Only a few hours remain until the Fed's decision on interest rates. The market is still uncertain about how much the interest rate will be lowered. The Fed's communication has been quite clear in recent weeks, with a strong signal conveyed by Powell during the Jackson Hole conference. According to Powell, the time has come to lower interest rates in the United States. However, it's still unclear how strong this move will be. The decision itself will take place at 19:00 BST, and forecasts will also be published then. The press conference will start at 19:30 BST.

What to expect from the Fed?

- The Bloomberg consensus clearly points to a 25 basis point rate cut.

- Among about 120 forecasts, only 9 indicate a 50 basis point cut, and one forecast suggests maintaining interest rates unchanged.

- Among those expecting a 50 bp cut are JP Morgan and Bloomberg Economics.

- The futures market prices in a 66% probability of a 50 basis point rate cut today, although it was even 72% recently.

- By the end of this year, the market prices in 4.6 cuts of 25 basis points each, which translates to about 115 basis points.

- Bloomberg indicates that today's 50 basis point cut will lead to increased expectations for two more 50 basis point moves.

- The futures market indicates cuts of about 250 basis points by the end of next year

Interest rate expectations according to Fed funds futures contracts. Source: Bloomberg Finance LP, XTB

Does the size of the cut matter?

It's worth to note that the Fed has been using a rather clear approach to its decisions for a long time and rarely surprises. The last surprise occurred at the beginning of the pandemic when the Fed cut interest rates by 125 basis points. However, then it was necessary to act quickly to prevent an economic recession. Looking at the history of expectations and moves by the Fed (consensus data from 1997), we've only had 4 instances of surprising larger cuts:

- In November 2002, a 50 basis point cut. This was almost the end of the cutting cycle related to the economic crisis after the dot-com bubble burst.

- In September 2007, a 50 bp cut. This was at the beginning of the cutting cycle related to the financial crisis.

- In December 2008, a 75 basis point cut. This was the last cut in the cycle related to the financial crisis. Then rates were lowered to 0.25 from 1.0%.

- In March 2020, by 125 basis points. The market expected only a 25 basis point cut. However, this was the beginning of the pandemic and liquidity problems in the market.

Is the US economy facing similar problems now as it did then? Not really. Inflation is falling but still elevated. The labor market has cooled but still generates employment growth according to the NFP report. Jobless claims hover around 230,000, and the unemployment rate is 4.2%, slightly above Fed forecasts. Strong crisis signals would be claims above 300,000 and an unemployment rate above 5%. Therefore, investors' attention, apart from the cut itself, should also focus on the forecasts.

- In June, economic projections were not changed from March. They indicate growth of 2.1% this year and 2.0% next year.

- The unemployment rate was estimated at 4.0% for this year. The forecast was raised to 4.2% for next year. This is also the long-term unemployment forecast.

- Inflation forecasts were slightly raised, but this is currently less important.

- The number of expected cuts was significantly reduced. The median indicated between one and two cuts in June, while in March, the chance of 3 cuts was estimated. Now, the forecast for the number of cuts will certainly be raised.

Among investors and analysts, there is a belief that the Fed is late with cuts, so the current move will make up for what should have happened in June or July. The lack of a 50 basis point cut could lead to significant declines in indices. Although the Fed is not guided by what directly happens in the stock market, it does affect sentiment on all assets worldwide.

During the last meeting with the publication of forecasts, most Fed members expected 1 or 2 cuts this year. Source: Bloomberg Finance LP

How will the market react?

EURUSD

It seems that a 25 basis point cut should significantly strengthen the dollar, which has been clearly weakened recently. Of course, economic forecasts and the outlook for further cuts this year and in the coming years will also matter. A 50 basis point cut, but no larger cuts in the future, could also improve the dollar's situation. A 50 basis point cut and communication of further strong cuts could lead to an increase in EURUSD in the medium term towards 1.12-1.13.

