Release of the US CPI data for March will likely be a key for the next FOMC rate decision. Should inflation drop significantly and the Fed notes an improvement in services inflation, pause in the rate hike cycle may be on the cards. On the other hand, jobs market remains firm, giving reasons for one more hike. What to expect from today's CPI release>

Why should inflation drop?

-

Market expects headline CPI to drop to 5.2% YoY but core CPI to accelerate to 5.6% YoY. If confirmed, it would be the first time when headline CPI drops below core since end-2020

-

Drop in inflation can be attributed to base effects - inflation kept climbing a year ago, mostly because of high fuel prices with oil still trading above $100 per barrel back then

-

Food prices, especially grain prices, were at extremely high levels while fertilizer prices were the highest in history. Currently, food prices are lower what should support drop in inflation

-

Wage growth, according to NFP report, slowed but remains at level inconsistent with 2% inflation

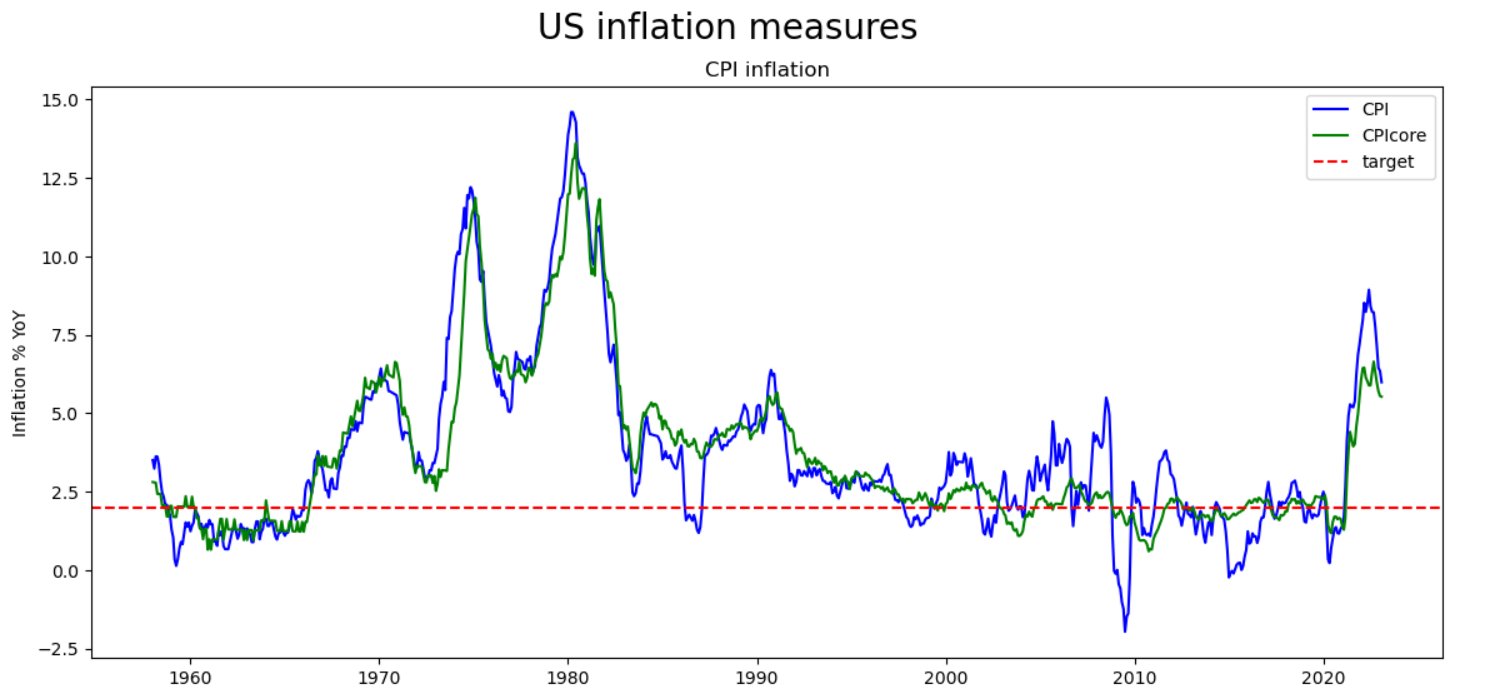

Headline US CPI is expected to drop below core gauge but both measures stay significantly above inflation target. Source: Macrobond, XTB

Headline US CPI is expected to drop below core gauge but both measures stay significantly above inflation target. Source: Macrobond, XTB

Why could there be an upside surprise?

-

Core inflation is expected to accelerate for the first time since September 2022. Higher labor costs as well as elevated energy prices are still being passed onto final prices

-

Car prices halted a steep year-over-year drop and started to increase on month-over-month basis

-

Fuel prices on a year-over-year basis are lower but have been recovering since the beginning of 2023. Moreover, WTI found its way above $80 per barrel after recent OPEC+ decision to cut output

-

Services inflation continue to accelerate, driven by wage growth

-

Costs related to real estate market services are also on the rise

Services inflation excluding shelter is expected to drop going forward but the correlation pictured on the chart above is not as strong as it used to be. Source: Macrobond, XTB

Services inflation excluding shelter is expected to drop going forward but the correlation pictured on the chart above is not as strong as it used to be. Source: Macrobond, XTB

US500

Today's inflation reading is likely to be crucial for the Fed when deciding whether to end the rate hike cycle in May or not. Should inflation surprise with a lower-than-expected reading, US500 may be gearing for a breakout above recent local highs. However, one should keep in mind that other events, like today's FOMC minutes or Wall Street earnings report that begins on Friday, may also have an impact on Wall Street equity indices.

US500 trades near key resistance zone ranging between 50% retracement of the downward move launched last year and a 4,200 pts mark. Volatility is limited and US yields resumed climb, suggesting potential reversal. However, US500 will also be vulnerable to other events in the hours and days to come, like FOMC minutes release or US banking earnings. Source: xStation5

US500 trades near key resistance zone ranging between 50% retracement of the downward move launched last year and a 4,200 pts mark. Volatility is limited and US yields resumed climb, suggesting potential reversal. However, US500 will also be vulnerable to other events in the hours and days to come, like FOMC minutes release or US banking earnings. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.