Minutes from latest FOMC meeting has just been released. The publication was perceived as dovish triggered moves on the markets. As aresult Wall Strret inidces rose sharply, while USD moved south.

Here are key takeaways from the document:

-

FED members agreed that a slower pace of rate hikes would allow the FOMC to better assess progress toward its goals "given the uncertain lags" associated with monetary policy.

-

Policymakers agreed that there were few signs of inflation pressures easing, however some of them suggested that slowing the pace of rate increases could reduce financial system risks, others suggested that slowing should wait for more progress on inflation

-

Policymakers observed that the labour market remained tight; many noted tentative signs that it may be gradually moving toward a better balance of supply and demand. Participants agreed that there were few signs of inflation pressures easing.

-

Many participants expressed significant uncertainty about the ultimate level of the fed funds rate required to contain inflation, with various participants suggesting it was higher than previously anticipated.

-

Some members observed that the labor market remained tight, many noted tentative signs that it may be gradually moving toward a better balance of supply and demand.

-

Central bankers agreed that the risks to the inflation outlook remained skewed to the upside.

-

Some participants stated that stricter policy was consistent with risk management; others observed an increasing risk of overtightening.

-

The minutes of the November 1-2 Fed policy meeting show that a substantial majority of participants thought a slowing in the pace of interest rate hikes would be appropriate soon.

-

All participants agreed that a 75-basis-point increase was necessary and a next step toward making monetary policy sufficiently restrictive.

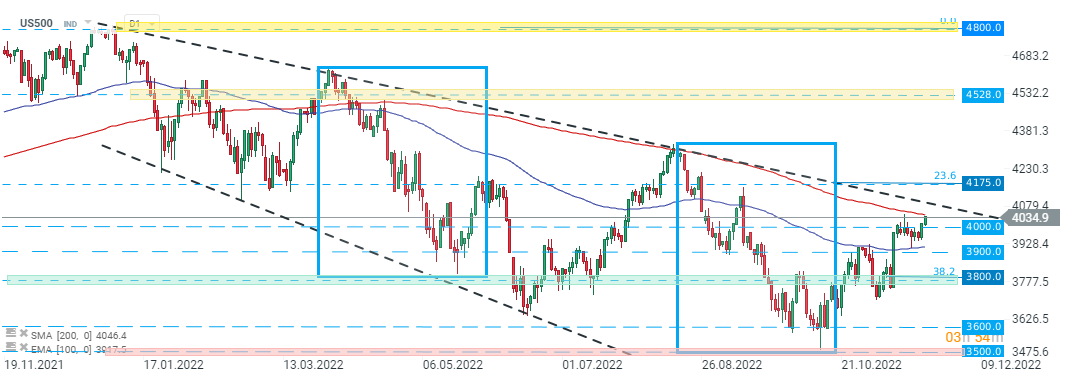

US500 rose sharply and is appraching recent highs. Source: xStation5

US500 rose sharply and is appraching recent highs. Source: xStation5

EURUSD is trading higher today and today’s Minutes provided more fuel for bulls. Source: xStation

EURUSD is trading higher today and today’s Minutes provided more fuel for bulls. Source: xStation

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.