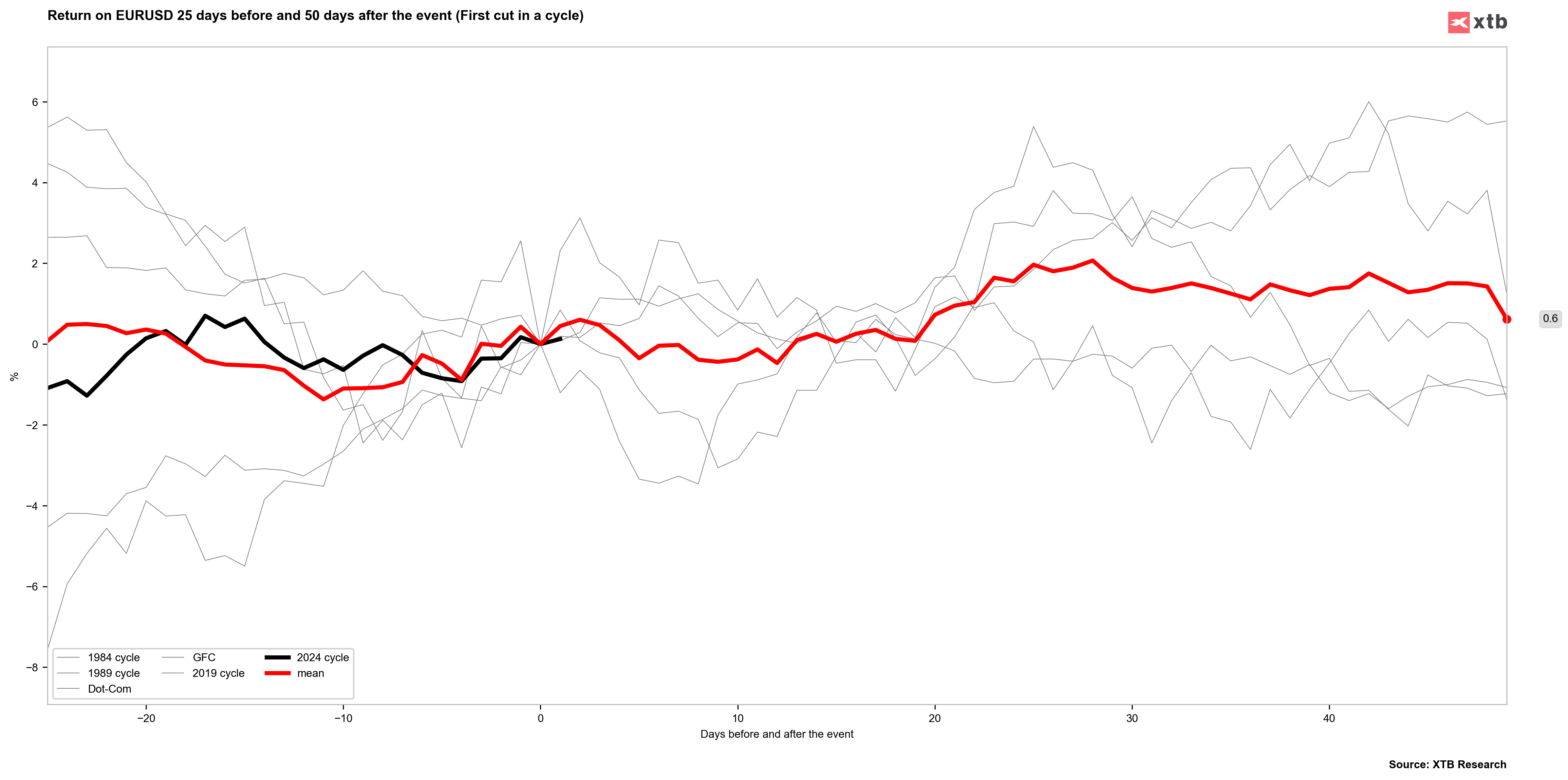

EURUSD changes after the first interest rate cut in the cycle. During the 2019 cut, the dollar initially lost value but later began to strengthen. Within 20 days of the decision, EURUSD returned to its pre-decision state. Source: Bloomberg Finance LP, XTB

EURUSD changes after the first interest rate cut in the cycle. During the 2019 cut, the dollar initially lost value but later began to strengthen. Within 20 days of the decision, EURUSD returned to its pre-decision state. Source: Bloomberg Finance LP, XTB

EURUSD is clearly gaining before today's Fed decision. However, it's visible that just above 1.1150 there may be strong selling pressure. A 25 bp cut could lead to a test of the 1.11 level. In case of a 50 bp cut, the target could be the zone between 1.1160 and 1.1180. Yields are behaving interestingly, suggesting a possible smaller cut than what the market expects. Source: xStation5

