Federal Reserve will release FOMC minutes from its July meeting today at 7:00 pm BST. However, market attention is primarily focused on today's revision of labor market data and the upcoming Jackson Hole speech from Fed Chair Powell, scheduled for Friday.. What can we expect from today's minutes release, and what impact might it have on the market?

Fed Maintained Its Stance in July

The Fed's statement during the July meeting did not bring many changes, although the emphasis on the dual mandate from the central bank was interpreted as a sign that it is time to normalize policy in response to the clear cooling in the labor market. Powell was decidedly more dovish during the press conference, so there is a possibility that the minutes from the discussions of the monetary committee members will indicate the potential start of rate cuts. Of course, since then, we've heard new statements from bankers suggesting the necessity of beginning the normalization of monetary policy. Besides the discussion on interest rates, it’s worth noting whether FOMC members discussed pausing balance sheet normalization.

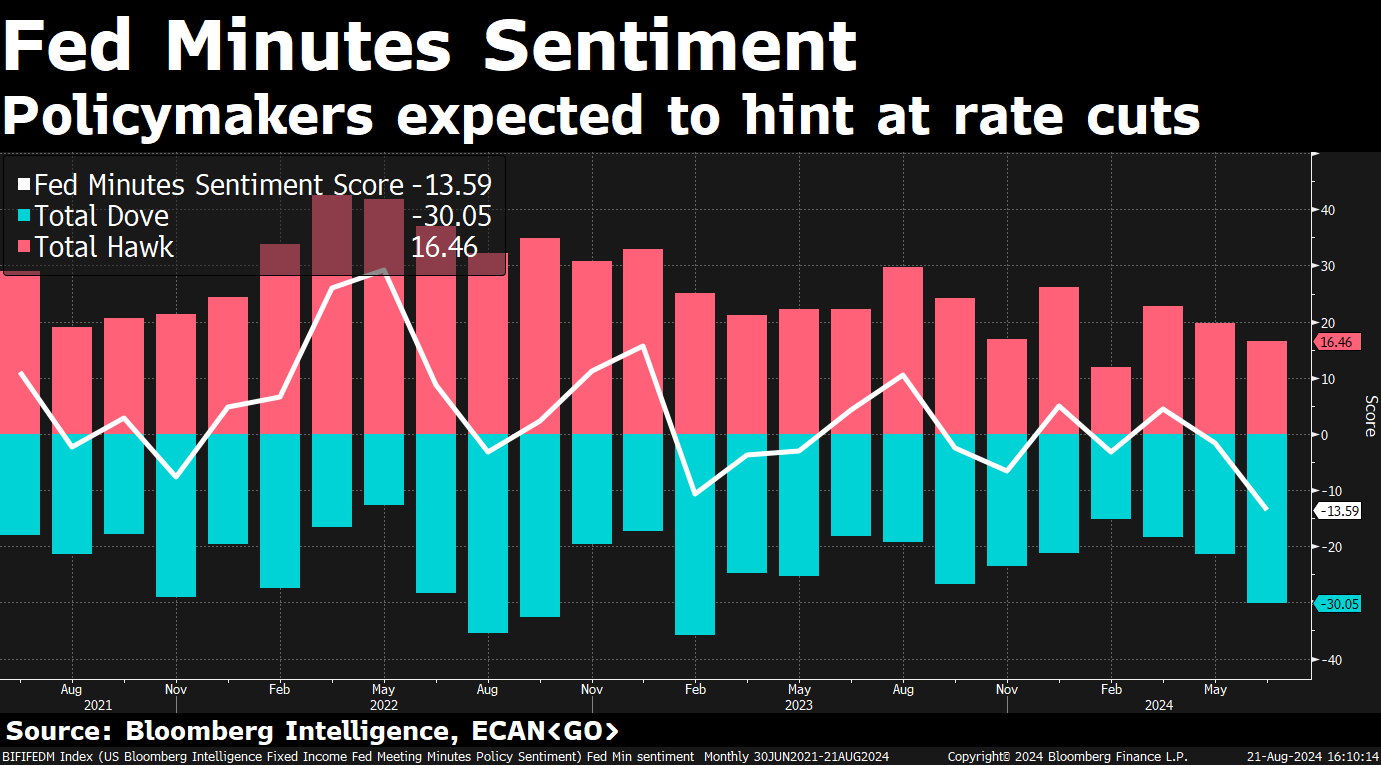

According to Bloomberg, the tone of the minutes should be more dovish. On the other hand, a large amount of other market information may limit the reaction to today's event. Source: Bloomberg Finance LP, XTB

It is worth mentioning that the BLS ultimately revised U.S. employment by 818,000, which is roughly in the middle of the expected range of 600,000 to 1 million. The labor market is, of course, significantly weaker than the monthly NFP data suggested, but this should not lead to major actions from the Fed. Nonetheless, Powell may acknowledge on Friday that the labor market is weaker than the Fed has perceived in recent months, which could be seen as a dovish signal.

