-

At 1:30 pm BST, we will learn the key NFP report, depicting the state of the US labor market in May.

-

Analysts estimate that non-farm employment increased by 180,000 in May compared to 175,000 in April.

-

Additional indicators in this report, namely unemployment, labor force participation, and wage growth, are expected to show no deviations from April's readings.

-

US100 is oscillating around its historical highs ahead of the NFP report.

-

The report's outcome may determine whether this barrier will be broken or if we will see a retreat in demand for risk-related instruments.

-

Currently, swaps estimate an 80% probability (cumulative value) that the Fed will make one rate cut of 25 basis points by September this year.

Ahead of us is the key reading of the week, the NFP data from the US labor market. It is widely believed that despite several indicators expected to accelerate slightly compared to April's reading, the overall tone of the report will indicate that economic momentum in the labor market is weakening. Worse data could theoretically allow for an extension of the rally in global risk-related markets, including stock indices, cryptocurrencies, or currencies excluding the dollar. Currently, swaps estimate an 80% probability (cumulative value) that the Fed will make one rate cut of 25 basis points by September this year. A worse reading could further increase this probability, opening the window for a bullish reaction on Wall Street. So, what to expect from today's data?

Early reports indicate a weaker NFP reading.

Forecasters expect the May US employment report to provide new evidence that the labor market is gradually cooling. This could also be suggested by data released earlier this week, especially the April JOLTS readings and the May ADP report. However, historically, these data have often not aligned linearly with NFP data, frequently indicating a completely opposite picture of the situation.

Early indications from JOLTS and ADP favor a lower NFP reading. Source: XTB

When analyzing macro outlook, it is also worth mentioning the ISM PMI data. In both cases (manufacturing and services), the May readings indicated a higher employment subindex, with mixed main ISM data and lower values in the price subindex, which in this context can be considered an inflation indicator. However, considering that both subindexes oscillated within the range of analysts' expectations (within +/- 1 standard deviation), their predictive ability for NFP data may be limited.

Implied FED interest rate path

Contracts futures based on FED funds indicate that there is an 80% probability (cumulative value) that the FED will make one rate cut of 25 basis points by September this year. The NFP reading is likely to change this value significantly, and it is the upward or downward revision that will be crucial for the market's reaction to the presented data.

Source: Bloomberg Financial LP

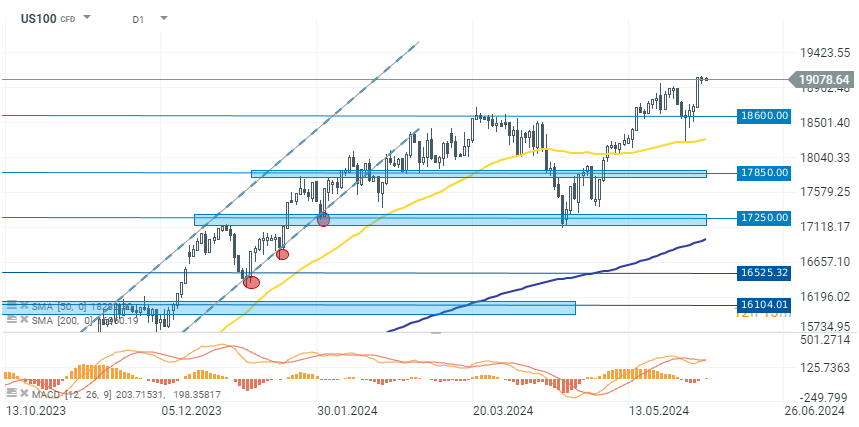

US100 (D1 Interval)

Before the release of the NFP data, the US100 is consolidating around historical highs above 19,000 points. Volatility in the index has been limited for two days, and investors' attention is focused on the release of labor market data at 14:30. The consensus indicates that the data will show further market stabilization around last month's readings. Data deviating from expectations may affect the Fed's rate cut path, and consequently cause greater market volatility. A reading slightly below expectations would give markets hope that the US economy is not in the worst condition, but on the other hand, it would increase the likelihood of faster rate cuts. In such a scenario, we can expect a breakout in the US100 index above the current consolidation channel. Also, a reading in line with expectations could trigger a similar reaction, looking at the recent publications of macroeconomic data.

On the other hand, a reading above expectations, contrary to the previous scenario, could reduce the chances of the first rate cut in September. Consequently, we can expect a downward reaction in the US100 index.

Source: xStation 5

Source: xStation 5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.