US500

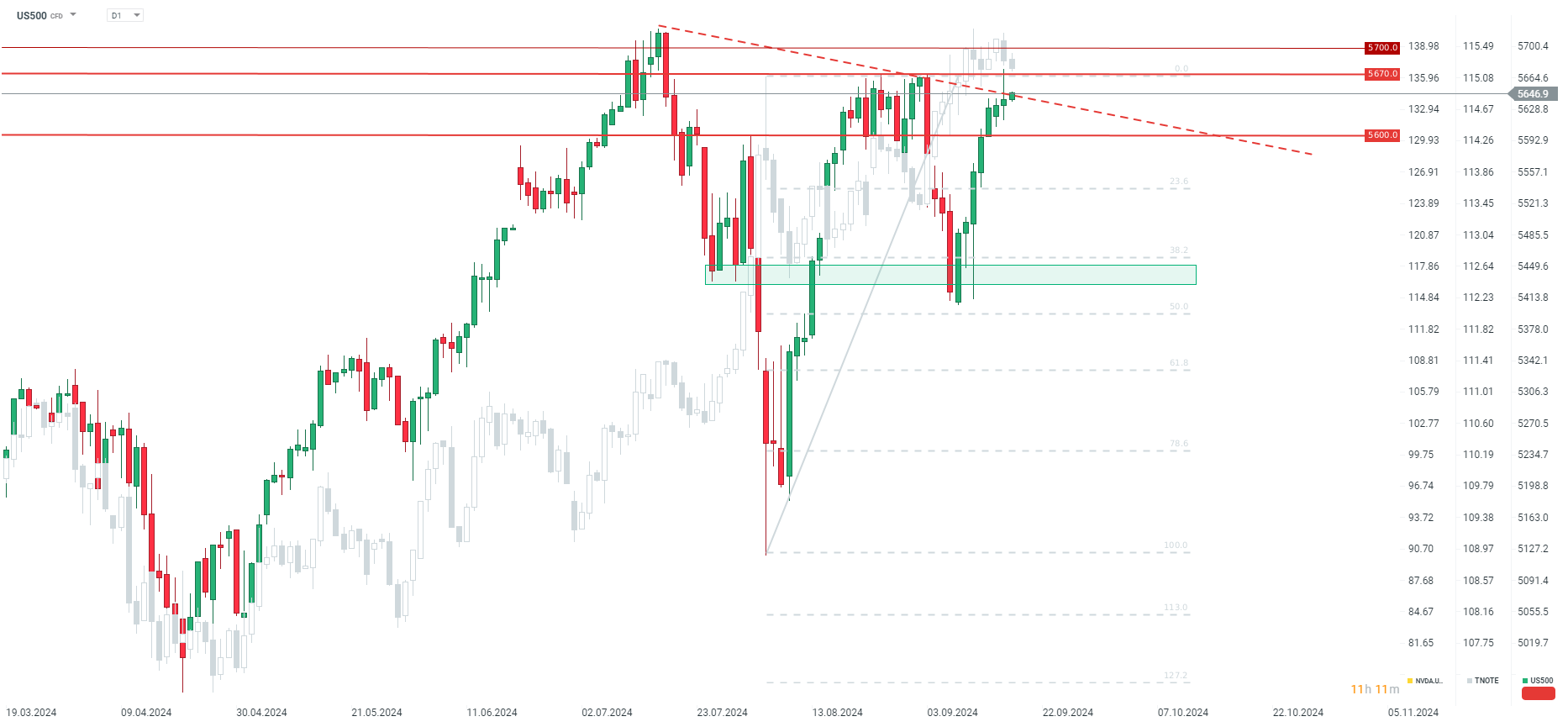

Although a 50 basis point cut could signal weak economic forecasts, it seems at this point that a smaller cut would be disappointing for the market. Even very optimistic forecasts would not be able to lead to a continuation of recent gains. If we have a 25 basis point cut, US500 could test the 5600 point area. On the other hand, delivering a 50 basis point cut, without very negative forecasts but with a promise of further strong cuts, should lead to a test of at least 5670 and an increase in subsequent sessions to 5700.