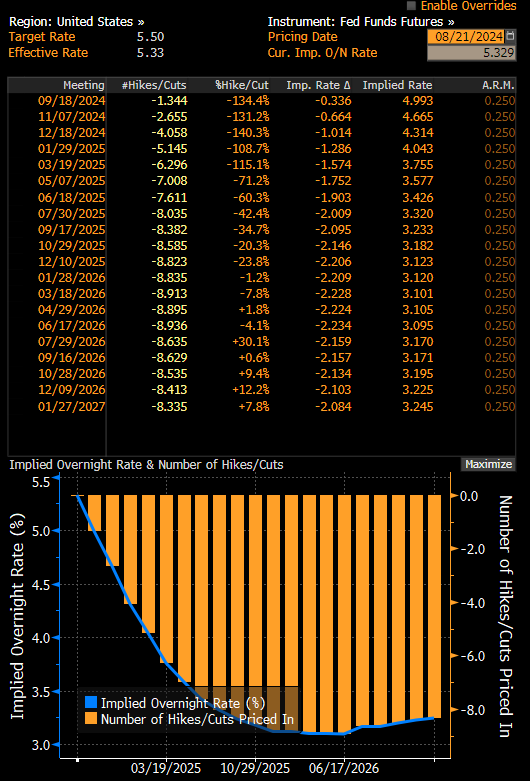

The market still estimates that the probability of a 50 bp rate hike in September is slightly above 30%, while a 25 bp cut is fully priced in. By the end of the year, a 100 basis points of rate cuts are anticipated. Source: Bloomberg Finance LP

How Might the Market React?

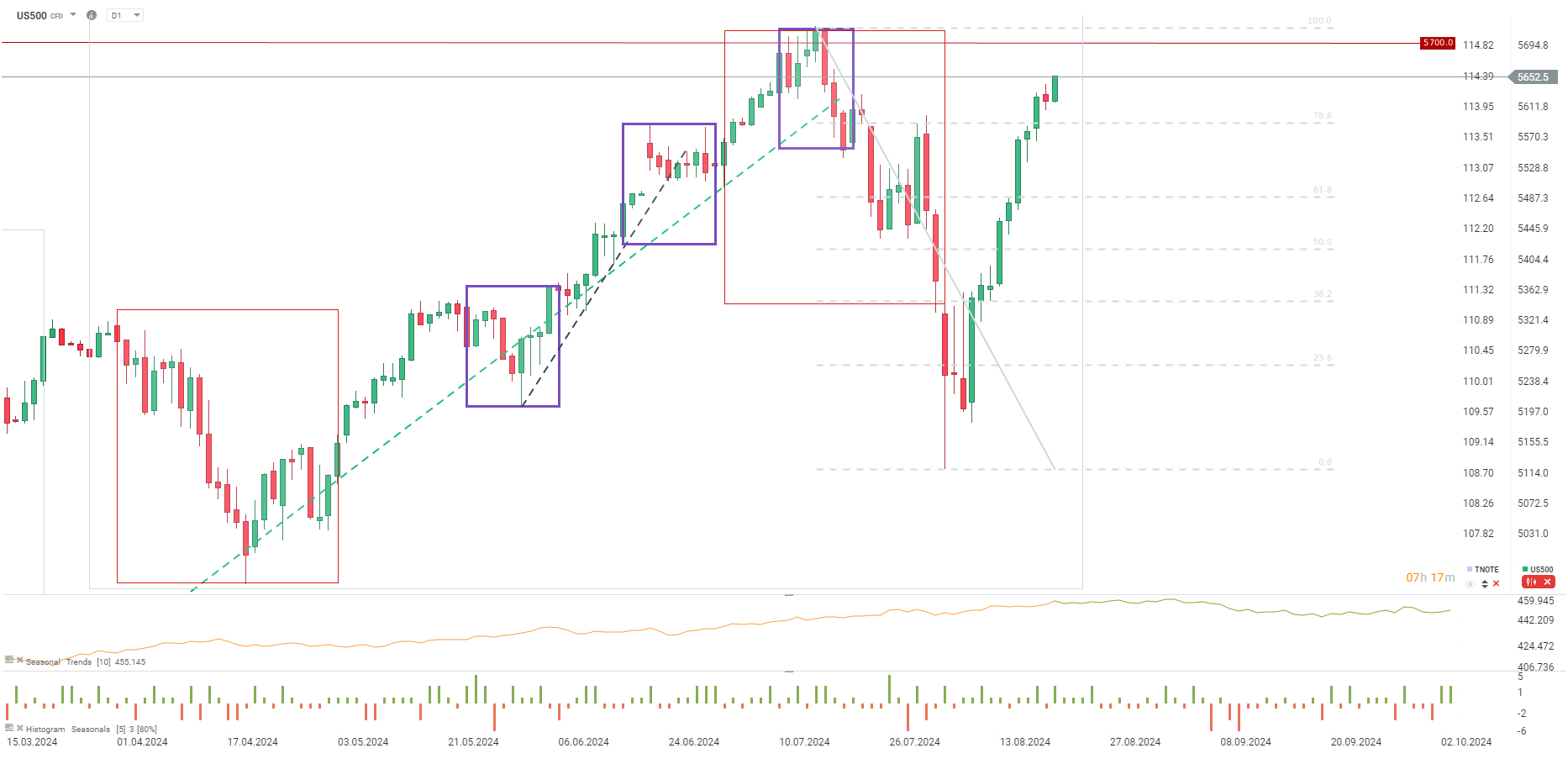

The US500 is rising today in anticipation of the minutes and after the BLS revision of employment data. Dovish minutes, a significant revision in employment numbers, and expectations of Powell hinting at rate cuts this Friday are all working in favor of Wall Street. Since August 8, the US500 has already risen by 8%, and it is just 1.5% below historic highs. The nearest resistance can be found at 5,700 points, while the support is just above the 78.6% retracement of the last downward wave, around 5,600 points.

Source: xStation5

US100: Nasdaq rebounds on new wave of AI optimism 🤖 🚀

Morning wrap (15.01.2026)

Daily Summary: US Futures Retreat Amid Geopolitical Tensions and Inflationary Heat

S&P 500 futures retreat 1% amid hawkish Fed rhetoric and robust data

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.