U.S. market sentiment is very weak today, but improved after July ISM data from the U.S., which the market took as evidence that a recession in the U.S. economy is not a foregone conclusion. ISM services data in June showed 48.8, but today's July reading shows a slight expansion at 51.4. Statements by the Fed's Goolsbee suggest that the Federal Reserve will not be in too much of a hurry to cut rates, 'overreacting' to the recent, noticeably weaker, but in Goolsbe's view 'not yet recessionary' data.

Such a 'hawkish' scenario is also made plausible by the strong reading of the services price sub-index, in today's ISM data (57 versus an expected drop to 55.1 after 56.3 in June). As a result, the ISM data is not unequivocally positive for the markets, so Wall Street's reaction after the report is admittedly upward, but the indexes are still far from erasing the declines.

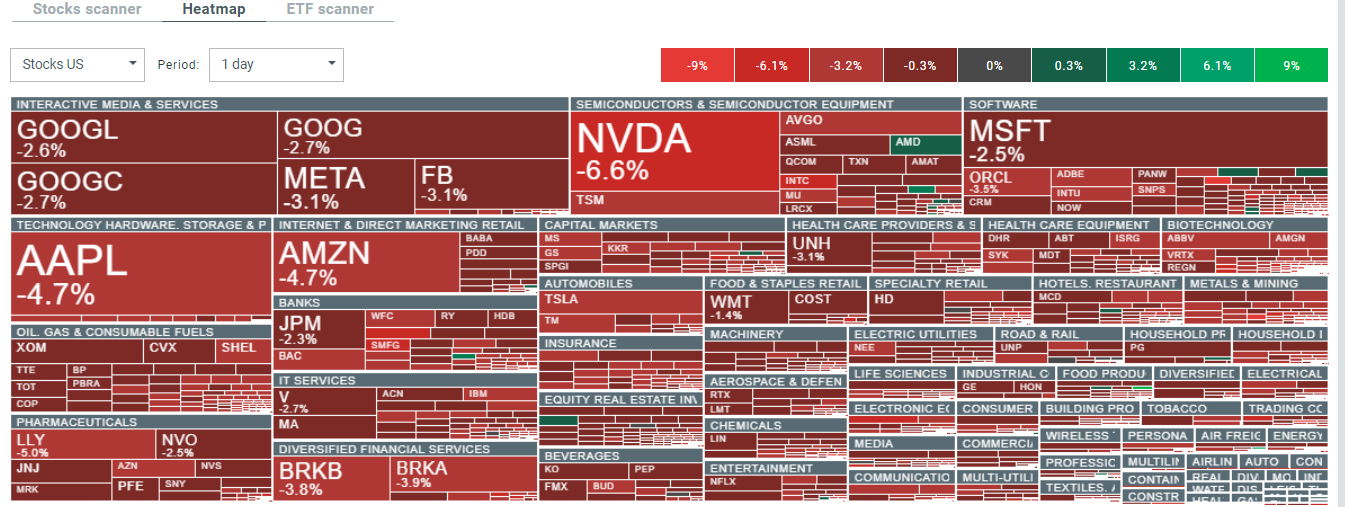

We are seeing a slight strengthening of the dollar and an improvement in sentiment in the stock market, which had feared that today's reading would confirm Friday's very weak ISM data from manufacturing and increase fears of a recession. US100 futures are still losing nearly 2.9%, although they were down nearly 5.5% before the Wall Street market opened. Still, strong selling pressure is seen across the entire technology, especially semiconductor sector.

- ISM data above forecasts, but price index much higher; Mixed comments from Fed's Goolsbee

- US 10-year bond yields fall below 3.8%

- Euphoric 13% gains on Kellogg (K.US) shares after potential deal to sell Kellanova brand to Mars for $30 billion

- Nvidia (NVDA.US) dives 9% below $100 per share in response to potential postponement of AI Blackwell GPU chip shipments until 2025; Apple and Amazon lose close to 5%

US100 (M15 interval)

Nasdaq 100 (US100) futures are trying to stave off a correction and bounce from around 17300 to near 18,000 points, where we see the 100-session simple moving average (SMA100, black line) and an important psychological resistance level.

Source: xStation5

ISM services data from the United States (for July)

- ISM index for services:51.4 (expected: 51; previous: 48.8)

- Employment sub-index: 51.1 (previous: 46.1)

- Price sub-index: 57 (previous: 56.3)

- New orders sub-index: 52.4 (previous: 47.3)

Previously released July PMI data for services showed a drop to 55 points, with a preliminary reading of 56 points and 56 in June. However, S&P's chief economist points out that the PMI report indicates a strong economy and job growth for the second month in a row. This clearly conflicts, with the 'recessionary' fears that the market has begun to discount in recent days, fearing high stock valuations.

Almost all stocks of large US companies are under pressure today, however the pressure weakens after the US ISM data. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.