- Markets are pricing in a 96% probability of a 25 bp rate cut, bringing the target range to 3.75–4.00%.

- The Fed is expected to end its QT program in November, after more than two years of balance sheet reduction.

- Chair Powell will likely emphasize “risk management” amid the lack of key macro data caused by the ongoing U.S. government shutdown.

- Swap markets price in nearly 87% odds of another 25 bp cut in December.

- Markets are pricing in a 96% probability of a 25 bp rate cut, bringing the target range to 3.75–4.00%.

- The Fed is expected to end its QT program in November, after more than two years of balance sheet reduction.

- Chair Powell will likely emphasize “risk management” amid the lack of key macro data caused by the ongoing U.S. government shutdown.

- Swap markets price in nearly 87% odds of another 25 bp cut in December.

Today’s Federal Reserve decision is expected to be a formality, as the market has fully priced in such a move. The Fed is set to cut rates by 25 basis points, but the key question is what comes next. The central bank has already received the September CPI report, which came in below expectations, though still above the Fed’s target.

Given the ongoing government shutdown, which will likely extend into November, the Fed will not receive October inflation or labor market data. This raises uncertainty over the economic outlook, but the shutdown itself is hurting workers and economic activity — a factor that could push the Fed toward another cut in December.

However, the tone of Powell’s remarks may not necessarily be overly dovish, especially if it hinges on the balance sheet decision.

Rate cuts — what next?

The Fed has made it clear that rate cuts will continue, a stance reinforced by the softer September CPI reading.

There was earlier speculation of a larger 50 bp cut, but this scenario is now mostly off the table — currently priced at just 3% probability. With the December meeting approaching, the likelihood of another 25 bp cut stands at nearly 90%.

This could change if Powell avoids a dovish tone during his remarks. On the other hand, the few hawkish voices within the FOMC mostly come from regional Fed presidents, who rotate among voting members. If Powell signals that the Fed needs more time and data confidence, this could lead to dollar strengthening and a correction on Wall Street.

Still, the Fed has an ace up its sleeve — one that could either accelerate current trends or deepen a correction.

Will the Fed end QT (balance sheet reduction)?

