Summary:

-

Brexit party to not contest Tory seats

-

Seen as a major boost to the prospects of a majority

-

Pound jumps in response before fading back

It’s been nearly a week into the official UK election campaign ahead of the December 12th ballot and yesterday we got the first potentially major development with the Brexit party (BXP) lending their support to the Conservatives. There had been a concern amongst the Conservatives that the “leave” vote would end up being split between themselves and the Brexit party but these fears were allayed to some extent after their leader Nigel Farage announced that they wouldn’t contest the 317 Conservative seats won in the 2017 election.

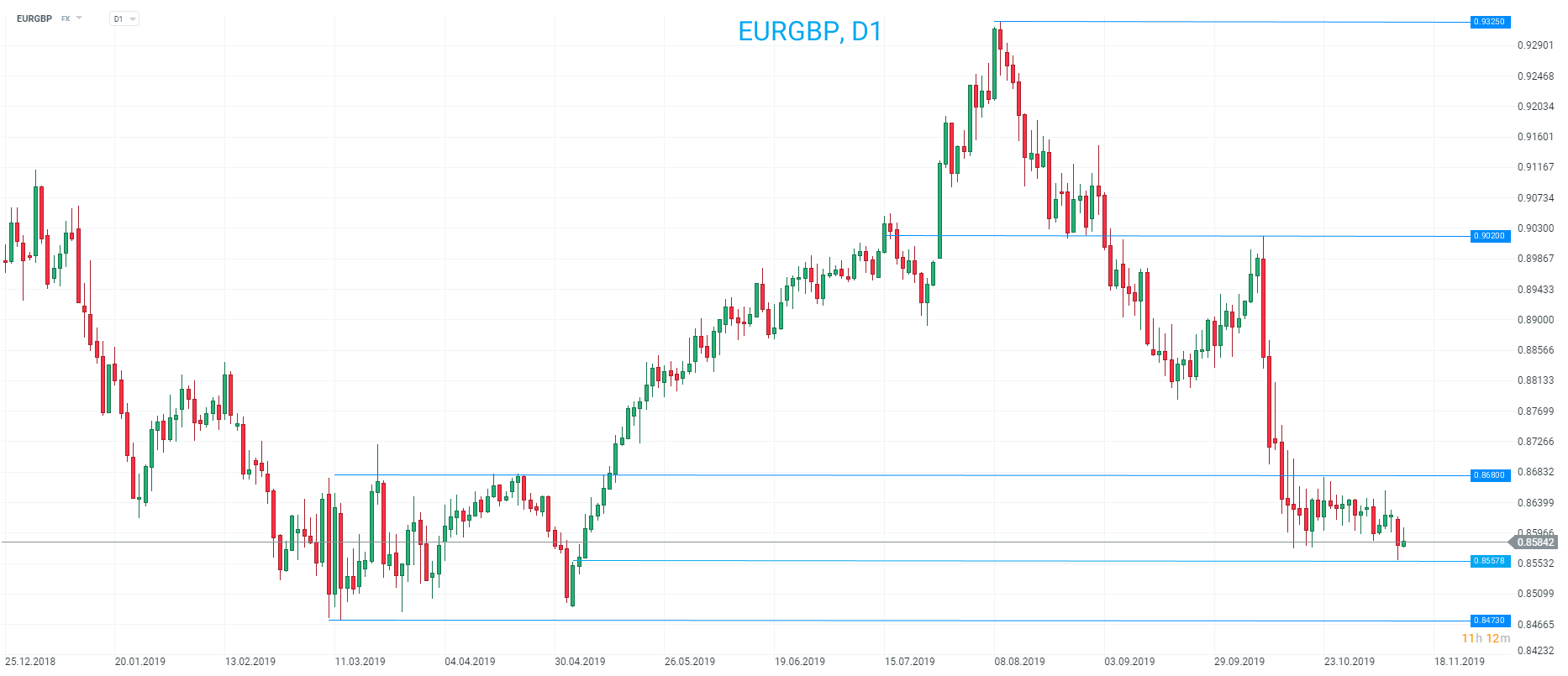

The pound jumped on the announcement from the Brexit party, surging by 75 pips in less than 15 minutes. However, the news has failed to provide a lasting boost. Source: xStation

Given that there are 650 seats available, 326 are needed for a majority, although in practice the number can be a little lower than this - the Speaker normally doesn’t vote and Sinn Fein MPs traditionally refuse to swear allegiance to the Queen and are therefore not entitled to vote. There were 7 Sinn Fein MPs in 2017.

