-

Oracle's AI Margin Hit: A reported 14% margin on Nvidia server rentals sparks major doubt over AI profitability.

-

Nasdaq Sells Off: The weak report immediately triggered a US100 drop and raised "red flags" on financing.

-

Profitability Challenge: High costs and aggressive pricing are undercutting AI profitability, contrary to hype.

-

Oracle's AI Margin Hit: A reported 14% margin on Nvidia server rentals sparks major doubt over AI profitability.

-

Nasdaq Sells Off: The weak report immediately triggered a US100 drop and raised "red flags" on financing.

-

Profitability Challenge: High costs and aggressive pricing are undercutting AI profitability, contrary to hype.

The US100 index pulled back by 0.5% today, though declines briefly reached 0.8%, and measured from the all-time high achieved just before the start of cash trading, the index fell by as much as 1%. The losses are primarily driven by growing skepticism surrounding the Artificial Intelligence (AI) sector, with particular focus on Oracle Corp.

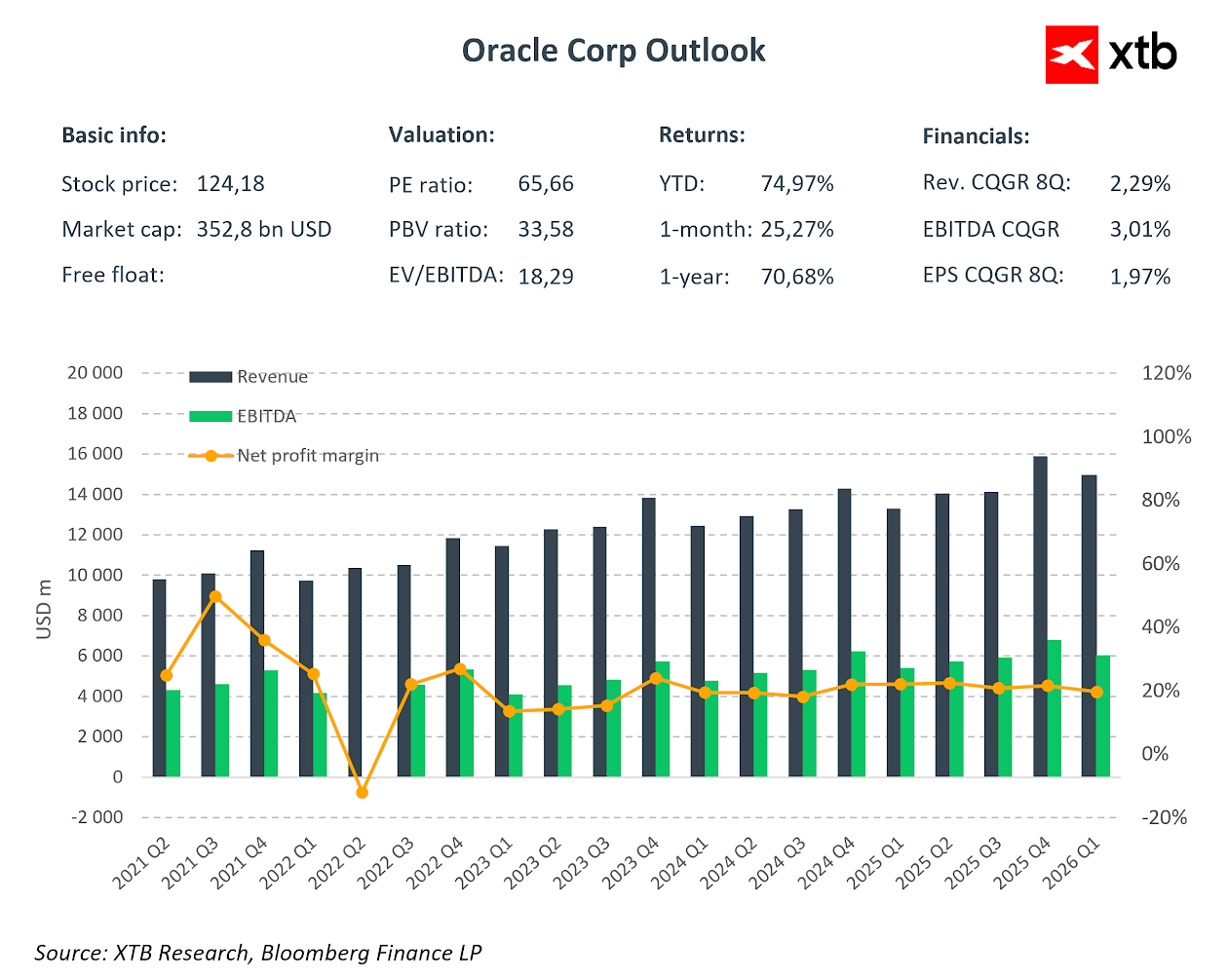

Oracle shares fell by up to 5% at the open after revelations from The Information exposed worrying details about the company’s margins in its AI business. This could be the first warning signal of a potential overvaluation of the entire sector.

The Information cited data showing a meager 14% gross margin on Oracle's $900 million revenue from renting Nvidia servers over the three-month period ending in August. Crucially, this is significantly below the typical margin. The report suggests Oracle may have incurred losses reaching $100 million on certain contracts for renting Nvidia's Blackwell chips.

The weak profitability is reportedly due to high costs associated with Nvidia's expensive chips, coupled with intense competition in the rental and cloud space, which is driving "dumping prices" for AI services. Compounding the issue are rising costs from energy consumption, the construction of additional infrastructure, and increasing personnel expenses.

While Oracle experienced a massive price jump following its previous quarter's results, driven by a surge in its backlog, an increasing number of analysts are now questioning the company's future profitability. The firm disclosed a $455 billion order backlog, including a recent agreement with OpenAI reportedly valued at $300 billion over the next five years. The company is reporting negative free cash flow due to immense investments in new data centers, leading its debt to grow faster than that of its competitors.

Recently, concerns have also surfaced regarding so-called "Circular Financing". While still far from the schemes seen during the dot-com bubble, these patterns are beginning to raise "red flags" among analysts.

The Oracle-OpenAI-Nvidia Schema

-

Nvidia invests in OpenAI (up to $100bn).

-

OpenAI purchases Oracle services ($300bn commitment).

-

Oracle rents chips from Nvidia.

-

Profits return to Nvidia through chip purchases.

Wall Street Analysts Red Flags

-

OpenAI’s annual revenue is five times smaller than its annual obligation to Oracle.

-

AMD is offering OpenAI a 10% equity stake in exchange for a purchasing commitment.

-

Jim Chanos, the famed short seller on Wall Street, warns: "Why are the sellers subsidising the buyers if demand is infinite?"

Market Reaction and Technical Outlook

The US100 tested the 25,000 point level today, which provides additional support tied to the local peaks from September 22-23. Oracle is currently paring losses, though the price had earlier broken through the local lows from October 1st, effectively reversing roughly half of the September 10th price jump.

A definitive breach of the 25,000 point level by the US100, combined with violating the 38.2% Fibonacci retracement of the latest upward wave, could trigger a larger correction. The last correction in September would suggest support lies around the 24,600 point level.

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

Palantir after earnings: another quarter, another record

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.