Fed decision did not bring any surprises in terms of interest rates. Rates were left unchanged at previous levels as expected. However, the Bank said that it will be appropriate to hike them as soon as the economy continues to improve. The US central bank also said that it will complete the QE taper in early-March and the reduction of the balance sheet will begin after the first rate hike.

That is some strong guidance but lacks key information - when the first rate hike will come? Fed Chair Powell will surely be pressed about the issue during the press conference at 7:30 pm GMT. Markets are pricing a 90% chance of a rate hike coming as soon as in March but will Powell confirm it?

Markets reacted positively to the announcement. Indices jumped with US100 testing 14,600 pts handle. GOLD moved higher initially but gave back gains later on and is now trading little changed compared to pre-announcement levels. USD moved higher initially just like gold but has given back gains later on and now trades lower. EURUSD erased daily gain to trade little changed.

US100 tested 14,600 pts area after FOMC decision that is marked with the downward trendline. The inital downward move was partially erased. Markets' attention turns to Powell's presser at 7:30 pm GMT. Source: xStation5

US100 tested 14,600 pts area after FOMC decision that is marked with the downward trendline. The inital downward move was partially erased. Markets' attention turns to Powell's presser at 7:30 pm GMT. Source: xStation5

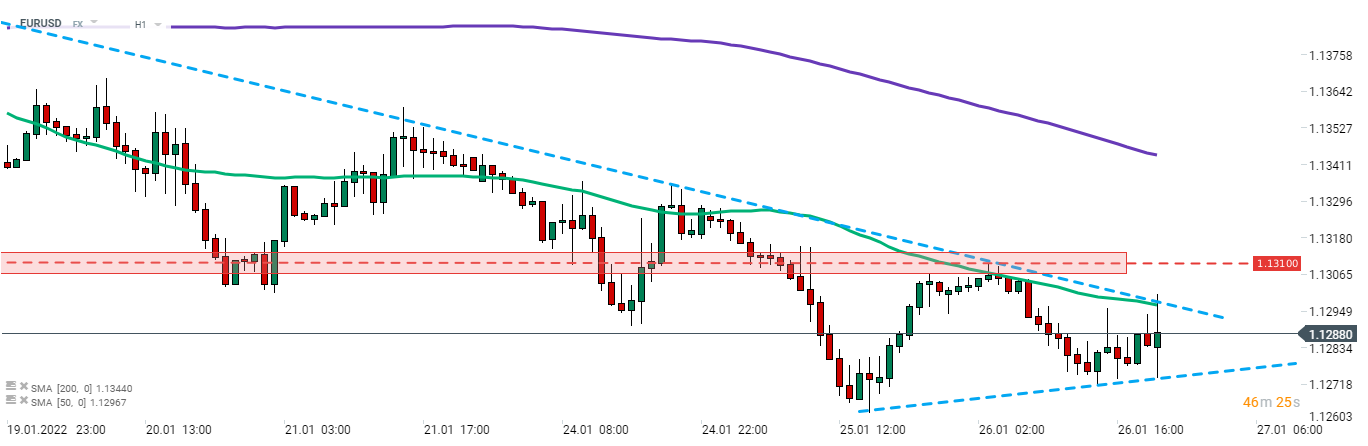

EURUSD erased daily gains following the FOMC decision announcement and now trades little changed on the day near both limits of the triangle pattern. Source: xStation5

EURUSD erased daily gains following the FOMC decision announcement and now trades little changed on the day near both limits of the triangle pattern. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.