADP report for September hinted at a weakish jobs gain of just 89k. Source: Bloomberg Finance LP, XTB Research

Biden's speech hints at good reading?

A point to note is that US President Joe Biden is scheduled to deliver a speech on jobs report at 4:30 pm BST today and this speech was announced on Thursday afternoon. Why is this important? Jobs data was provided to the White House on Thursday afternoon and the fact that Biden's speech was announced after that time could be a strong hint that the NFP report for September will be solid. Of course, it does not necessarily mean that the report will be superb but it is a fact that Biden tends to speak on jobs after a good report is released.

A look at the markets

US100

Nasdaq-100 futures (US100) has managed to recover a bulk of loss from the beginning of the week but continue to trade below the 15,000 pts mark. A look at the chart at D1 interval shows that the index has managed to defend the lower limit of the Overbalance structure at 14,650 pts and therefore prevent technical setup from becoming more bearish. As long as the index stays above the 14,650 pts zone the uptrend is still in play, at least in theory.

Source: xStation5

Source: xStation5

EURUSD

Strong pick-up in US Treasury yields has provided support for the US dollar and pushed EURUSD down to a 10-month low. As the situation on the bond market calmed a bit, an attempt to recover some losses and climb back above the 1.0550 resistance zone can be observed on the pair. However, even a break above this zone would not be confirmation of bullish trend reversal as a break above the upper limit of the Overbalance structure at 1.0630 would be needed.

Source: xStation5

Source: xStation5

GOLD

Gold as well as other precious metals have been trading under pressure recently as bond yields kept climbing. Taking a look at the GOLD chart at the D1 interval, we can see that the price has plunged from the upper limit of the bearish channel to the lower limit. While declines have been halted, no recovery move has been launched yet. Strong NFP report would likely trigger another pick-up in yields and it could mean more pain for GOLD bulls with potential for a decisive breakout below the range of the channel.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.