- Markets continue to rise despite growing odds of an extended U.S. government shutdown (Kalshi estimates around 14 days).

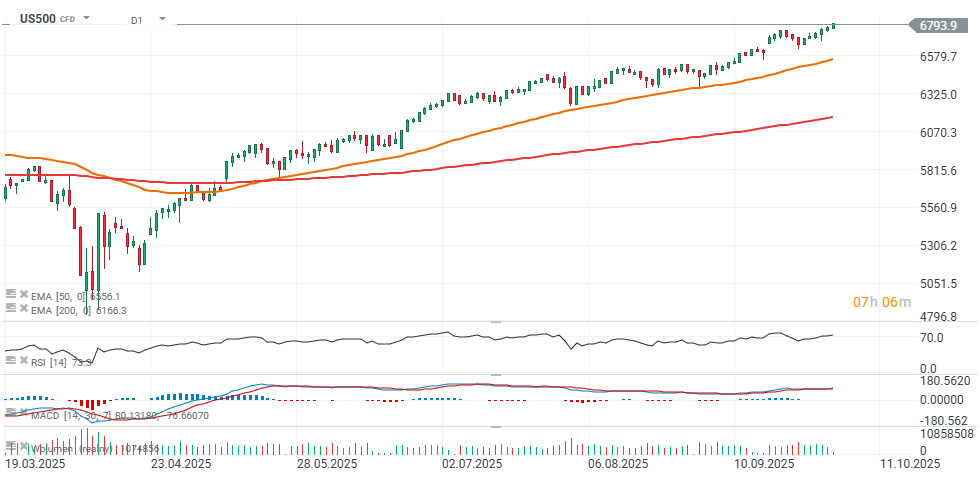

- The US500 is pushing to new all-time highs, approaching the 6,800 level after weaker U.S. ISM Services data.

- Applied Materials shares are sliding after the company warned that U.S. trade policy will weigh on earnings.

- USA Rare Earth, an early-stage rare-earth mining company, is surging on speculation of a potential deal with the U.S. government.

- Markets continue to rise despite growing odds of an extended U.S. government shutdown (Kalshi estimates around 14 days).

- The US500 is pushing to new all-time highs, approaching the 6,800 level after weaker U.S. ISM Services data.

- Applied Materials shares are sliding after the company warned that U.S. trade policy will weigh on earnings.

- USA Rare Earth, an early-stage rare-earth mining company, is surging on speculation of a potential deal with the U.S. government.

- Markets continue to rise despite growing odds of an extended U.S. government shutdown (Kalshi estimates around 14 days).

- The US500 is pushing to new all-time highs, approaching the 6,800 level after weaker U.S. ISM Services data.

- Applied Materials shares are sliding after the company warned that U.S. trade policy will weigh on earnings.

- USA Rare Earth, an early-stage rare-earth mining company, is surging on speculation of a potential deal with the U.S. government.

The US500 index is climbing to fresh record highs, while the RSI indicator has moved above 73 points—signaling strong optimism and upward momentum across the broader market, despite the government shutdown. Interestingly, following 86% of past shutdowns, the S&P 500 traded higher 12 months later with an average gain of +12.7%, although it ended the shutdown higher in only about 55% of cases. The reason lies in history: shutdowns in the 1970s and 1980s were often accompanied by sharp selloffs. Since 1995, however, the S&P 500 has advanced after every subsequent shutdown. On the macro side, ISM data showed a steep drop in new orders, which prevented the headline figure from meeting forecasts; meanwhile, the employment and prices sub-indices posted slight gains, beating expectations.

Source: xStation5

Stock News

-

Applied Materials (AMAT.US) fell around 2% after the semiconductor equipment giant warned its fiscal 2026 revenue could drop by $600 million. The decline stems from a new rule introduced by the U.S. Department of Commerce’s Bureau of Industry and Security, expected to weigh on future sales.

-

Freeport-McMoRan (FCX) gained 1.3% after UBS upgraded the copper and gold producer to buy from neutral, signaling greater confidence in the company’s outlook.

-

Baidu (BIDU.US) advanced nearly 2% after Morgan Stanley raised its price target for the Chinese search engine operator to $140 from $100, reflecting stronger growth expectations.

-

USA Rare Earth (USAR.US) surged about 10% after CNBC reported the company is in direct talks with the Trump administration. The news fueled speculation of a potential deal with the U.S. government, boosting investor optimism.

-

Maplebear (CART.US), parent of Instacart, slipped about 1.5% after Piper Sandler’s Tom Champion downgraded the stock to neutral from overweight, citing intensifying competition in the delivery-services sector.

-

Tronox Holdings (TROX.US) declined nearly 3% after JPMorgan cut its rating from overweight to neutral, pointing to deteriorating conditions in the titanium dioxide industry that may weigh on near-term performance.

U.S. ISM Services Data – September

-

ISM Services PMI: 50.0 (forecast 51.7; previous 52.0)

-

ISM Services Employment: 47.2 (forecast 46.6; previous 46.5)

-

ISM Services New Orders: 50.4 (forecast 54.0; previous 56.0)

-

ISM Services Prices Paid: 69.4 (forecast 68.0; previous 69.2)

Technicals (AMAT.US & FCX.US)

Applied Materials (AMAT.US): Shares pulled back after reaching the 71.6% Fibonacci retracement of the June 2024 rally. The first significant support in the correction scenario lies around $205, defined by prior price reactions and the 61.8% Fibonacci retracement.

Source: xStation5

Freeport-McMoRan (FCX.US): Shares are attempting to return to an uptrend, staging a V-shaped rebound from the recent price low near $32.

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.