The latest CPI report from the United States showed deceleration in price growth but it still came above market expectations. Moreover, core CPI inflation continued to accelerate faster-than-expected, what led to an immediate market reaction. It looks like US500 and USDJPY will once again be in the center of attention with USDJPY cross offering the largest carry trade potential among major currency pairs.

While inflation is easing, it continues to surprise to the upside, at least when it comes to headline measure. Data for September showed a smaller impact of energy prices and cars prices on the overall inflation. Data for OCtober is likely to show a positive contribution from energy prices - gasoline price increase again and price of oil and oil derivatives resume declines only in recent days.

What are market expectations?

-

Headline inflation is expected to continue to drop but only from 8.2 to 8.0% YoY. It should be noted that headline US inflation stayed above 8% since March!

-

On a monthly basis, headline CPI is expected to come in at 0.6% MoM, compared to previous 0.5% MoM (reflecting increase in fuel prices)

-

Core inflation is expected to slow from 6.6 to 6.5% YoY

-

On a monthly basis, core CPI is expected to increase 0.5% MoM, compared to a previous increase of 0.6% MoM

Inflation is key measure for Fed

The latest US jobs report supported the outlook for further tightening of Fed's policy. However, the unemployment rate started to increase, in-line with the central bank's projections. This was likely a reason behind strong upward move on stock market indices and weakening of USD in the aftermath of data release. Today, the market will also look for hints on whether Fed's actions are having an effect on lowering inflation. As such, reading that is in-line with expectations or below them may provide a lift for equities, which would welcome more stimulus (or at least hopes for more stimulus) following a mixed earnings season.

On the other hand, if inflation fails to slow, especially core measure, the chance for another 75 bp rate hike in December will increase. This could lead to an upward impulse on USDJPY.

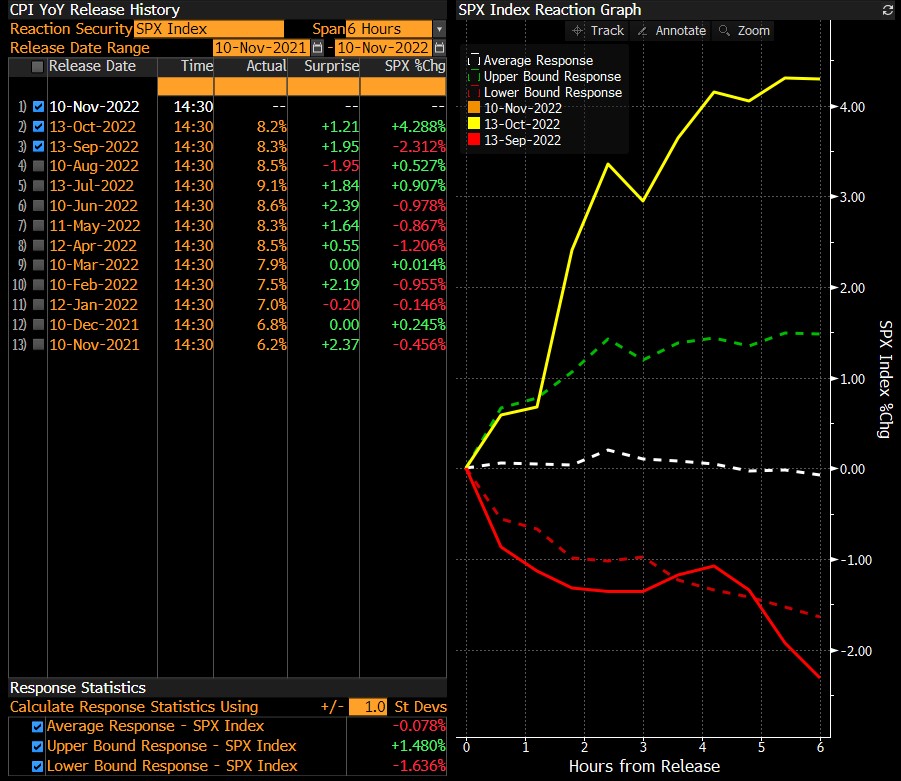

As one can see, S&P 500 saw quite a reaction to previous inflation data, especially the latest two. It should be noted that cash markets open an hour after the release. Immediate reaction will be, however, visible on the futures market (US500). Source: Bloomberg

As one can see, S&P 500 saw quite a reaction to previous inflation data, especially the latest two. It should be noted that cash markets open an hour after the release. Immediate reaction will be, however, visible on the futures market (US500). Source: Bloomberg

US500

US500 briefly dropped to the lowest level since November 2020 following release of inflation data for September. However, the market started to recover later on and bounced over 10%. If today's release comes in-line with Fed expectations and shows that the central bank's actions are having effect, it could mean that a smaller rate hike will be announced at the December meeting. This, in turn, will limit yields rally and give a chance to breath and look towards 4,000 pts area. Source: xStation5

US500 briefly dropped to the lowest level since November 2020 following release of inflation data for September. However, the market started to recover later on and bounced over 10%. If today's release comes in-line with Fed expectations and shows that the central bank's actions are having effect, it could mean that a smaller rate hike will be announced at the December meeting. This, in turn, will limit yields rally and give a chance to breath and look towards 4,000 pts area. Source: xStation5

USDJPY

USDJPY is trading in an important technical spot. If US inflation fails to slow in-line with expectations, the pair may launch upward impulse and look towards the 150.00 area. On the other hand, a break below 145.00 area on the back of lower-than-expected inflation print would provide the pair with a chance to launch a large downward correction with 140.00 area being a potential target. Source: xStation5

USDJPY is trading in an important technical spot. If US inflation fails to slow in-line with expectations, the pair may launch upward impulse and look towards the 150.00 area. On the other hand, a break below 145.00 area on the back of lower-than-expected inflation print would provide the pair with a chance to launch a large downward correction with 140.00 area being a potential target. Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.