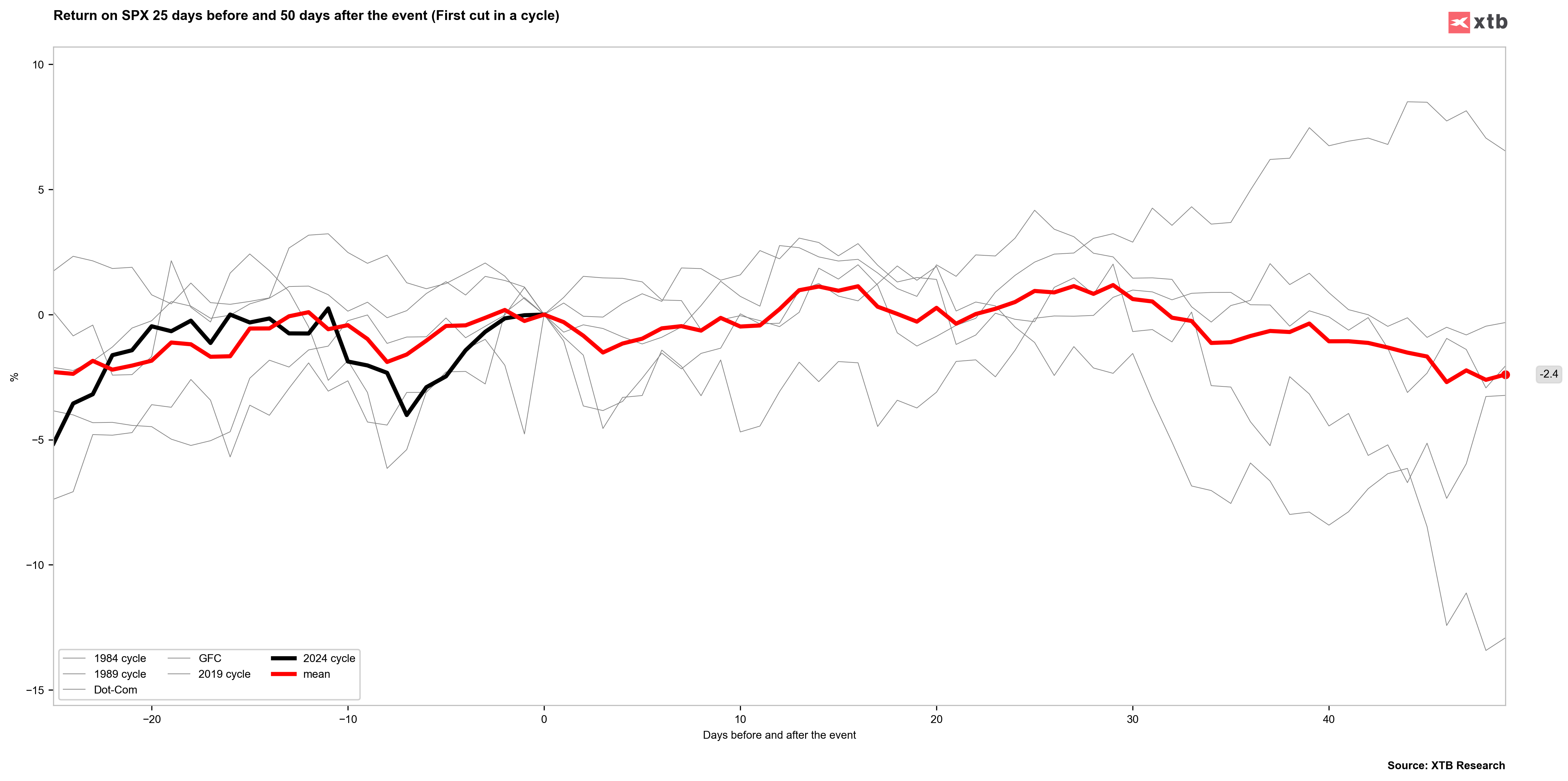

Looking at the behavior of the S&P500 after the first cut in the cycle, we usually had profit-taking in the first few days after previous gains. As you can see, the S&P 500 usually gained about 9-10 sessions before the decision. Nevertheless, within 10-20 sessions, the S&P 500 was usually close to pre-decision levels. Source: Bloomberg Finance LP, XTB

US500 is trying to break above the downward trend line. It's also worth noting the rolling of futures contracts after the end of today's session. Based on current levels, tomorrow's price will open about 61 points higher. Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.