Financial reports from major technology companies have negatively disappointed Wall Street and show a further slowdown. Despite a festive quarter in most business segments, the mega-techs failed to beat analysts' expectations. With a slowing economy and weaker consumer sentiment, it seems that a 'disinflationary' 2023 could be a challenge for Silicon Valley giants.

Apple (AAPL.US)

- Revenue $117.15 billion vs. $121.14 billion forecasts

- Earnings per share (EPS): 1.88 vs. 1.94 forecasts

- Iphone revenue: $65.78 billion vs. $68.3 billion forecasts

- MacBook revenue: $7.74 billion vs. $9.72 billion forecasts

- iPad revenue: $9.4 billion vs. $7.78 billion forecasts

- Total product revenue $96.39 billion vs. $98.98 billion forecasts

- Revenue in China: $23.91 billion vs. $21.8 billion forecasts

- Home and accessories: $13.48 billion vs. $15.32 billion forecasts

iPhone sales down 8% vs. record Q1 2022 although it's worth taking into account that in Q4 the company struggled with the closure of a key 'iPhoneCity' factory in Zhengzhou, China, which affected shipments and production. Higher revenues from iPads manufactured not only in China, but also in Vietnam indicate that the 'covid-zero' policy may have taken a 'one-time' toll on iPhone sales, smartphones still don't have geographically diversyfied production. However, higher-than-expected revenue from China may indicate that the Chnese opening economy will become an increasingly important market for Apple.

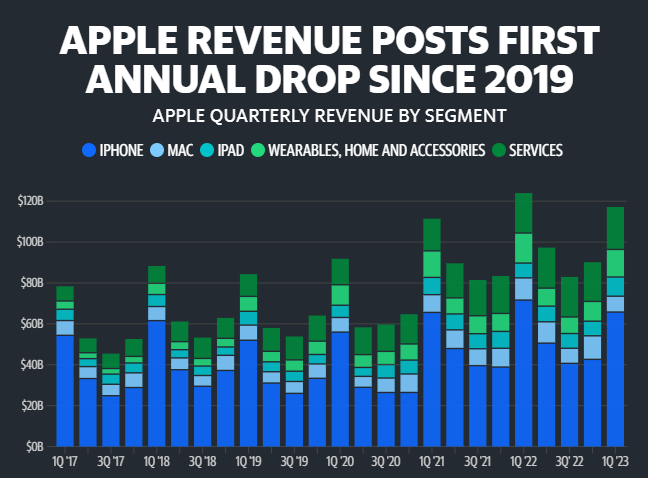

Apple reported its first year-over-year revenue decline since 2019. Although iPhone revenues were close to Q4 2021, they failed to beat Q1 2022 despite the debut of the new iPhone 14 and the holiday quarter. Source: Statista, YahooFinance

Amazon (AMZN.US)

- Revenue: $149.2 billion vs. $145.8 billion

- Earnings per share (EPS): $0.03 vs $0.17 forecasts

- Cloud computing (AWS) revenue: $21.38 billion vs $21.76 billion forecasts

- Operating profit: $2.7 billion vs. $2.51 billion forecasts

- Operating margin: 1.8% vs. 1.85% forecasts

- E-commerce sales: $64.53 billion vs. $65.03 billion forecasts

- Estimated operating profit in Q1 2023: 0 to $4.0 billion vs. $3.52 billion forecasts

- Estimated Q1 2023 revenue: $121 to $126 billion vs $125.55 billion forecasts

Amazon Web Services cloud computing revenue is seeing a slowdown and came in almost $400 million below expectations. AWS's high-margin business accounts for more than half of the company's net income, and if revenue from it slows in the double digits in 2023 as well, earnings per share could continue to fall in an environment of lower e-commerce sales. Earnings were surprisingly weak although it's worth noting that they were significantly weighed down by a loss in shares in EV manufacturer Rivian Automotive (RIVN.US), whose share price has risen more than 20% since the beginning of the year. The company forecast slower sales growth in Q1.

Alphabet (GOOGL.US)

- Revenue: $63.12 billion vs. $63.24 billion forecasts

- Earnings per share (EPS):$1.05 vs. $1.20

- Advertising revenue: $59.04 billion vs $60.64 billion forecasts

- Google cloud revenue: $7.32 billion vs $7.3 billion forecasts

- Youtube revenue: $7.96 billion vs $8.27 billion forecasts

- Services revenue: $67.84 billion vs $68.9 billion forecasts

- Other revenues: $8.80 billion vs $8.14 billion forecasts

The weaker earnings are mainly due to the weak advertising sector. A recent investment bank Cowen research indicated that ad spending will fall twice in 2023 compared to 2022, and 2/3 of advertisers are factoring recession into their budgets meaning Google's revenues can continue to fall until recesson fears persist. Cloud computing revenues, while slightly beating expectations, are clearly slowing.

Apple (AAPL.US) stock chart, D1 interval. The key level worth watching is the SMA200 (red line), above which the company managed to rise this week in an attempt to reverse the trend. A possible drop below $147 level could herald further weakness. Source: xStation5

Apple (AAPL.US) stock chart, D1 interval. The key level worth watching is the SMA200 (red line), above which the company managed to rise this week in an attempt to reverse the trend. A possible drop below $147 level could herald further weakness. Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.