The first of four key macro reports for Fed's September decision - NFP report for July - will be released today at 1:30 pm BST. The US jobs market has been performing very well after Covid pandemic and seems to be quite resilient to tightening credit conditions. Of course, this is a reason to cheer but at the same time it makes it harder for inflation to quickly fall back to Fed's target. This turns out to be a problem for the Fed as it has a dual mandate - keeping prices stable and employment strong.

What does the market expect from today's report?

- Market consensus points to a 200k increase in non-farm payrolls in July, slightly lower than previous reading of 209k. However, it should be said that ADP data came in strong for the second month in a row and showed 324k increase in July

- The last time NFP printed a below 200k jobs increase was back in December 2020. However, gains on the labour market have been slowing since July 2022

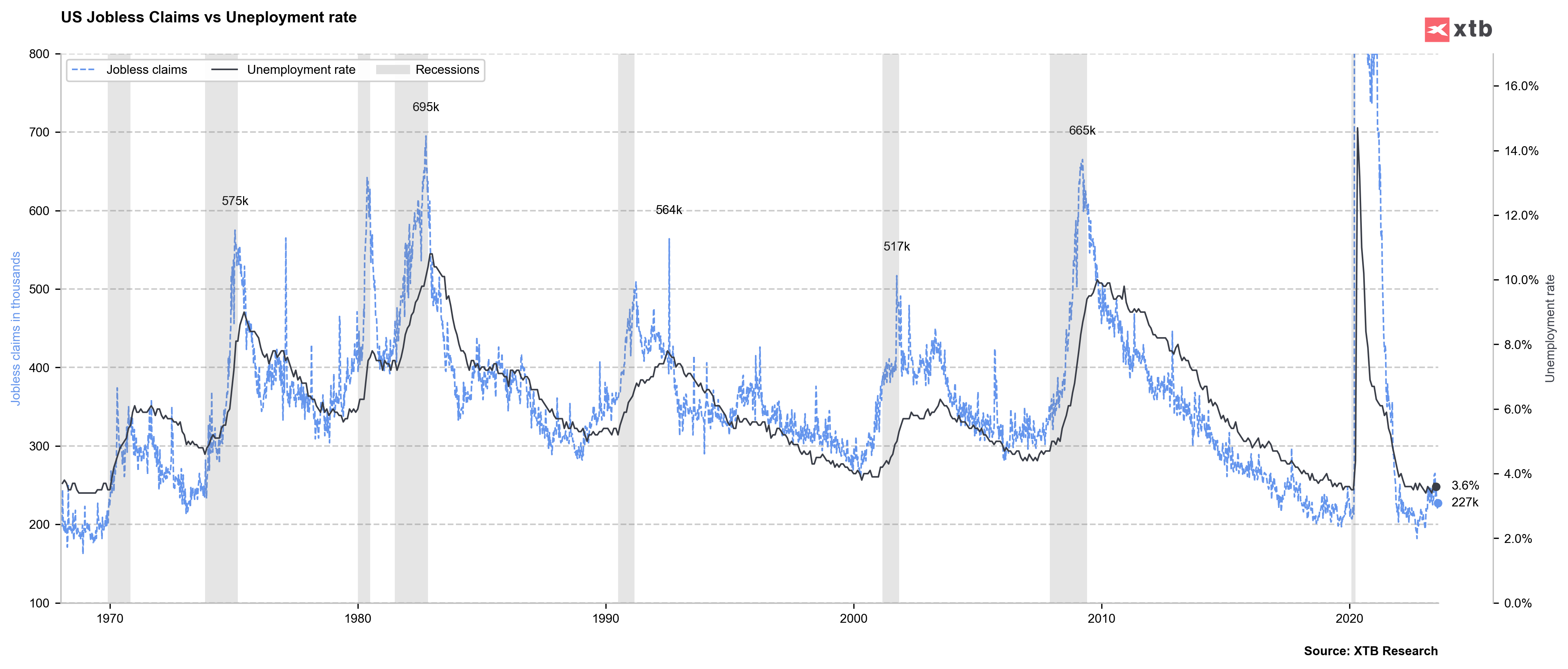

- It is expected that the unemployment rate will remain unchanged at 3.6%. Fed still expects unemployment rate to climb above 4% this year

- Wage growth is expected to slow from 4.4% YoY in June to 4.2% YoY in July. Wage growth that would be in-line with inflation target is closer to 3.0% YoY

- 4-week average for US jobless claims dropped to 228k, the lowest reading since March. Claims data has been printing lower values since June and it should have a positive impact on employment change

- Jobs market is cooling but most likely much slower than Fed would want to. Better-than-expected or in-line readings may confirm need for another rate hike at September meeting

ADP data has been a rather poor predictor of NFP readings in recent months. Even an in-line print of around 200k could be seen as a disappointment for USD traders, but at the same time provide support from rebound attempts on stock markets. Source: Bloomberg Finance LP, XTB Research

Jobless claims data suggests that the chance of the unemployment rate to rebound is slim. On the other hand, JOTLS job openings continue to drop. Nevertheless, job openings remain at an extremely high level of 9.6 million vacancies. Does this mean that potential for more US jobs gains is running out? Source: Bloomberg Finance LP, XTB Research

What's next for US500?

US500 continues to trade above the lower limit of the Overbalance structure, signaling that uptrend that been going on since March is still in play. Should today's daily candlestick overshadow body and wicks of yesterday's bearish candlestick, it could be a strong bullish signal for next week. Of course, a very strong NFP report with job gain much higher than expected 200k could put pressure on equities and lead to another test of 4,500 pts area by US500. A break below this area could trigger a pullback to as low as 23.6% retracement that can be found near the upward trendline. Source: xStation5

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.