Investors' attention today turns to inflation readings from the world's largest economies. The publication with the greatest market significance is, of course, US CPI inflation, which will be an important factor in shaping the Fed's future monetary policy and may prove to be a valuable reference for other central banks' decisions. Today's 1:30 p.m. BST release will create a lot of volatility in the broad market, so let's take a look at the most important data on the report.

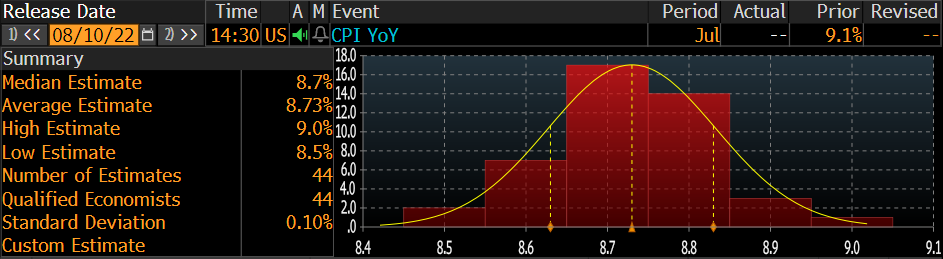

The consensus of analysts surveyed by Bloomberg assumes that the July inflation reading will reach 8.7% y/y, compared to an earlier reading of 9.1% y/y. However, we mark special attention to the small standard deviation of forecasts, which increases the chance of a plus/minus surprise. Source: Bloomberg

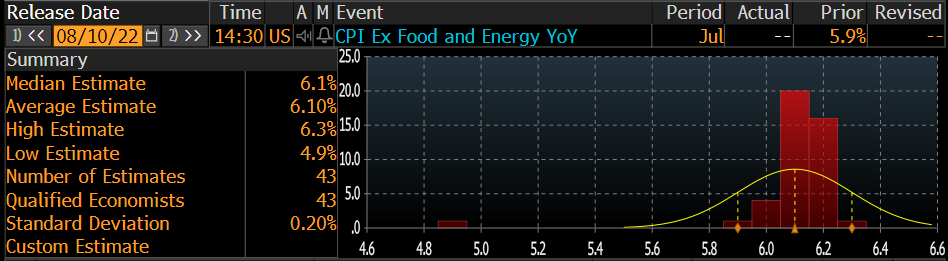

The forecasts for inflation readings excluding food and energy prices are slightly different. Here, analysts assembled by Bloomberg forecast an acceleration of inflation to 6.1% y/y, compared to an earlier reading of 5.9% y/y. This highlights the importance of especially oil and gasoline prices in the US as a factor creating inflation (average prices fell in July). Source: Bloomberg

Money market rates currently point to a 76% probability of a 75 basis point rate hike at the September FOMC meeting. Today's reading will certainly bring an update in market valuations. Source: Bloomberg

At the moment, stock markets are trading at mixed levels, the U.S. dollar is weakening against other currencies, and 10-year yields are rising slightly.

EURUSD pair rose slightly during today's session and is currently testing the upper limit of the triangle formation. Nevertheless, traders restrain themselves from taking larger transactions ahead of CPI release. Markets forecast that the annual inflation rate in the US will slow to 8.7% in July, however a significant downward surprise could reduce some pressure on the Fed and push USD even lower. On the other hand, a hotter-than-expected reading will reinforce the central bank's aggressive stance against surging inflation (especially given last week's strong NFP reading) and likely trigger another dollar rally. Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.