Will the Fed soften its policy?

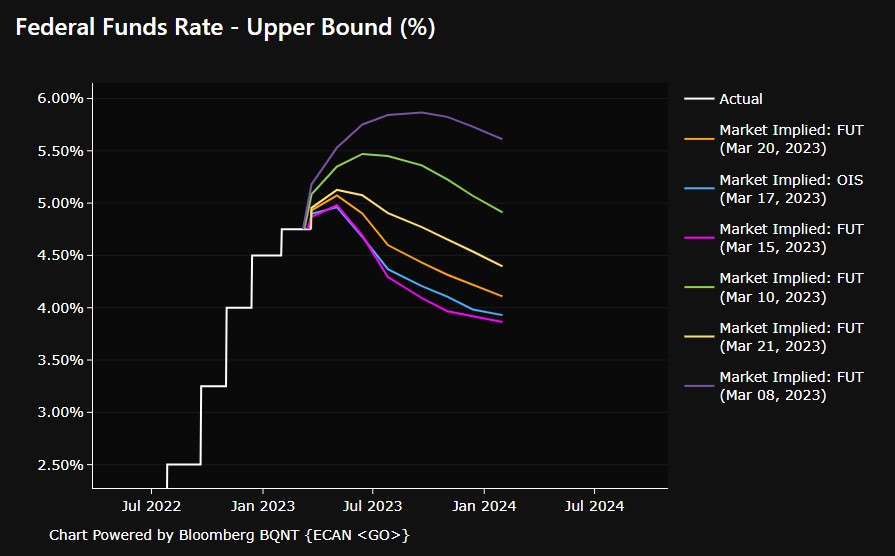

As recently as March 8, the market speculated that the Fed could raise by 50 basis points in March, and the forward rate could exceed 5.5% (this was the baseline scenario). The collapse of SVB and the takeover of Credit Suisse changed everything in the market. Although the crisis seems to have been averted this risk could theoretically return with redoubled force, which could repeat the 2008 crisis.

Interest rate expectations in the US have changed dramatically over the past two weeks. Currently, the market sees chances of incomplete two hikes in the current cycle looking at the implied change. On the other hand, it then sees fairly rapid and sizable reductions by the end of this year. Source: Bloomberg

What is worth paying attention to?

- The market is pricing in a more than 80% probability of a 25 basis point hike. We too believe that the Fed should continue to hike.

- However, there have been expectations that due to systemic risks, the Fed will decide to pause (not necessarily end the hike cycle). Goldman Sachs believes the Fed will not raise and will end QT

- The Fed has increased liquidity in the markets, so there are claims that it may also abandon QT or reduce its scale. Theoretically, it could even increase QT to offset the impact of the recent liquidity increase

- Liquidity is needed for smaller entities. Large ones have liquidity enough

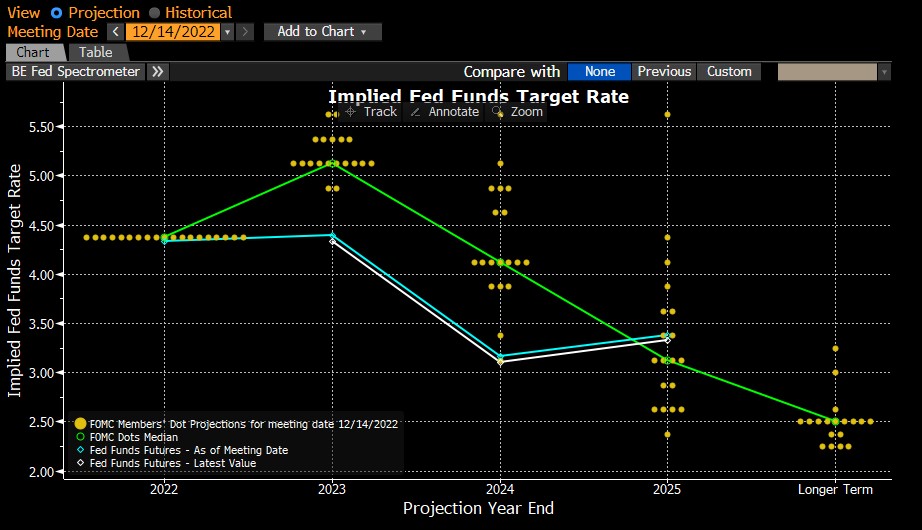

- The dot-chart, which will show what the Fed's expectations are for further moves, will be key

- The Fed has to decide between minimizing systemic risk and continuing to fight inflation hard

- The positive scenario for markets is to keep the forward rate forecast unchanged or raise it slightly. This would give room for one more hike

- An increase in the forward rate forecast above 5.5% could be considered a hawkish move by the Fed.

- The mix of the forward rate decision and QT will be key

- U.S. inflation slows, but remains high in Fed's view. Inflation remains mainly in services

- Commodity-related inflation should decline further. Oil prices have fallen significantly, so the base effect will have a very large impact on inflation in March and April

The market is much more cautious in its assumptions than the Fed was at its last meeting. Will the Fed decide to raise its rate forecast at the end of this year? Source: Bloomberg

The market is much more cautious in its assumptions than the Fed was at its last meeting. Will the Fed decide to raise its rate forecast at the end of this year? Source: Bloomberg

How will the markets react?

The US500 is roughly where it was just before the SNB collapse. The US500 broke the falling trendline in January and tested it again on March 10. There was speculation that a so-called "bull market trap" may have been set. Keeping the US500 above the falling trendline, however, may negate such expectations. Nevertheless, it is crucial for the bulls to break 4200 points, which could happen if the forward rate is kept unchanged and the assumptions of the balance sheet reduction program are changed. However, if the Fed maintained a sharp hawkish stance (raising the rate forecast and maintaining QT). Then the area around 3800 points could be tested.

US500

Source: xStation5

EURUSD

The Fed's increase in liquidity resulted in sharp declines in US yields, bringing EURUSD back to the 1.08 level. Maintaining the Fed's hawkish stance could bring yields back to the 3.75% area or higher, which could lead to a retest of the 1.05 area. On the other hand, if the Fed shows its dovish side (it is the tight monetary conditions that are partly responsible for the banking sector's troubles), then EURUSD could return to stronger gains towards 1.10. In addition, the euro has the support of a strong drop in gas prices. Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.