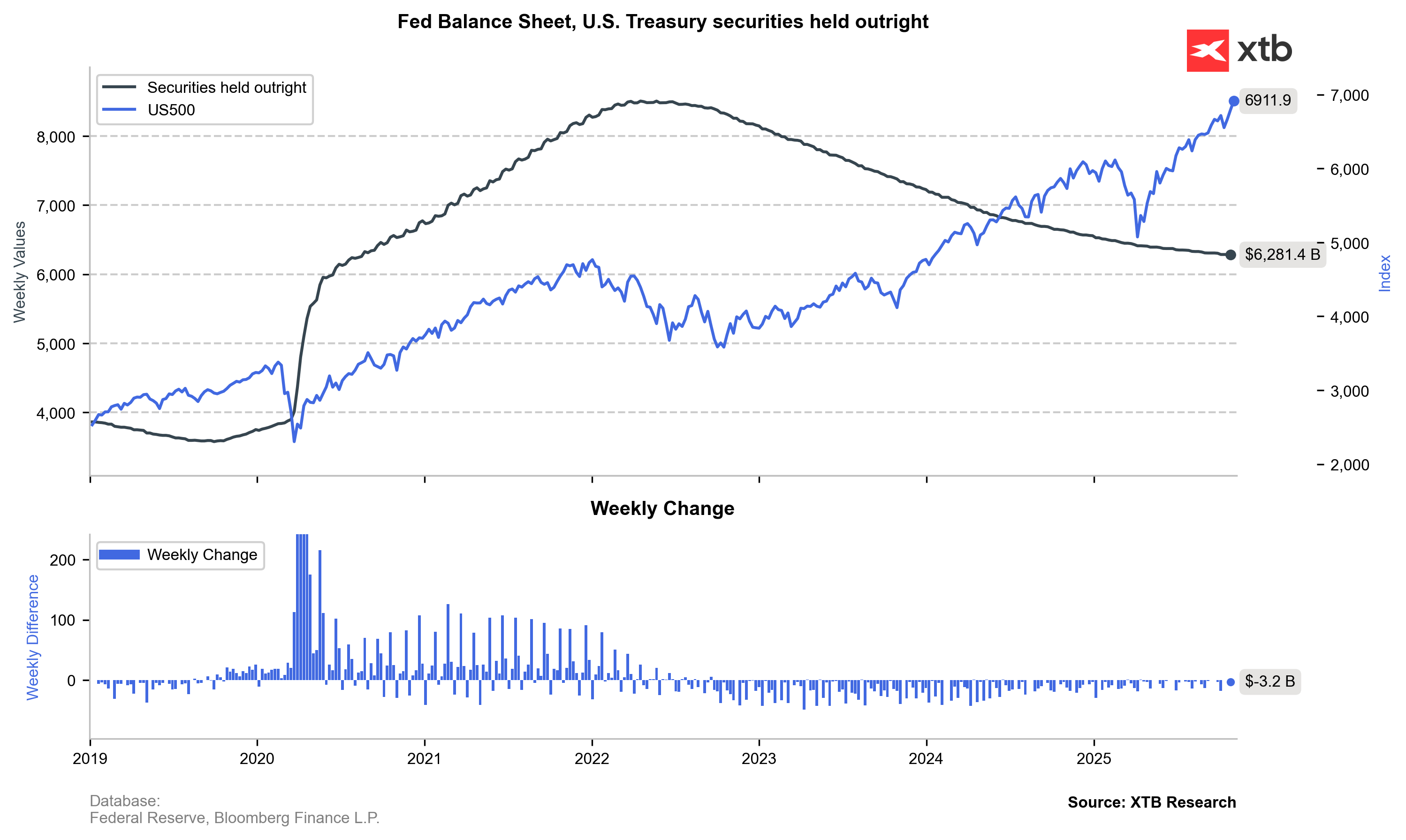

The Fed’s balance sheet is currently shrinking at a slow pace of $5 billion, and Powell has already hinted that the end of QT is near.

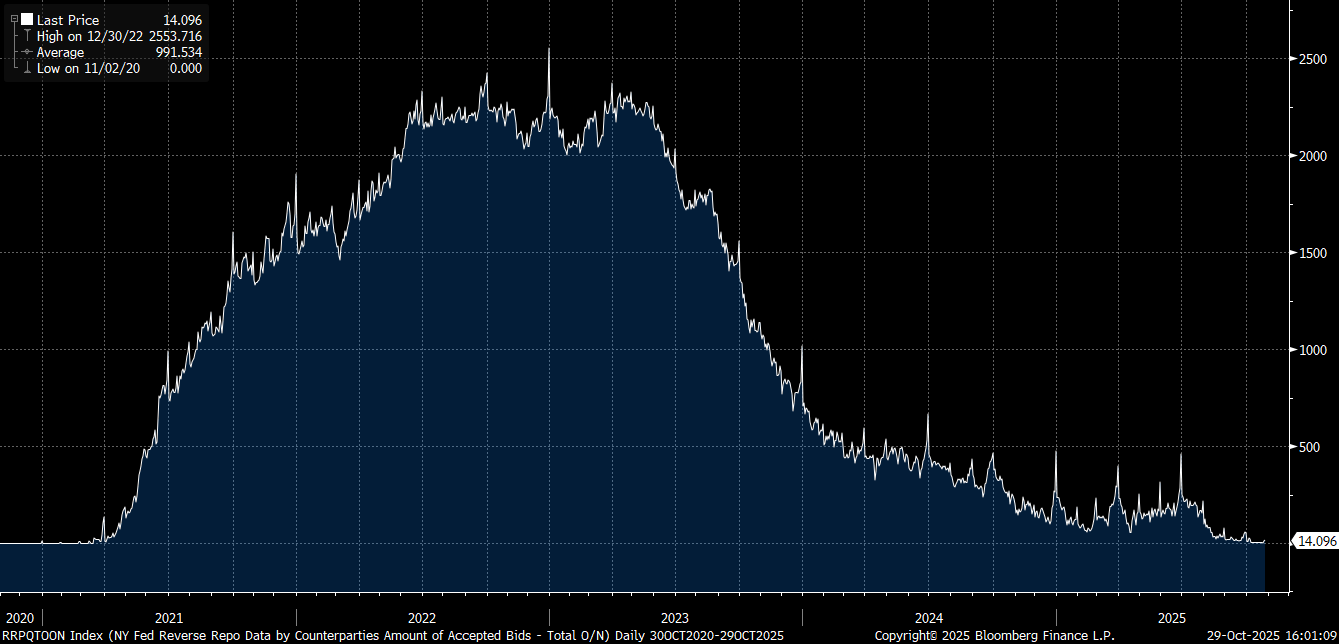

Moreover, several indicators suggest that system reserves have shifted from “ample” to merely “adequate.” The reverse repo facility has fallen to just a few billion dollars, implying virtually zero excess liquidity in the system.

