Sentiment during Friday’s session is clearly more constructive. The VIX volatility index has corrected nearly 10% from its local highs and is down roughly 5% since midnight. US500 futures are up more than 0.7%, while US100 is gaining about 1.3%.

- Asian markets regained stability after early declines on Friday, although investors remained notably cautious toward the technology sector. Amazon shares initially dropped around 11% in US after-hours trading, but the decline has since narrowed to roughly 7%. The company plans to spend $200 billion on artificial intelligence this year and delivered an earnings and revenue outlook that investors found underwhelming.

- Geopolitics also seems to be giving markets some breathing room. The United States continued negotiations with Iran in Oman, and investors are treating the very fact that talks are ongoing as an encouraging signal—reducing aggressive positioning around the risk of a US–Tehran military confrontation.

- On the European front, the Kremlin indicated that recent discussions involving Ukraine and Russia were meaningful and constructive. President Zelensky said the next round of negotiations could take place in the United States, which may suggest the two sides are moving closer to a compromise, maybe at least on one key issue.

US500 and VIX (D1)

S&P 500 futures have pulled back to roughly 100 points below the 50-day EMA (orange line). The drawdown from the highs is still relatively modest, and the index remains about 300 points below record levels.

Source: xStation5

Source: xStation5

US earnings season (FactSet data as of February 4)

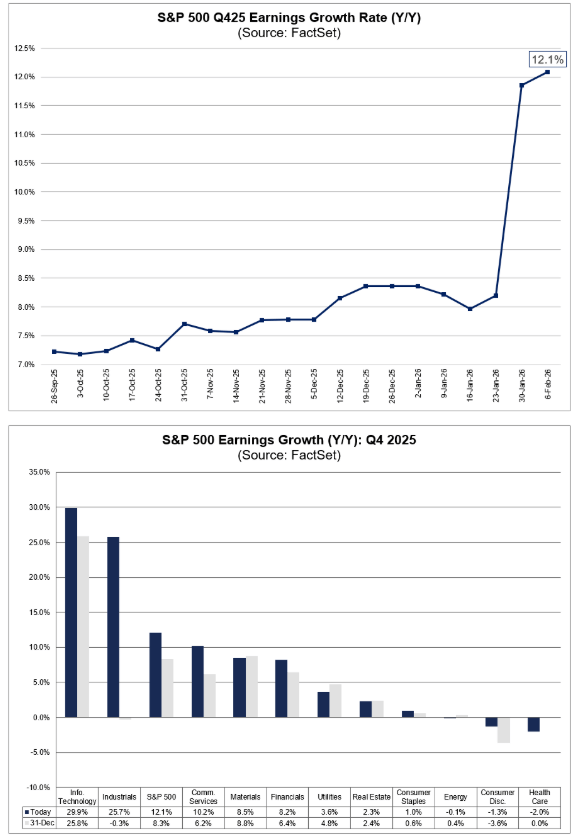

Despite the recent pullback, the S&P 500 is still delivering what typically underpins a bull market: double-digit earnings growth, now on track for a fifth straight quarter (so far). Over the past week alone, blended Q4 EPS growth jumped from 8.2% to 11.9%. If that figure holds, it would mark the first time since Q4 2017–Q4 2018 that the index has posted five consecutive quarters of double-digit year-over-year earnings growth.

Importantly, this improvement has been building for months:

-

On September 30, Q4 earnings growth was estimated at about 7.2%

-

On December 31, it was 8.3%

-

Today, the blended rate stands at 11.9%

In other words, the season has consistently raised the bar for the index.

Where the earnings upside is coming from

The acceleration in earnings growth is concentrated in three high-impact sectors:

Information Technology, Industrials, and Communication Services — the main drivers of the upgrade since year-end.

-

Industrials: the biggest narrative shift, but with a meaningful one-off component.

The sector’s blended earnings growth has swung from -0.3% to +25.6% since December 31, largely driven by two headline surprises:-

Boeing: $9.92 vs -$0.44 expected

-

GE Vernova: $13.48 vs $2.93 expected

A key nuance: both prints were heavily influenced by one-time items (a major gain on an asset sale for Boeing and a sizeable tax-related benefit for GE Vernova). This boosts the season’s stats, but doesn’t fully translate into underlying run-rate strength.

-

-

Information Technology: high-quality support for the index.

Tech has lifted blended earnings growth from 25.8% to 29.8% year over year, with major contributions from:-

Apple: $2.84 vs $2.67

-

Microsoft: $4.14 vs $3.91

-

-

Communication Services: Meta is once again moving the needle.

The sector’s growth rate has improved from 6.2% to 10.2%, led by:-

Meta Platforms: $8.88 vs $8.21

-

Looking ahead

Markets are still pricing in continued double-digit earnings growth beyond Q4. Consensus projections for the next four quarters remain ambitious, reinforcing the idea that fundamentals—at least on earnings—are still doing the heavy lifting for valuations. So far, the Q4 season is delivering.

-

Q1 2026: 11.7%

-

Q2 2026: 14.9%

-

Q3 2026: 15.2%

-

Q4 2026: 15.4%

Source: FactSet Research Systems

Daily summary: Semiconductors, US dollar and oil put pressure on Wall Street

US dollar strengthens, pressuring EUR/USD, silver and Bitcoin 📉

Oil surges almost 2% amid US - Iran tensions 📈

📉US100 loses 2%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.