Release of US data pack for February, including PCE inflation, is a key macro event in the afternoon today. Even though it will be a report for February, somewhat outdated given that we are entering April next week, it is the Fed's preferred measure of inflation and will therefore be watched closely.

However, it may not have too much impact on the next FOMC rate decision. This is because traders will be offered data for March prior to the next FOMC meeting (both CPI and PCE). Nevertheless, today's reading is likely to impact market expectations regarding Fed's rate path and it may trigger some moves on the market.

1:30 pm BST - US, data pack for February.

- Headline PCE. Expected: 5.1% YoY. Previous: 5.4% YoY

- Core PCE. Expected: 4.7% YoY. Previous: 4.7% YoY

- Personal Income. Expected: 0.2% MoM. Previous: 0.6% MoM

- Personal Spending. Expected: 0.3% MoM. Previous: 1.8% MoM

CPI data for February, which was already released, pointed to another slowdown in the headline measure and a similar outcome is expected from headline PCE data today. However, the question is what comes next as some price growth proxies, like for example Manheim index for used vehicles, points to a possibility of CPI re-accelerating in Q2 2023.

Manheim used vehicles index (green line, 3-month lead) suggests that inflation slowdown may take a halt and reverse in the coming months. Source: XTB, Bloomberg

Manheim used vehicles index (green line, 3-month lead) suggests that inflation slowdown may take a halt and reverse in the coming months. Source: XTB, Bloomberg

A look at the markets

EURUSD

EURUSD bulls failed to break above the resistance zone ranging above 1.0920 mark. As a result, a double top was painted in the area. This is a bearish pattern but a strong signal would be generated only once the pair drops below the neckline of the pattern, which can be found near 38.2% retracement in the 1.0710 area.

EURUSD at H1 interval. Source: xStation5

EURUSD at H1 interval. Source: xStation5

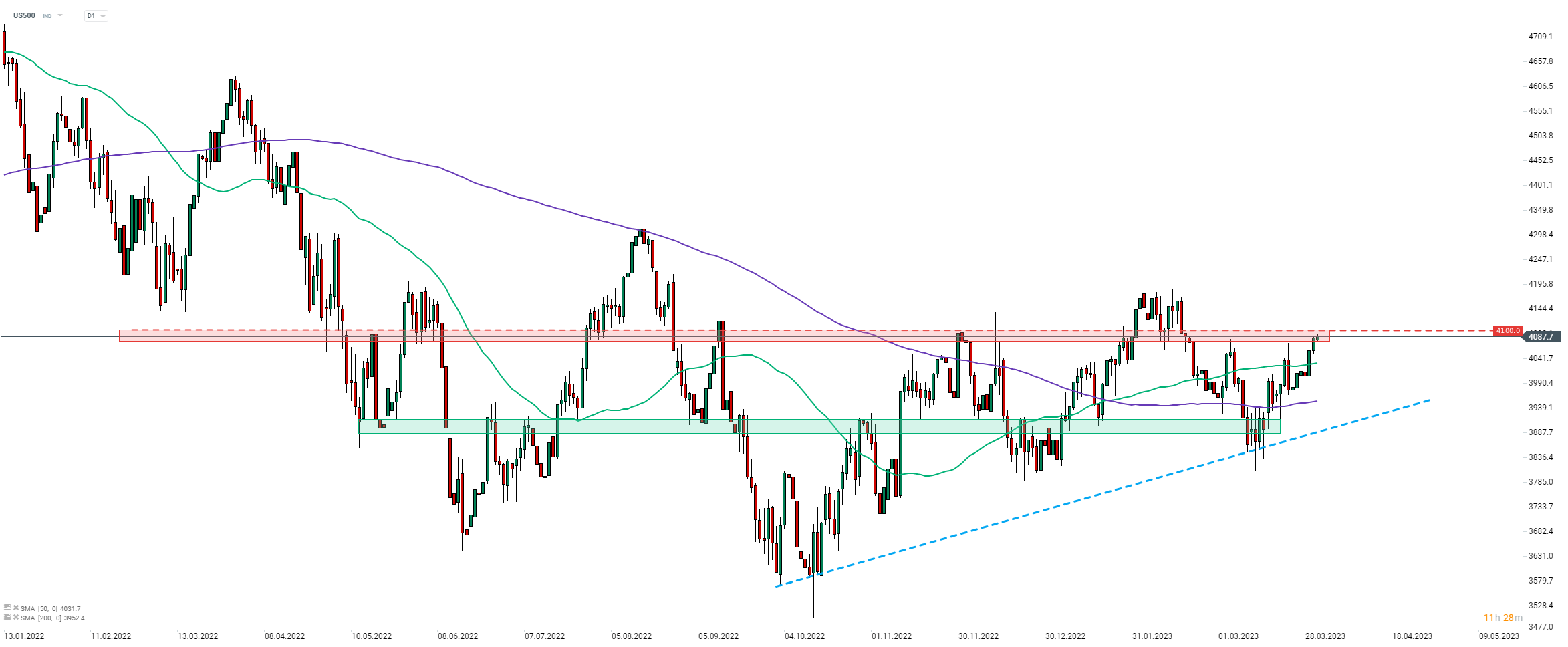

US500

S&P 500 futures (US500) traded higher in the early afternoon ahead of the US PCE report release and ahead of the Wall Street cash session open. The index reached 4,100 pts resistance zone and a softer PCE reading could provide fuel for another attempt at breaking above it.

US500 at D1 interval. Source: xStaiton5

US500 at D1 interval. Source: xStaiton5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.