Investors' attention is turned to woes of the US banking sector following a 60% plunge in SVB Financial shares and subsequent sell-off in shares of other US banks. While this unquestionably is the main story of the day, if not week or month, investors may forget about another big event - release of US NFP data for February, scheduled for 1:30 pm GMT today. What market expects from today's release?

1:30 pm GMT - US, NFP report for February.

-

Non-farm payrolls. Expected: +205k. Previous: +517k (ADP: +242k)

-

Average earnings growth. Expected: 4.7% YoY. Previous: 4.4% YoY

-

Unemployment rate. Expected: 3.4%. Previous: 3.4%

Today's NFP release is one of the two pieces of key US data for Fed, which are still left for release ahead of the March 22, 2023 decision. The second one is US CPI print for February, scheduled for Tuesday, 1:30 pm GMT next week.

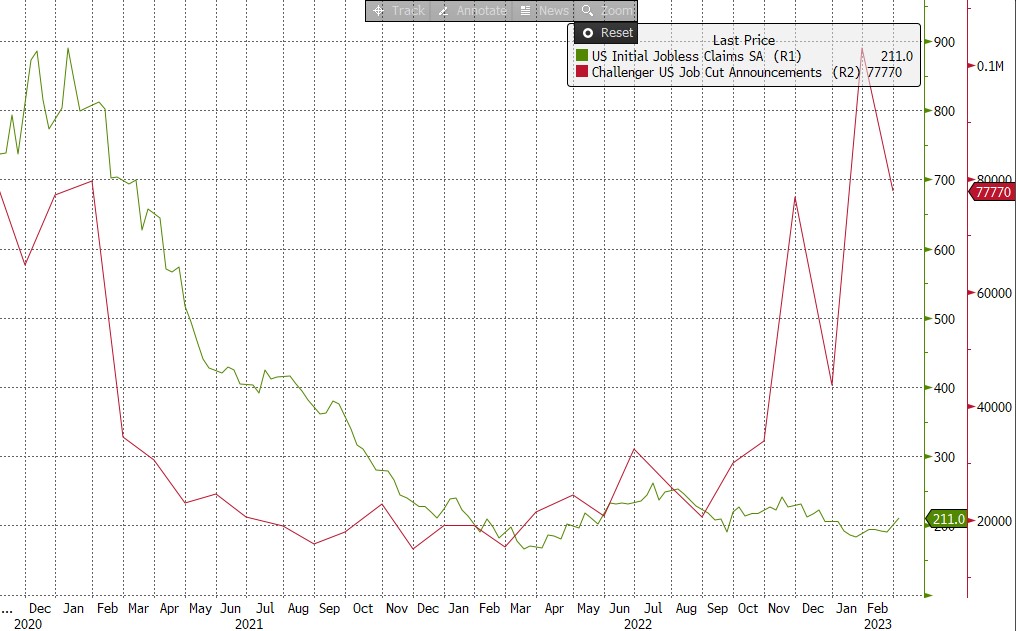

As far as the US labor market is concerned, it remains strong and tight. Jobless claims data that keeps coming in sub-200k proves it, as well as employment subindices in ISM data. On top of that, JOLTS data keeps pointing to an abundance of open positions. Powell was accused during recent hearings in Congress that he may trigger a spike in unemployment as he attempts to get control over the inflation. However, Powell sees a chance for inflation to be brought down while retaining low unemployment. On the other hand, when we take a look at details of the Challenger report we can see that planned lay-offs are on the rise.

Jobless claims remain at low levels, which hints at a strong jobs market in the United States. On the other hand, the Challenger report shows that job cut announcements are on the rise. Source: Bloomberg, XTB

Jobless claims remain at low levels, which hints at a strong jobs market in the United States. On the other hand, the Challenger report shows that job cut announcements are on the rise. Source: Bloomberg, XTB

