- US100 edges higher after the U.S. market open

- Uranium stocks under pressure following Trump–Putin call

- Progyny shares drop over 10%

- Niles Investment Management sees no repeat of 2008 scenario

- Moody’s says there are no signs of US systemic credit contagion

- US100 edges higher after the U.S. market open

- Uranium stocks under pressure following Trump–Putin call

- Progyny shares drop over 10%

- Niles Investment Management sees no repeat of 2008 scenario

- Moody’s says there are no signs of US systemic credit contagion

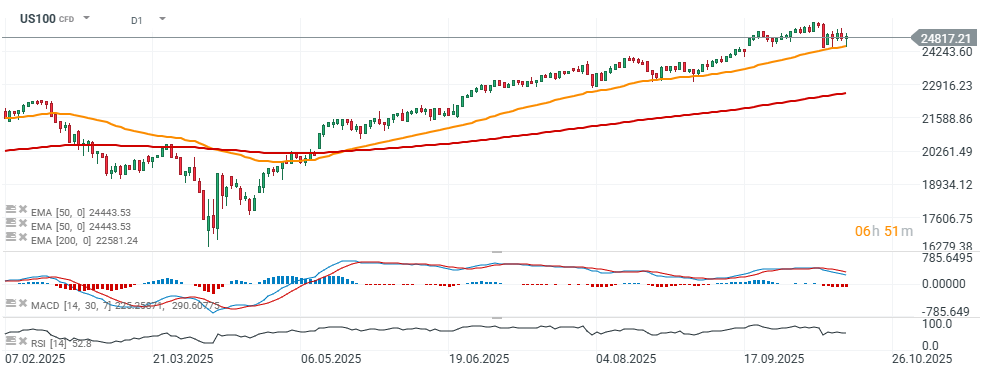

U.S. indices are posting slight gains on Friday, with regional banks slowly rebounding after recent losses. The US100 index is up 0.1%, holding above the 50-day EMA (orange line).

Source: xStation5

Trump’s IVF initiative may have a “nuanced” impact on Progyny shares, stock down 13%. On Thursday, the Trump administration announced an initiative aimed at expanding access to in vitro fertilization (IVF) procedures. Until now, their use has been limited by high costs and the fact that they are not always covered by health insurance.

- In response to the news, Progyny — a company specializing in fertility-related healthcare benefits — saw its shares fall 13% on Friday morning, as investors assessed the potential consequences of the announcement.

- According to Bank of America, the president’s actions are potentially positive for Progyny, but “the actual impact may be more nuanced.” Lutz pointed out that the government’s proposal still lacks details, and it remains unclear whether potential cost reductions would translate into higher procedure volumes and greater demand for insurance coverage.

As a market leader with broad geographic reach, Progyny appears well positioned to benefit from any increase in accessibility and demand for IVF procedures, Lutz added, maintaining a buy rating on the stock.

Source: xStation5

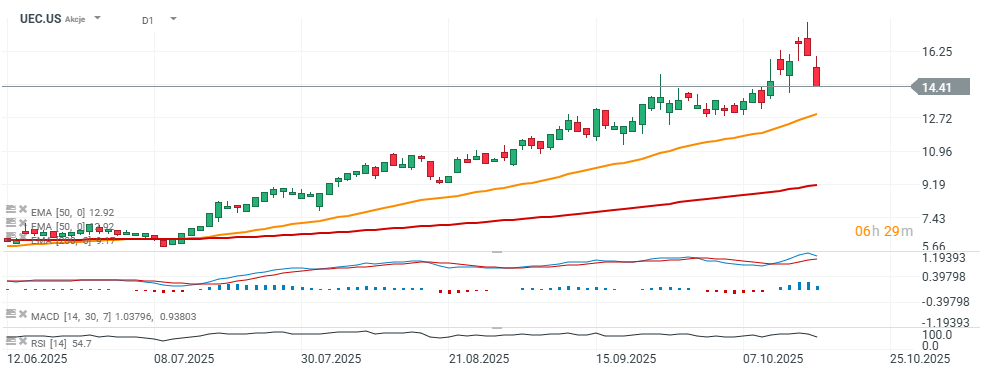

Uranium Energy Corp. (UEC.US) is down more than 10%, with the broader uranium sector also under pressure — from Kazakh miner Kazatomprom (KAP.UK) to Canada’s Cameco (CCJ.US) — suggesting that the driver of the declines extends beyond the U.S. market. In addition to profit-taking following record price gains, the sell-off may also be linked to the renewed contact between Trump and Putin, which could imply the absence of strict sanctions on Russian uranium and processing. That, in turn, could lead to a decline in spot prices.

Source: xStation5

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

NATGAS surges 5% reaching 3-year high 🔎

Bitcoin loses 3% 📉Technical bearish flag pattern?

3 markets to watch next week (05.12.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.