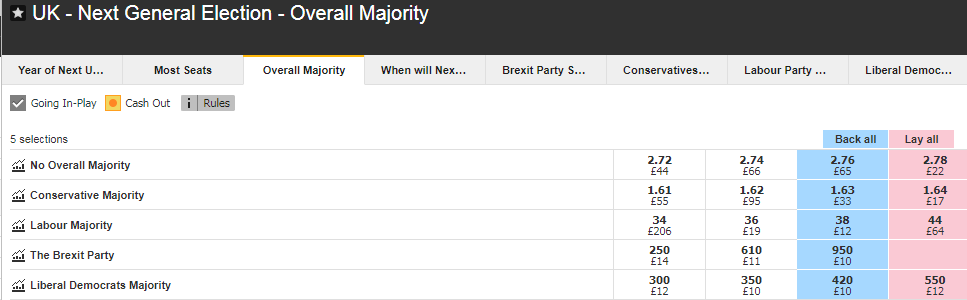

According to bookmakers, the odds of a Conservative majority have shortened after the Brexit party support, with a price of 1.63 giving an implied probability of 61.3%. Note that it seems they are the only party with a fighting chance of securing a majority with the odds on a Labour majority very long. Source: Betfair exchange

The Conservatives retain a solid lead in popular polls by around 11 points but how this translates into seats is obviously the most important aspect and due to the first-past-the-post electoral system this can involve a large margin of error. For instance the latest polls put Conservative support around 40% and this is the proportion of the popular vote won by Labour during the last election in 2017, which gave them just 262 seats - a long way short of a majority. Due to this it is complex and with a large margin for error to attempt to model the number of seats that each party will win, but as a rough proxy of current expectations we can once more look to betting markets.

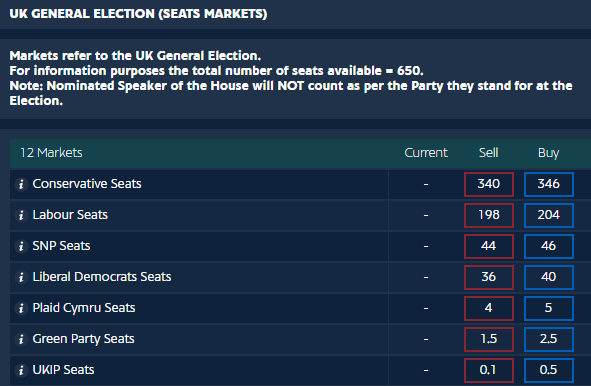

The seats markets shows that the Conservatives are expected to achieve a decent majority according to bookmakers. It is worth noting that the size of the majority could be important as anything over 20-25 would allow the party to not rely on the support of their more eurosceptic ERG wing to pass legislation. Source: Sporting index

Taking the two markets shown together it is quite clear that the main opposition to the Conservatives would come from a coalition amongst Labour, Lib Dems and the SNP. The seats markets puts these combined on a midpoint of 283 (276-290 spread) so they would need to improve significantly to get a majority. However, along these lines the Conservatives are unlikely to find any support from these parties and it seems that if they fail to secure a majority on their own the best they would receive very little help from elsewhere and due to the feelings of the ERG would find themselves with a huge problem to pass any Brexit bill.

In summary it’s still early days but the latest events have been seen as a clear positive for the Conservatives and their prospects of securing a majority. It is worth noting that the Brexit party are still set to contest the remaining 333 seats for the time being and they could still eat into the Conservative vote amongst these and cause them to lose seats. Expectations according to bookmakers are pointing to a decent chance of a solid Conservative majority but with a month to go there are sure to be many twists and turns still to come. Before the last election, polls showed a higher level of support for them than that at present, and the Conservatives ended up losing seats so it is entirely feasible that this could play out once more.

The EURGBP fell to its lowest level in 6 months after the pound rallied on the Brexit party announcement. Price is now just over 1% from its lowest level of the year around 0.8473. Source: xStation

The EURGBP fell to its lowest level in 6 months after the pound rallied on the Brexit party announcement. Price is now just over 1% from its lowest level of the year around 0.8473. Source: xStation

Daily Summary: Precious metals are bleeding, and the US government is shut down again!🔒

Another US Gov. Shutdown: What can it mean this time?

BREAKING: ISM data above expectations. EUR/USD under pressure

Market Wrap: Europe recovers, insiders selling, strong EU PMIs

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.