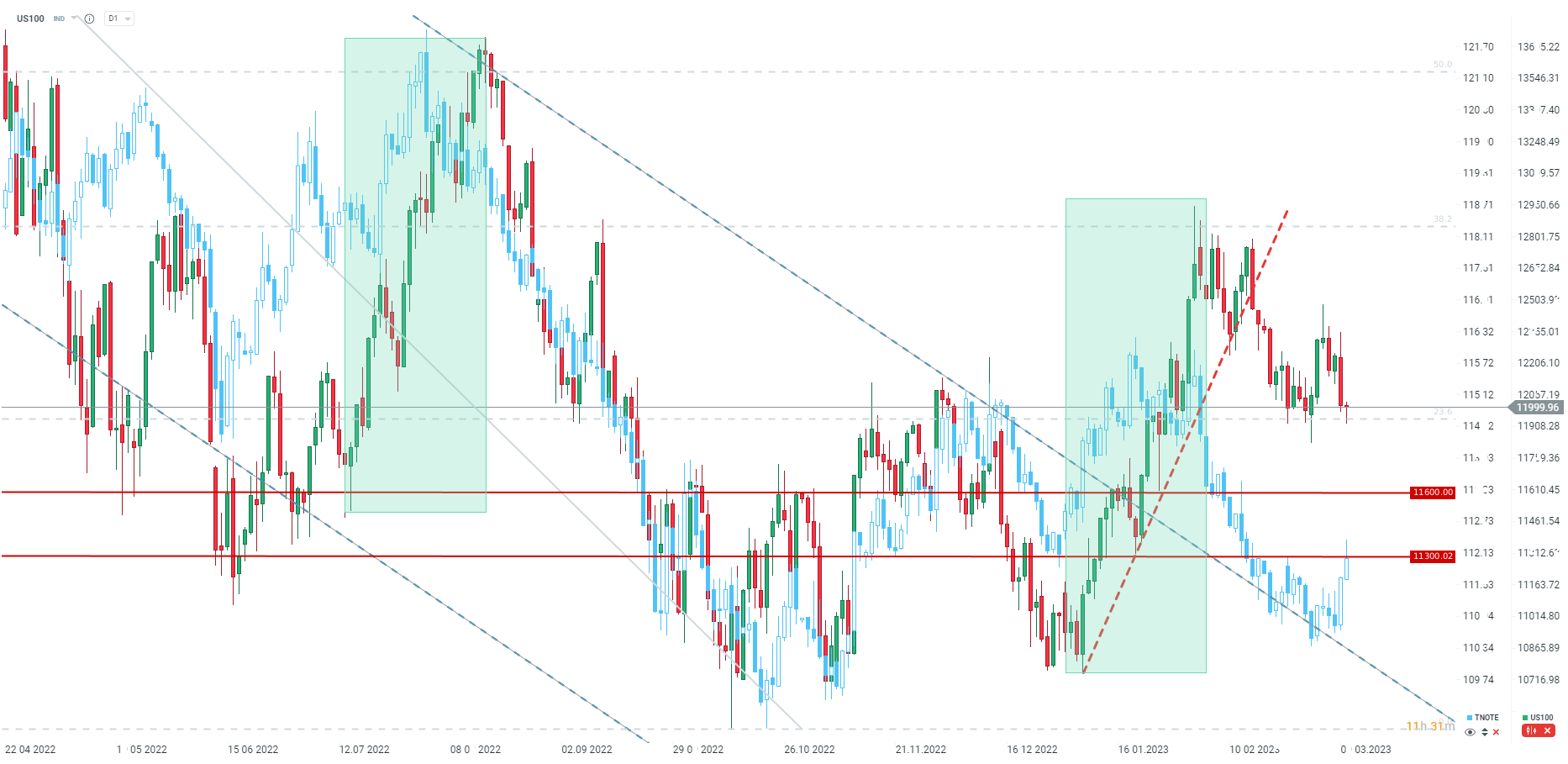

US100

Market is seeing a chance for a 50 basis point rate hike at the FOMC meeting in March. In our opinion, the chance for such a move is if the NFP once again surprises with as strong reading as it was the case in January. Also, inflation data scheduled for next week would likely have to rise or drop less than market expects. Should we see moderate NFP and CPI releases, and SVB case does not turn out to be 'black swan' event, a 25 bp rate hike could be decision FOMC makes in less than 2 weeks from now.

US100 will attempt to defend 23.6% retracement and climb back above 12,000 pts. Failure to do so could see index drop to as low as 11,600-11,700 pts, what would help close divergence with TNOTE.

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.