While markets expect QT to end in December, there’s a strong chance Powell could announce its conclusion as early as November — which would be a major bullish catalyst for U.S. equities.

The reverse repo operations, which drain liquidity, have been minimal over the past three months, confirming tight financial conditions.

The Fed’s balance sheet has already been reduced by one-third, and overall system reserves have declined significantly. This could be a signal to end QT, which markets would likely view positively. In case of further economic deterioration, the Fed could swiftly restart asset purchases (QE), further lowering real interest rates.

Source: Bloomberg Finance L.P., XTB

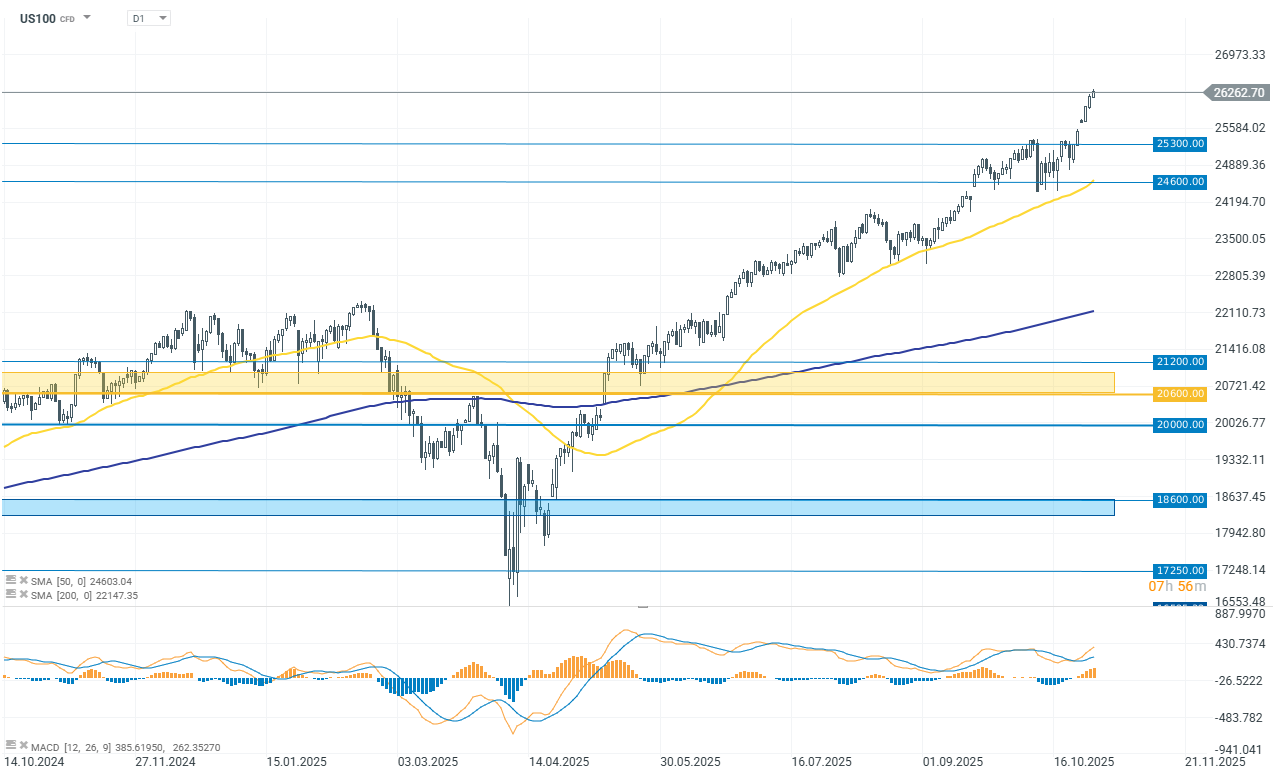

US100

The tech-heavy Nasdaq (US100) is up 0.34% ahead of the Fed decision, though gains have partly faded after opening more than 0.60% higher. The index remains at record highs, marking its third consecutive day of gains and up 2% for the week.

However, the market is currently playing with three key themes — today’s Fed decision is only one of them. Investors are also focusing on the corporate earnings season, which has so far delivered strong results, and the upcoming meeting between U.S. President Donald Trump and China’s President Xi Jinping.

US OPEN: US500 tests record highs as technology sector leads gains

Zelensky set to meet Trump on Sunday: A renewed hope for a breakthrough?

Three Markets to Watch Next Week (26.12.2025)

Chart of the day - Silver (26.12.25)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.