One key macro events of the day - release of US CPI inflation report for March - is already behind us, but there is another one looming large. Minutes from FOMC March 2024 meeting will be released at 7:00 pm BST today. Release may also trigger a volatility spike on the markets and will be watched closely by market participants.

FOMC March 2024 meeting saw interest rates being left unchanged in the 5.25-5.50% range, but has included a new set of economic projections. Those included higher core inflation forecasts for 2024 compared to December projections, as well as higher GDP growth forecast for 2024-2026 period. 'Dot-plot' showed median expectation was still for three cuts (75 basis points of easing) this year, but with just one member seeing a chance for four cuts, while back in December 2023 dots 5 FOMC members saw 4 or more rate cuts this year.

What to watch in the release?

While new forecasts and Powell's post-meeting press conference already provided investors with new informations, traders will look for more in today's minutes. Attention will be on whether there were discussions about future rate path, and if so, then how specific. Also, any mentions on balance sheet and pace of its reductions will also be scrutinized. So far, Fed decided not to make any changes there, but those will be need before or when rate easing begins. The document will likely highlight fact that path towards inflation target remains uncertain and bumpy. It should be noted that FOMC meeting in March was held after two surprisingly hawkish CPI reports in a row (January and February) and Fed members noted this as contributing to lack of confidence to cut rates. However, now we know that inflation also remained higher than expected in March.

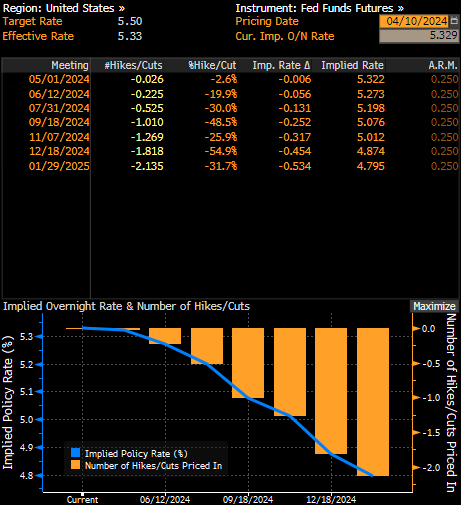

Money markets now see just an around-20% chance of Fed delivering the first rate cut at June meeting, following a hawkish CPI data for March released earlier today. Source: Bloomberg Finance LP

It will be hard to surprise markets

While FOMC minutes is certainly a volatility event, it should be noted that market's reaction today may be somewhat muted. Given that March 2024 meeting was a quarterly meeting, the majority of information that Fed wanted to pass to investors has been passed via economic projections already. Having said that, it will be hard to surprise markets. Secondly, markets are already 'stretched' after today's CPI release. Should minutes directly or indirectly reject idea of rate cut in the first half of 2024, USD could extend gains while indices may deepen declines.

However, it should be noted that back in March when Fed held a monetary policy meeting, markets were split whether the first rate cut will be delivered in May or in June. Now, after another hawkish CPI reading markets are split between July and September. Having said that, any potential hawkish surprise may be already priced in.

S&P 500 futures (US500) hold onto post-CPI losses ahead of FOMC minutes release. Pullback was halted at 200-period moving average (purple line, H4 interval) in the 5,200 pts area, but the index remains down over 1% on the day. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

📈Wall Street rebounds, VIX slips 5% 🗽What does US earnings season show us?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.