FOMC is set to announce rate decision today at 7:00 pm GMT. It looks almost certain that the bank will go with a 25 basis point rate hike, what would be a second slowdown in tightening pace in a row. However, such decision was seen as hawkish last time. Will it be the same this time? Here are key things you need to know ahead of today's FOMC decision:

-

Market is pricing in a 25 basis point rate hike with almost no probability of 50 bp rate move. However, some institutions forecast a 50 bp rate hike although they are in minority

-

Market expects rates to peak at 5% but a lot of Fed members suggested that rates needs to rise beyond that

-

Majority of Fed members signaled in recent weeks that 25 bp rate hike is in play

-

Q4 US GDP growth turned out to be very strong at 2.9% annualized

-

US retail sales dropped in November and December

-

Jobs market remains strong - claims drop to multi-month lows, significantly below 200 thousand, and JOLTS climb above 11 million. However, ADP report disappointed signaling jobs gain of just slightly above 100k in January

-

According to some Fed members, there is a chance to push inflation down to the goal even with strong labor market

-

This would signal a possibility of a 'soft landing' and allow Fed to focus on other monetary policy settings rather than rates (i.e. trimming of balance sheet)

-

Investors will look for hints in a statement whether further rate hikes would be appropriate or whether Fed is readying a pause in cycle

-

Powell will likely retain hawkish bias and will repeat that there is a lot more to do. However, he may also signals that chance of achieving 'soft landing' has increased

According to market pricing, Fed is expected to be less active in the near future when it comes to rate hike and cuts cannot be ruled out in the later part of the year. Unless market changes its view, indices may resume climb after a knee-jerk negative reaction. Source: Bloomberg

According to market pricing, Fed is expected to be less active in the near future when it comes to rate hike and cuts cannot be ruled out in the later part of the year. Unless market changes its view, indices may resume climb after a knee-jerk negative reaction. Source: Bloomberg

Given the above, today's meeting can be seen as hawkish even if the Fed delivers a 25 basis point rate hike, in-line with expectations. On the other hand, any changes in the statement as well as shifts in Powell's attitude may signal that pause in the rate hike cycle could arrive as soon as end-Q1. We see a chance for drops on indices and strengthening of USD after today's decision. However, those are likely to be short-term moves after which markets will resume moves in-line with January's trends - strong gains on Wall Street and sell-off on USD market.

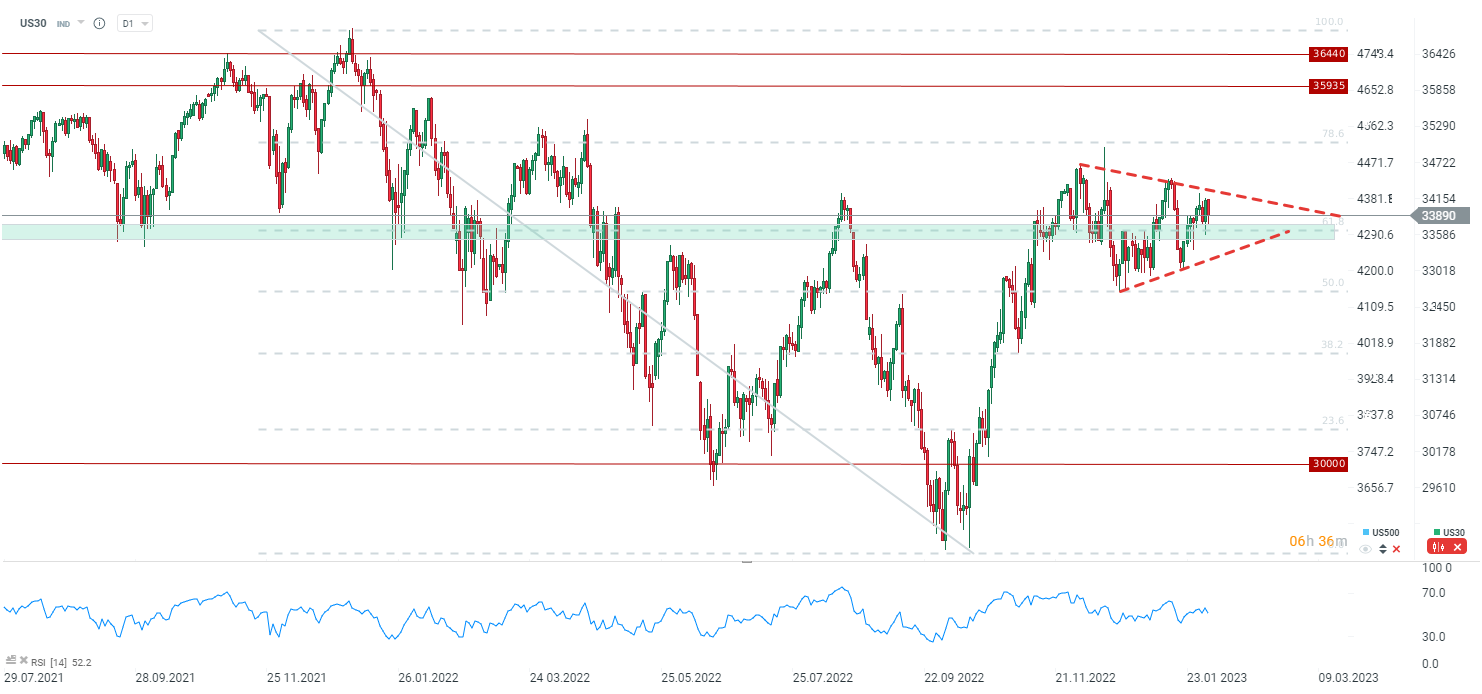

US30 is trading 0.8% lower today. Index is trading within a triangle pattern and today's FOMC meeting may lead to a test of either limit of the pattern. Source: xStation5

US30 is trading 0.8% lower today. Index is trading within a triangle pattern and today's FOMC meeting may lead to a test of either limit of the pattern. Source: xStation5

US Open: Rebound attempt on Wall Street 📈Meta Platforms surges 3.5%

VIX sell-off deepens amid rebound on Wall Street 📉

Morning wrap (22.01.2026)

Daily Summary: Trump signals restraint over Greenland, easing market jitters

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.